Jim Simons Trims Stake in United Therapeutics Corp

Details of the Recent Trade by Jim Simons (Trades, Portfolio)

On December 29, 2023, Renaissance Technologies, led by Jim Simons (Trades, Portfolio), adjusted its investment in United Therapeutics Corp (NASDAQ:UTHR) by reducing its holdings. The firm sold 80,294 shares at a price of $219.89 each, resulting in a -3.57% change in the position. Following this transaction, Renaissance Technologies holds 2,170,214 shares of United Therapeutics, which represents a 0.81% stake in the firm's portfolio and 4.62% of the traded company's outstanding stock.

Jim Simons (Trades, Portfolio) and Renaissance Technologies

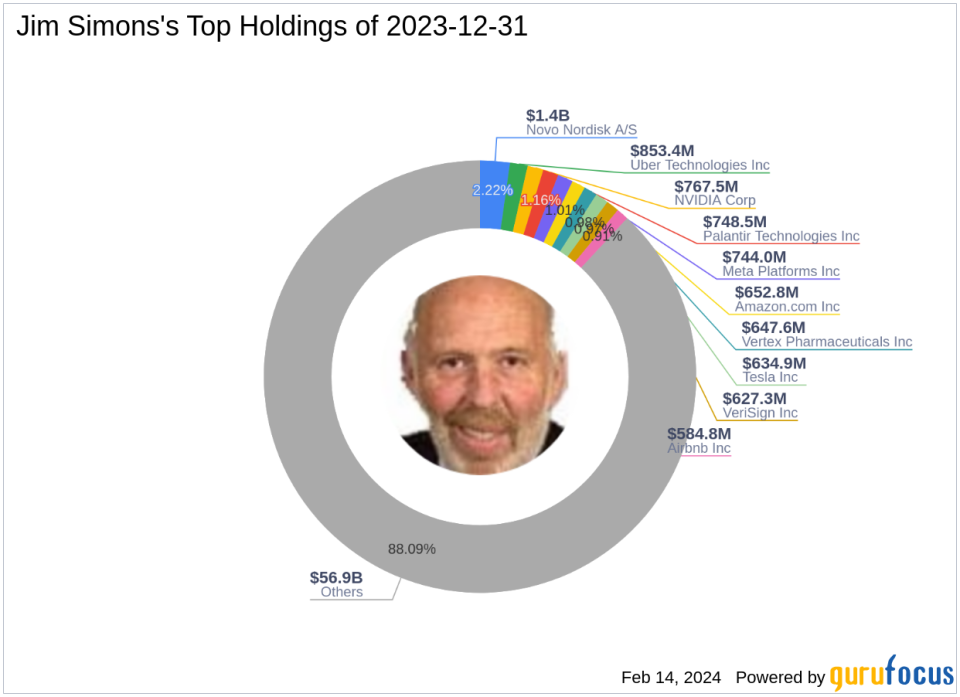

Jim Simons (Trades, Portfolio), a renowned mathematician and quantitative investor, founded Renaissance Technologies in 1982. The firm has gained a reputation for its data-driven, algorithmic trading strategies, which have consistently outperformed the market. Simons' investment philosophy revolves around the use of advanced mathematical models to identify non-random price movements and capitalize on them. Renaissance Technologies manages a diverse portfolio, with significant investments in the technology and healthcare sectors, including top holdings such as Meta Platforms Inc (NASDAQ:META), NVIDIA Corp (NASDAQ:NVDA), and Novo Nordisk A/S (NYSE:NVO).

