JLL (NYSE:JLL) Posts Better-Than-Expected Sales In Q4

Real estate firm JLL (NYSE:JLL) reported Q4 FY2023 results beating Wall Street analysts' expectations , with revenue up 4.9% year on year to $5.88 billion. It made a non-GAAP profit of $4.23 per share, improving from its profit of $3.62 per share in the same quarter last year.

Is now the time to buy JLL? Find out by accessing our full research report, it's free.

JLL (JLL) Q4 FY2023 Highlights:

Revenue: $5.88 billion vs analyst estimates of $5.79 billion (1.5% beat)

EPS (non-GAAP): $4.23 vs analyst estimates of $3.73 (13.3% beat)

Free Cash Flow of $542.5 million, up 96.4% from the previous quarter

Gross Margin (GAAP): 51.7%, in line with the same quarter last year

Market Capitalization: $8.79 billion

"JLL's fourth-quarter and full-year 2023 operating results reflected strong growth within our resilient business lines in the face of the market-wide pullback in transaction activity and elevated geopolitical uncertainty. With a focus on operating efficiency, we drove improved cash generation while continuing to invest in our platform," said Christian Ulbrich, JLL CEO.

Founded in 1999 through the merger of Jones Lang Wootton and LaSalle Partners, JLL (NYSE:JLL) is a company specializing in real estate advisory and investment management services.

Real Estate Services

Technology has been a double-edged sword in real estate services. On the one hand, internet listings are effective at disseminating information far and wide, casting a wide net for buyers and sellers to increase the chances of transactions. On the other hand, digitization in the real estate market could potentially disintermediate key players like agents who use information asymmetries to their advantage.

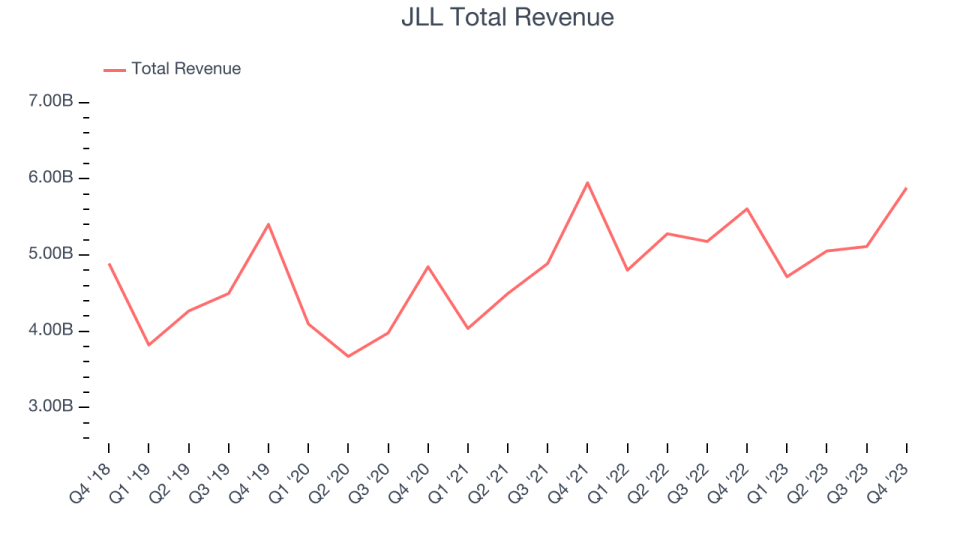

Sales Growth

A company’s long-term performance can give signals about its business quality. Any business can put up a good quarter or two, but many enduring ones muster years of growth. JLL's annualized revenue growth rate of 4.9% over the last five years was weak for a consumer discretionary business.

Within consumer discretionary, a long-term historical view may miss a company riding a successful new product or emerging trend. That's why we also follow short-term performance. JLL's recent history shows the business has slowed as its annualized revenue growth of 3.5% over the last two years is below its five-year trend.

This quarter, JLL reported reasonable year-on-year revenue growth of 4.9%, and its $5.88 billion of revenue topped Wall Street's estimates by 1.5%. Looking ahead, Wall Street expects sales to grow 7% over the next 12 months, an acceleration from this quarter.

Unless you’ve been living under a rock, it should be obvious by now that generative AI is going to have a huge impact on how large corporations do business. While Nvidia and AMD are trading close to all-time highs, we prefer a lesser-known (but still profitable) semiconductor stock benefitting from the rise of AI. Click here to access our free report on our favorite semiconductor growth story.

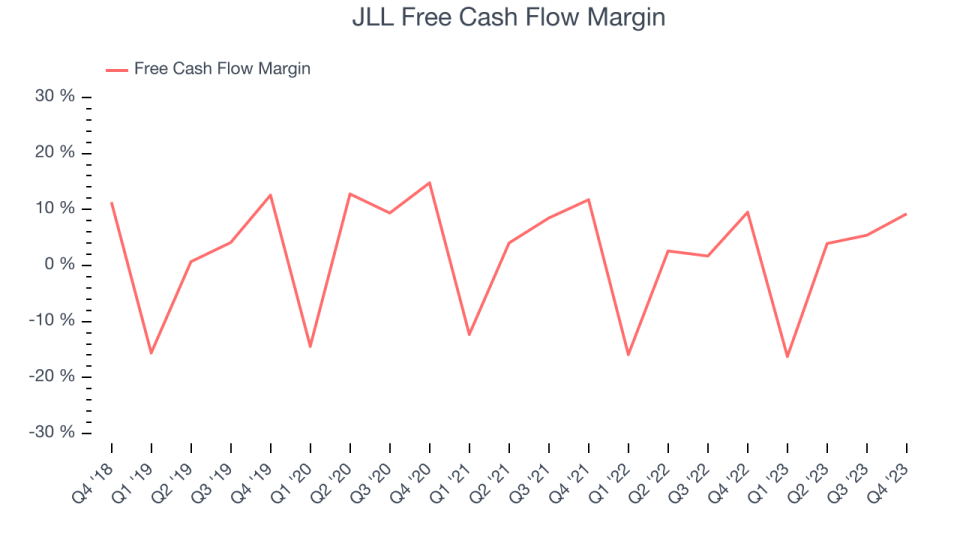

Cash Is King

If you've followed StockStory for a while, you know we emphasize free cash flow. Why, you ask? We believe that in the end, cash is king, and you can't use accounting profits to pay the bills.

Over the last two years, JLL broke even from a free cash flow perspective, subpar for a consumer discretionary business.

JLL's free cash flow came in at $542.5 million in Q4, equivalent to a 9.2% margin and in line with the same quarter last year.

Key Takeaways from JLL's Q4 Results

We were impressed by how significantly JLL blew past analysts' operating margin estimates this quarter. We were also excited its revenue and EPS outperformed thanks to better-than-expected results in its Capital Markets segment ($537 million vs estimates of $462 million). Management seemed happy as they expected Capital Markets revenue to drop by more than the 12% decline it posted because Q4 2023 had the lowest investment sales volumes since 2011. Overall, we think this was a strong quarter that should satisfy shareholders. The stock is up 2% after reporting and currently trades at $188.45 per share.

JLL may have had a good quarter, but does that mean you should invest right now? When making that decision, it's important to consider its valuation, business qualities, as well as what has happened in the latest quarter. We cover that in our actionable full research report which you can read here, it's free.