John B Sanfilippo & Son Inc (JBSS) Reports Growth Amidst Acquisition and Market Challenges

Net Sales: Increased by 6.2% to $291.2 million, with significant contribution from the Lakeville Acquisition.

Sales Volume: Rose by 11.8% to 89.9 million pounds, driven by increased snack bar sales.

Gross Profit: Grew by 2.5% to $57.9 million, despite a slight decrease in gross profit margin.

Diluted EPS: Increased by 13.1% to $1.64 per share, reflecting the company's ability to manage acquisition costs and drive earnings growth.

Operating Expenses: Decreased by $1.7 million, aided by a one-time bargain purchase gain from the acquisition.

Inventory: Increased by 14.0%, largely due to the Lakeville Acquisition's inventory addition.

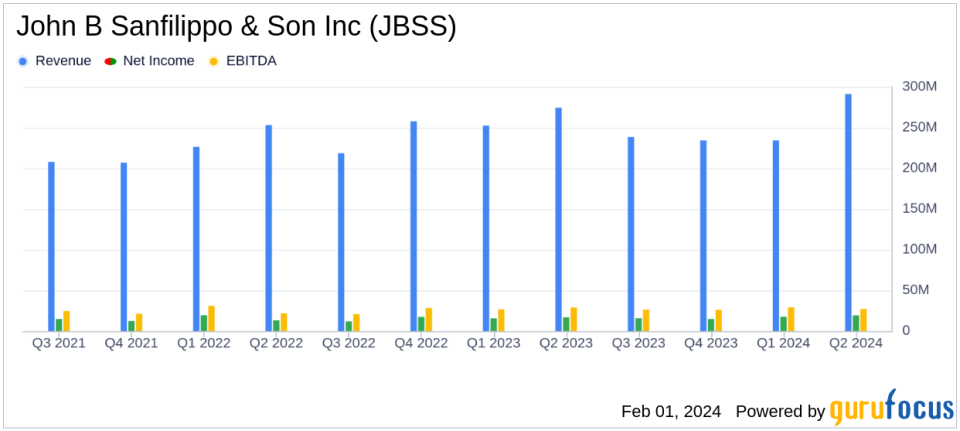

On January 31, 2024, John B Sanfilippo & Son Inc (NASDAQ:JBSS) released its 8-K filing, announcing its financial results for the fiscal second quarter ended December 28, 2023. The company, a leading processor and distributor of nuts, including peanuts, pecans, cashews, walnuts, almonds, and other nuts in the United States, reported an increase in net sales and diluted earnings per share (EPS), indicating a robust performance despite market challenges.

Performance Highlights and Strategic Acquisitions

JBSS's fiscal 2024 second quarter results were marked by a 6.2% increase in net sales, reaching $291.2 million, and an 11.8% increase in sales volume, amounting to 89.9 million pounds. This growth was primarily driven by the Lakeville Acquisition, which added approximately $28.7 million to quarterly net sales and 11.6 million pounds to quarterly sales volume. The acquisition not only expanded JBSS's product offerings but also contributed to a 13.1% increase in diluted EPS, which rose to $1.64 per share.

Jeffrey T. Sanfilippo, Chief Executive Officer, commented on the quarter's achievements, stating:

This was a significant quarter for our Company as it represents the first quarter of financial results that includes our recent Lakeville Acquisition. The Lakeville Acquisition increased our quarterly sales volume by 11.6 million pounds, or 14.4% over the second quarter of fiscal 2023, and increased quarterly net sales by approximately $28.7 million, or 10.5% over the second quarter of fiscal 2023. In addition, we delivered a 13.1% increase in diluted earnings per share, which includes the dilutive impact of the Lakeville Acquisition.

Challenges and Operational Efficiency

Despite the positive impact of the acquisition, JBSS faced a challenging operating environment characterized by elevated retail selling prices and cautious consumer behavior. Sales volume, excluding the impact of the Lakeville Acquisition, decreased by 2.6%. However, the company saw a strong performance from its re-launched Orchard Valley Harvest brand, with sales volume in the Consumer channel for this product line growing over 15% in the quarter.

Gross profit margin experienced a slight decrease to 19.9% of net sales from 20.6% due to the Lakeville Acquisition. Nevertheless, gross profit increased by $1.4 million, and excluding the acquisition, gross profit margin and gross profit saw improvements of approximately 2.6% and $4.3 million, respectively, due to lower commodity acquisition costs and increased manufacturing efficiencies.

Financial Position and Outlook

JBSS's balance sheet reflects a strategic position with an increase in total inventories, mainly attributable to the Lakeville Acquisition. Excluding this acquisition, the value of total inventories on hand decreased by 6.9% year over year. The company's operating expenses saw a net decrease due to a one-time bargain purchase gain, partially offset by acquisition-related expenses.

Looking ahead, Mr. Sanfilippo expressed optimism about the company's direction:

As we enter the last half of the fiscal year, we will continue to identify and implement operational improvements at our Lakeville facility and pursue additional sales opportunities given our new capabilities. In addition, we will utilize all our best-in-class competencies, including innovation, category management and customer service, to mitigate the impact of reduced consumer demand. I believe we have the right team and strategies to overcome these short-term challenges and deliver long-term shareholder value.

John B Sanfilippo & Son Inc's performance in the fiscal 2024 second quarter demonstrates resilience and strategic growth, particularly in the face of a challenging market. The company's ability to integrate acquisitions effectively and drive sales volume growth, while managing costs and improving operational efficiencies, positions it well for continued success in the Consumer Packaged Goods industry.

Explore the complete 8-K earnings release (here) from John B Sanfilippo & Son Inc for further details.

This article first appeared on GuruFocus.