United Therapeutics Corp at a Glance

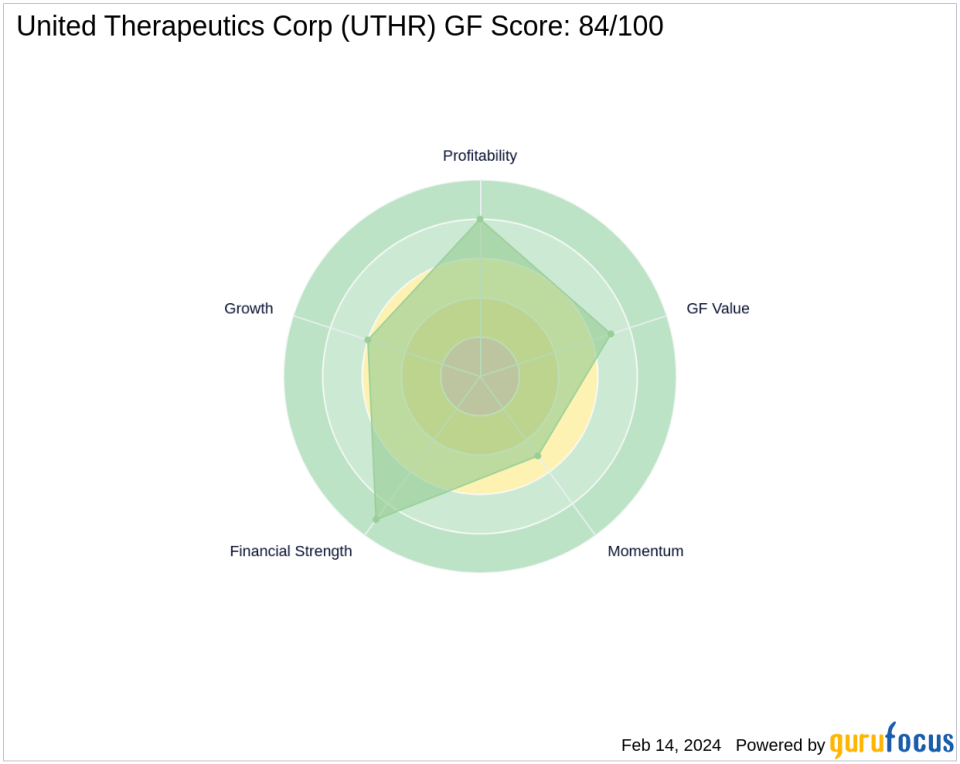

United Therapeutics Corp, founded in 1999, is a biotechnology company focused on developing treatments for pulmonary arterial hypertension (PAH) and other medical conditions. With a market capitalization of $10.04 billion, the company's product portfolio includes Adcirca, Orenitram, and Remodulin, among others. United Therapeutics has shown a strong financial performance with a PE ratio of 11.78 and is currently considered modestly undervalued with a GF Value of $262.28. The stock is trading at $213.75, which is 81% of its GF Value, indicating a potential margin of safety for investors.

Impact of the Trade on Simons' Portfolio

The recent sale of United Therapeutics shares by Renaissance Technologies has a minor impact on the firm's portfolio, with a -0.03% trade impact. However, the transaction reflects a strategic adjustment by Simons, possibly in response to the stock's current market position and valuation.

Simons' Investment Focus

Jim Simons (Trades, Portfolio)' investment strategy has a strong emphasis on the technology and healthcare sectors. These industries are known for their innovation and growth potential, aligning with Simons' data-centric approach to investing. The firm's top holdings reflect this focus, with significant positions in companies that are at the forefront of technological and medical advancements.

Market Position of United Therapeutics Corp

United Therapeutics Corp holds a solid position in the biotechnology industry, with a robust GF Score of 84/100, indicating good outperformance potential. The company's financial strength is reflected in its balance sheet rank of 9/10, and its profitability rank stands at 8/10. With a growth rank of 6/10 and a GF Value rank of 7/10, the company demonstrates a balanced profile of growth and value.

Other Notable Investors in United Therapeutics Corp

Aside from Jim Simons (Trades, Portfolio), other prominent investors such as Joel Greenblatt (Trades, Portfolio), Charles Brandes (Trades, Portfolio), and Ken Fisher (Trades, Portfolio) also hold shares in United Therapeutics Corp. The presence of these well-respected investors further validates the company's appeal in the investment community.

Conclusion: Analyzing the Transaction's Influence

The reduction in United Therapeutics Corp shares by Jim Simons (Trades, Portfolio)' Renaissance Technologies may signal a strategic portfolio realignment. Despite the sale, the firm maintains a significant stake in the company, suggesting continued confidence in its long-term prospects. With United Therapeutics' strong financial metrics and a market valuation that suggests it is modestly undervalued, the company remains an attractive investment for those seeking exposure to the biotechnology sector.

This article, generated by GuruFocus, is designed to provide general insights and is not tailored financial advice. Our commentary is rooted in historical data and analyst projections, utilizing an impartial methodology, and is not intended to serve as specific investment guidance. It does not formulate a recommendation to purchase or divest any stock and does not consider individual investment objectives or financial circumstances. Our objective is to deliver long-term, fundamental data-driven analysis. Be aware that our analysis might not incorporate the most recent, price-sensitive company announcements or qualitative information. GuruFocus holds no position in the stocks mentioned herein.

This article first appeared on GuruFocus.