Is JinkoSolar Holding Co (JKS) Too Good to Be True? A Comprehensive Analysis of a Potential ...

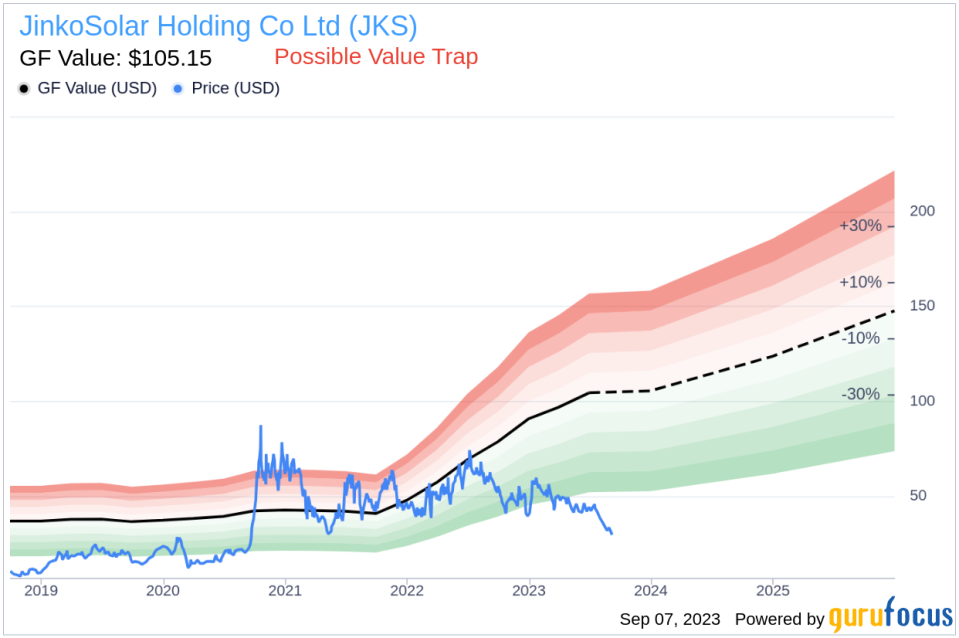

Value-focused investors are always on the hunt for stocks that are priced below their intrinsic value. One such stock that merits attention is JinkoSolar Holding Co Ltd (NYSE:JKS). The stock, which is currently priced at 29.82, recorded a loss of 7.33% in a day and a 3-month decrease of 27.07%. The stock's fair valuation is $105.15, as indicated by its GF Value.

Understanding GF Value

The GF Value represents the current intrinsic value of a stock derived from our exclusive method. The GF Value Line on our summary page gives an overview of the fair value that the stock should be traded at. It is calculated based on three factors: historical multiples (PE Ratio, PS Ratio, PB Ratio, and Price-to-Free-Cash-Flow) that the stock has traded at, GuruFocus adjustment factor based on the company's past returns and growth, and future estimates of the business performance.

We believe the GF Value Line is the fair value that the stock should be traded at. The stock price will most likely fluctuate around the GF Value Line. If the stock price is significantly above the GF Value Line, it is overvalued and its future return is likely to be poor. On the other hand, if it is significantly below the GF Value Line, its future return will likely be higher.

Identifying Potential Risks

However, investors need to consider a more in-depth analysis before making an investment decision. Despite its seemingly attractive valuation, certain risk factors associated with JinkoSolar Holding Co Ltd (NYSE:JKS) should not be ignored. These risks are primarily reflected through its low Altman Z-score of 1.29, and a Beneish M-Score of -1.31 that exceeds -1.78, the threshold for potential earnings manipulation. These indicators suggest that JinkoSolar Holding Co, despite its apparent undervaluation, might be a potential value trap. This complexity underlines the importance of thorough due diligence in investment decision-making.

Decoding the Altman Z-score and Beneish M-Score

Before delving into the details, let's understand what the Altman Z-score entails. Invented by New York University Professor Edward I. Altman in 1968, the Z-Score is a financial model that predicts the probability of a company entering bankruptcy within a two-year time frame. The Altman Z-Score combines five different financial ratios, each weighted to create a final score. A score below 1.8 suggests a high likelihood of financial distress, while a score above 3 indicates a low risk.

