John Bean (JBT) Q3 Earnings Beat Estimates, Increase Y/Y

John Bean Technologies Corporation JBT reported adjusted earnings of $1.11 per share in third-quarter 2023, which came in 16% higher than the prior-year quarter. The figure beat the Zacks Consensus Estimate of 99 cents per share. High order levels, pricing actions and gains from the company’s restructuring actions were instrumental in driving the improved results in the quarter.

On a reported basis, the company’s earnings per share (from continuing operations) were 95 cents compared with the prior-year quarter’s earnings per share of 80 cents.

Revenues of $404 million increased 1.2% from the year-ago quarter. A 3% contribution from acquisitions was offset by a 2% decline in organic revenues. The top-line figure lagged the Zacks Consensus Estimate of $419 million. We had estimated organic growth to be 2.2% and contribution from acquisitions to be 4.3%.

In the reported quarter, the company’s orders (from continuing operations) increased 14% year over year to $398 million. The figure came in lower than our projection of orders of $439 million.

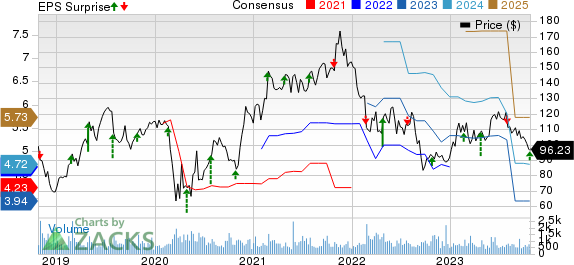

John Bean Technologies Corporation Price, Consensus and EPS Surprise

John Bean Technologies Corporation price-consensus-eps-surprise-chart | John Bean Technologies Corporation Quote

The backlog was $689 million at the end of the third quarter, up 4% year over year. Our projection for the backlog was $716 million.

The cost of sales decreased 1.4% year over year to $260 million in the third quarter. Gross profit was up 6% year over year to $144 million. The gross margin was 35.7% compared with the year-earlier quarter’s figure of 34%.

Selling, general and administrative expenses were up 2.3% year over year to $101.5 million. Adjusted operating profit declined 21% year over year to $43 million from the prior-year quarter’s $55 million. Adjusted operating margin was 10.7% compared with 13.7% in the third quarter of 2022.

In the quarter under review, adjusted EBITDA was around $66 million, reflecting a year-over-year increase of 9%. Adjusted EBITDA margin was 16.4% compared with the year-ago quarter’s 15.2%.

Financial Performance

John Bean reported cash and cash equivalents of $402 million at the end of the third quarter of 2023, a significant increase from $72 million at the end of 2022. The company generated around $96 million in cash from operating activities in the nine-month period ended Sep 30, 2023, compared with $87 million in the prior-year comparable period.

The company’s total debt was $646 million as of Sep 30, 2023, down from $978 million as of Dec 31, 2022.

AeroTech Sale Completed

JBT closed the previously announced sale of the AeroTech segment on Aug 1. Effective from the second quarter of 2023, AeroTech's financial results were classified as discontinued operations.

Guidance for Q4 & 2023

John Bean expects revenue growth in 2023 to be in the range of 4.5% to 5.5%. This suggests revenues of $1,662 million to $1,678 million. JBT had earlier expected revenues to be between $1,670 million and $1,720 million for the year.

Adjusted EBITDA is anticipated to be within $265 million and $271 million for 2023. The previous guidance for adjusted EBITDA was $263-$278 million. Adjusted EBITDA margin will likely be between 16% and

16.25%.

Adjusted earnings per share are now projected to be between $3.95 - $4.10, higher than the previously shared guidance of earnings of $3.80 - $4.05 per share.

For the fourth quarter, revenues are expected to be flat or increase 4% from the fourth quarter of 2022. Adjusted EBITDA will range between $73 million and $79 million. JBT expects adjusted earnings per share to be between $1.25 and $1.40 for fourth-quarter 2023.

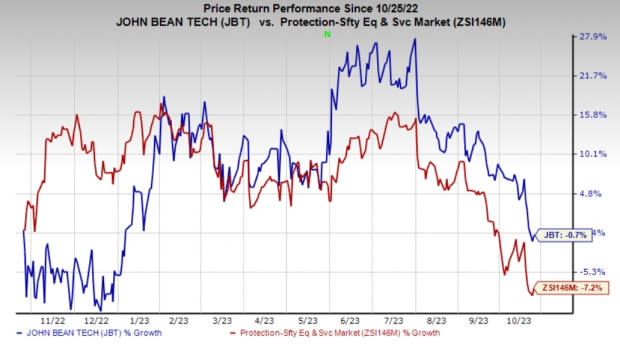

Price Performance

John Bean’s shares have dipped 0.7% in the past year compared with the industry’s 7.2% fall.

Image Source: Zacks Investment Research

Zacks Rank & Stocks to Consider

John Bean carries a Zacks Rank #5 (Strong Sell).

Some better-ranked stocks from the Industrial Products sector are Applied Industrial Technologies AIT, Astec Industries, Inc. ASTE and Brady BRC. Each of these stocks sports a Zacks Rank #1 (Strong Buy). You can see the complete list of today’s Zacks #1 Rank stocks here.

Applied Industrial has an average trailing four-quarter earnings surprise of 15%. The Zacks Consensus Estimate for AIT’s 2023 earnings is pegged at $9.13 per share, which indicates year-over-year growth of 2%. The estimate has moved up 2% in the past 60 days. Its shares have gained 32% in the last year.

Astec has an average trailing four-quarter earnings surprise of 20%. The Zacks Consensus Estimate for ASTE’s 2023 earnings is pegged at $3.24 per share. It indicates year-over-year growth of 163%. The consensus estimate for 2023 earnings has moved 1% north in the past 60 days. ASTE’s shares have gained 7% in the last year.

The Zacks Consensus Estimate for Brady’s 2023 earnings per share is pegged at $3.62. The consensus estimate for 2023 earnings has moved 13% north in the past 60 days and suggests year-over-year growth of 9.9%. It has a trailing four-quarter average earnings surprise of 7.2%. Shares of BRC have rallied 17% in the last year.

Want the latest recommendations from Zacks Investment Research? Today, you can download 7 Best Stocks for the Next 30 Days. Click to get this free report

Astec Industries, Inc. (ASTE) : Free Stock Analysis Report

Applied Industrial Technologies, Inc. (AIT) : Free Stock Analysis Report

John Bean Technologies Corporation (JBT) : Free Stock Analysis Report

Brady Corporation (BRC) : Free Stock Analysis Report