Jim Simons Trims Stake in Via Renewables Inc

Overview of Jim Simons (Trades, Portfolio)' Recent Stock Transaction

Jim Simons (Trades, Portfolio)' Renaissance Technologies, a firm renowned for its quantitative investment strategies, has recently adjusted its holdings in the energy sector. On December 29, 2023, the firm reduced its stake in Via Renewables Inc (NASDAQ:VIA), a move that aligns with its data-driven approach to trading. This article delves into the specifics of the transaction and its implications for both the firm and the stock involved.

Profile of Jim Simons (Trades, Portfolio)

Jim Simons (Trades, Portfolio), the founder of Renaissance Technologies Corporation, has been a prominent figure in the investment world since 1982. The firm, under Simons' leadership, has become synonymous with the use of advanced mathematical models to inform its trading decisions. Renaissance Technologies is particularly known for its ability to sift through vast amounts of data to identify non-random price movements and capitalize on them. This scientific approach to investing has set the firm apart in the financial industry, earning it a reputation for consistently outperforming the market.

Via Renewables Inc Company Overview

Via Renewables Inc operates as an independent retail energy services company in the United States, offering alternative natural gas and electricity choices to residential and commercial customers. The company's business is segmented into Retail Electricity and Retail Natural Gas, with the former being the primary revenue generator. Via Renewables' strategy involves purchasing electricity supply from market counterparties and supplying it to consumers under various contract terms. The company's focus on stable energy costs and green alternatives positions it within the competitive energy market.

Transaction Specifics

The trade action taken by Renaissance Technologies was a reduction in its holdings of Via Renewables Inc, with a trade share change of -1,000 shares. This adjustment had no significant impact on the firm's portfolio, given the trade impact is marked as 0. However, the firm still maintains a position of 131,101 shares in VIA, which corresponds to a 4.06% holding ratio in the traded stock.

Stock Performance and Valuation

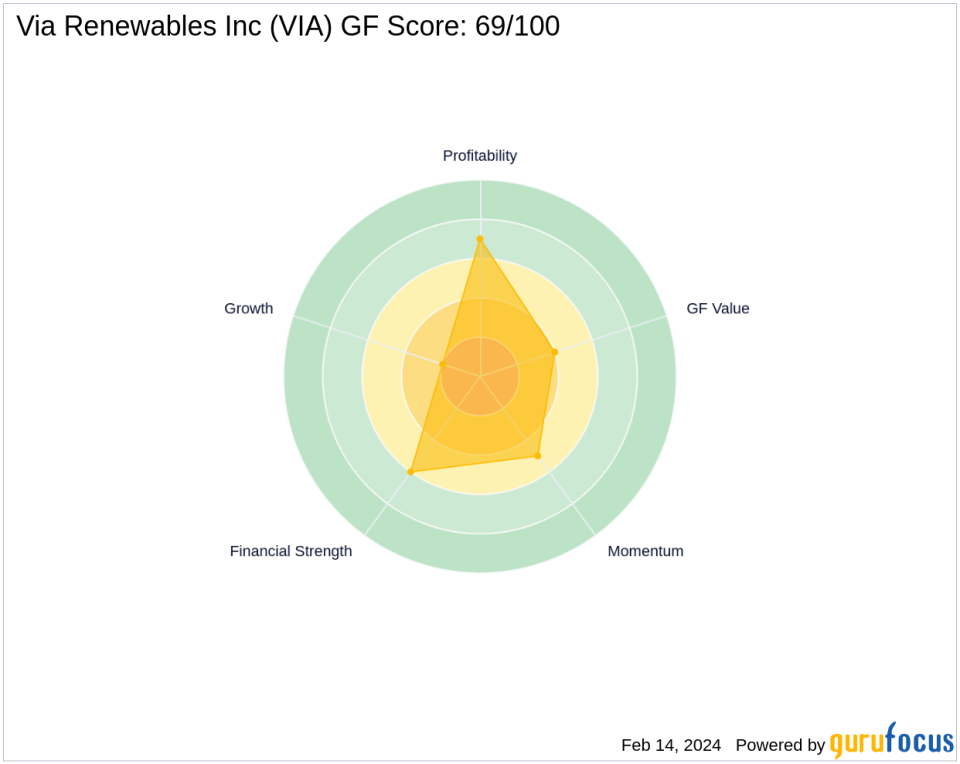

As of the current date, Via Renewables Inc's stock price stands at $10.7, which is a 13.83% increase from the trade price of $9.4. Despite this uptick, the stock is considered a possible value trap according to the GF Value, with a price to GF Value ratio of 0.41. This suggests that investors should exercise caution, as the stock may not offer a sufficient margin of safety. The stock's performance metrics, including a GF Score of 69/100, indicate poor future performance potential.

Market Position and Sector Analysis

With a market capitalization of $34.59 million, Via Renewables Inc is a smaller player in the Utilities - Regulated industry. The company's position within the sector is influenced by its specialized focus on retail energy services and its commitment to providing alternative energy solutions to its customer base.

Financial Health and Future Prospects

The financial health of Via Renewables Inc is reflected in its Financial Strength rank of 6/10 and a Profitability Rank of 7/10. However, the company's Growth Rank is low at 2/10, indicating potential challenges in expanding its market share and revenue. The GF Value Rank of 4/10 also suggests that the stock may not be an attractive investment based on its intrinsic value.

Conclusion

The decision by Jim Simons (Trades, Portfolio)' Renaissance Technologies to reduce its stake in Via Renewables Inc reflects the firm's strategic and data-driven approach to portfolio management. While the transaction itself had a negligible impact on the firm's overall holdings, it underscores the importance of closely monitoring stock valuations and market positions. Investors considering Via Renewables Inc should weigh the company's financial health, sector standing, and future growth prospects against the current market valuation to make informed investment decisions.

This article, generated by GuruFocus, is designed to provide general insights and is not tailored financial advice. Our commentary is rooted in historical data and analyst projections, utilizing an impartial methodology, and is not intended to serve as specific investment guidance. It does not formulate a recommendation to purchase or divest any stock and does not consider individual investment objectives or financial circumstances. Our objective is to deliver long-term, fundamental data-driven analysis. Be aware that our analysis might not incorporate the most recent, price-sensitive company announcements or qualitative information. GuruFocus holds no position in the stocks mentioned herein.

This article first appeared on GuruFocus.