Developed by Professor Messod Beneish, the Beneish M-Score is based on eight financial variables that reflect different aspects of a company's financial performance and position. These are Days Sales Outstanding (DSO), Gross Margin (GM), Total Long-term Assets Less Property, Plant and Equipment over Total Assets (TATA), change in Revenue (?REV), change in Depreciation and Amortization (?DA), change in Selling, General and Admin expenses (?SGA), change in Debt-to-Asset Ratio (?LVG), and Net Income Less Non-Operating Income and Cash Flow from Operations over Total Assets (?NOATA).

Company Overview

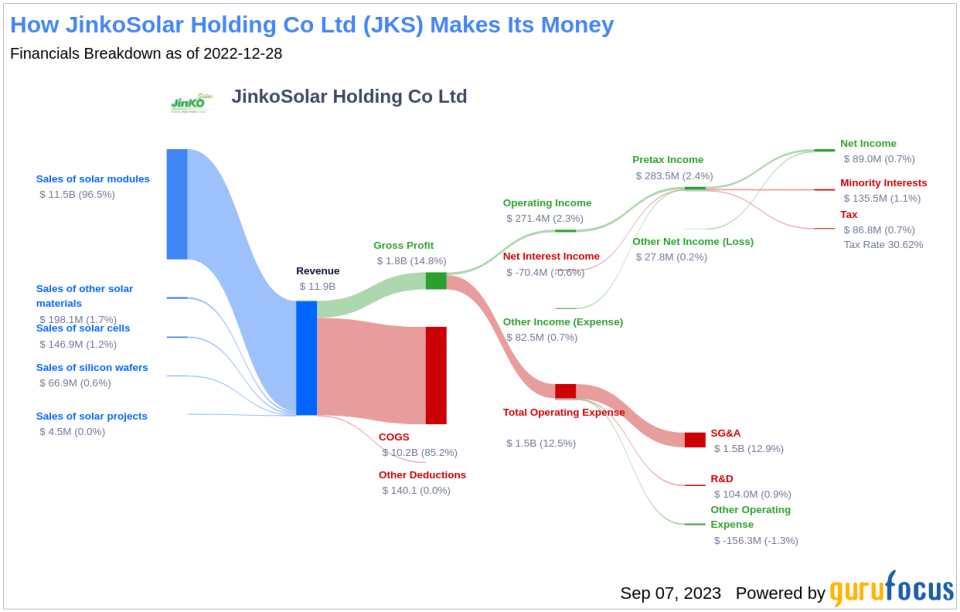

JinkoSolar Holding Co Ltd is engaged in the photovoltaic industry. The firm has built a vertically integrated solar power product value chain, manufacturing from silicon wafers to solar modules. It sells solar modules under the JinkoSolar brand. The company's product includes Silicon wafers, Solar cells, and Solar modules. Its geographical segments are China (including Hong Kong and Taiwan), North America, Europe, Asia Pacific (except China, which includes Hong Kong and Taiwan), and the Rest of the world.

Breaking Down JinkoSolar Holding Co's Low Altman Z-Score

A dissection of JinkoSolar Holding Co's Altman Z-score reveals JinkoSolar Holding Co's financial health may be weak, suggesting possible financial distress:

The Retained Earnings to Total Assets ratio provides insights into a company's capability to reinvest its profits or manage debt. Evaluating JinkoSolar Holding Co's historical data, 2021: 0.08; 2022: 0.04; 2023: 0.07, we observe a declining trend in this ratio. This downward movement indicates JinkoSolar Holding Co's diminishing ability to reinvest in its business or effectively manage its debt. Consequently, it exerts a negative impact on its Z-Score.

Assessing the Gross Margin

The Gross Margin index tracks the evolution of a company's gross profit as a proportion of its revenue. A downward trend could indicate issues such as overproduction or more generous credit terms, both of which are potential red flags for earnings manipulation. By examining the past three years of JinkoSolar Holding Co's historical data (2021: 16.79; 2022: 15.27; 2023: 15.56), we find that its Gross Margin has contracted by 3.56%. Such a contraction in the gross margin can negatively impact the company's profitability as it signifies lesser income from each dollar of sales. This could put a strain on the company's capacity to manage operating costs, potentially undermining its financial stability.

Examining Year-Over-Year Change in Revenue

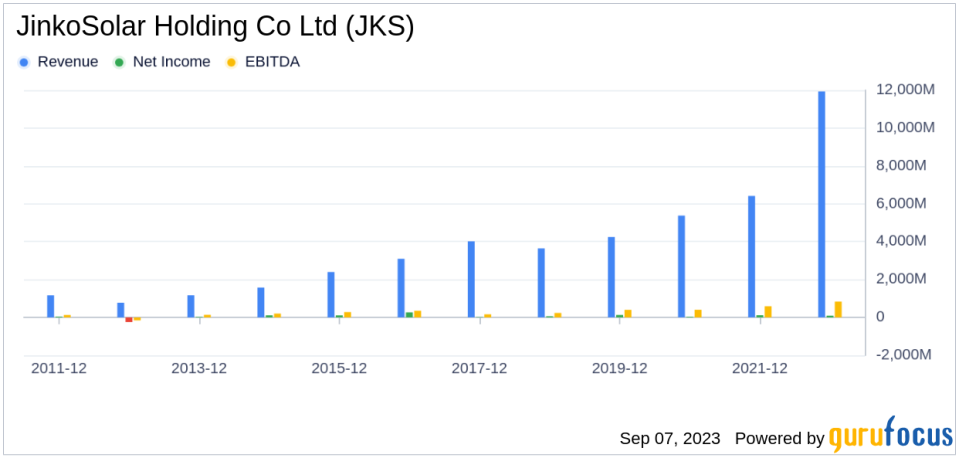

The Year-Over-Year (YoY) change in Revenue calculates the percentage difference in sales between the previous year and the current year. A notable upswing in this ratio could potentially signal aggressive income recognition or sales manipulation tactics. Delving into JinkoSolar Holding Co's revenue data over the past three years (2021: 5,182.51; 2022: 9,041.58; 2023: 14,754.41), it's apparent that there has been a significant surge in revenue in the last 12 months, with a rise of 74.46 %.

Understanding Depreciation, Depletion, and Amortization (DDA)

The change in Depreciation, Depletion, and Amortization (DDA) reflects the rate at which a company's assets lose value over time. Analyzing JinkoSolar Holding Co's DDA data over the past three years (2021: 0; 2022: 0; 2023: 0), a decreasing rate might be a cause for concern. This decline may suggest that the company is prolonging the useful life of its assets, possibly to manipulate earnings. By extending the lifespan of assets, depreciation charges are spread over a longer period, thereby reducing annual expenses and artificially boosting reported profits. While this may create a more favorable short-term financial picture, it could also distort the true value and condition of the company's assets, misleading investors and potentially hiding underlying operational or financial issues.

Scrutinizing the TATA Ratio

The TATA (Total Accruals to Total Assets) ratio, calculated as the Net Income less Non-Operating Income and Cash Flow from Operations, divided by Total Assets, is a key indicator of the quality of a company's earnings. For JinkoSolar Holding Co, the current TATA ratio (TTM) stands at 0.013. A positive TATA ratio can be a warning sign, suggesting that the earnings are composed more of accruals rather than cash flow, which could be an indication of aggressive income recognition. Accrual accounting permits management some discretion in recognizing revenue and expenses, and a company intent on artificially boosting its earnings might exploit this flexibility.

In essence, a higher TATA ratio might mean that the company's reported income is not as firmly grounded in real cash earnings, signaling poor quality of earnings, potentially resulting from accounting gimmicks or financial engineering rather than true operational performance. Investors and analysts should examine the components of the TATA ratio closely, especially when the value is positive, to understand the underlying drivers and assess whether it might indicate a need for more detailed scrutiny of the company's financial practices.

Conclusion

In conclusion, while JinkoSolar Holding Co Ltd (NYSE:JKS) may seem like an attractive investment due to its current undervaluation, the company's low Altman Z-Score and high Beneish M-Score suggest potential financial distress and earnings manipulation, respectively. These risk factors, coupled with the company's declining Retained Earnings to Total Assets ratio, contracting Gross Margin, and positive TATA ratio, indicate that JinkoSolar Holding Co might be a potential value trap. Therefore, investors should exercise caution and conduct thorough due diligence before making an investment decision.

GuruFocus Premium members can find stocks with high Altman Z-Score using the following Screener: Walter Schloss Screen .To find out the high quality companies that may deliever above average returns, please check out GuruFocus High Quality Low Capex Screener.

This article first appeared on GuruFocus.