John Bean (JBT) Scales 52-Week High: More Room to Run?

Shares of John Bean Technologies JBT scaled a new 52-week high of $125.88 on Jul 6, before closing the session lower at $118.71.

JBT has a market capitalization of $3.8 billion and a Zacks Rank #3 (Hold), currently.

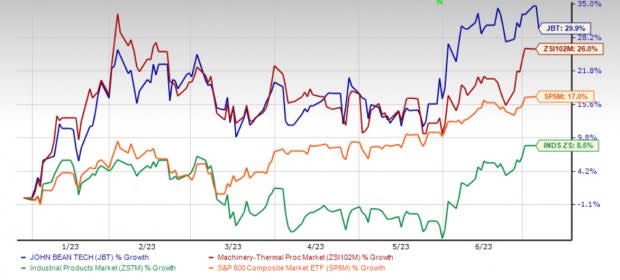

In the year so far, the company has gained 29.9%, faring better than the industry, which witnessed 26% growth. The Industrial Products sector and the S&P 500 composite have moved up 8.5% and 17%, respectively, in the same time frame.

Image Source: Zacks Investment Research

Solid Order Levels Support FY23 View

The company’s shares have gained 16% since it reported solid first-quarter fiscal 2023 results. Adjusted earnings per share were 94 cents in the quarter, which increased 7% from the prior-year quarter. Revenues of $530 million marked a 12.9% improvement from the prior-year quarter. Total orders increased 12.9% year over year to $638 million and the total backlog at the end of the first quarter was $1,160 million, up 5.3% year over year.

Backed by this performance, the company expects 2023 revenues to improve 7-10% from the 2022 reported level. Adjusted earnings per share are projected between $5.00 and $5.50. The company had reported adjusted earnings per share of $4.77 in 2022.

Strategies to Become a Food and Beverage Solutions Provider

In 2022, John Bean introduced its Elevate 2.0 strategy which is expected to drive continued growth and margin expansion for the company. Among other components of this strategy, the company intended to become a pure-play food and beverage technology solutions provider. The food and beverage processing industry has solid growth prospects, supported by favorable underlying secular and cyclical trends. JBT intends to capitalize on the rising demand for digitally enabled customer-centric solutions, automation and sustainable solutions in the industry.

In sync with this, John Bean recently announced that it has entered into a definitive contract to sell its AeroTech business for $800 million. The all-cash transaction is expected to close in the third quarter of 2023, subject to customary post-closing items. Net proceeds from the sale will be utilized to repay its debt. The company’s shares have gained 8% since this announcement.

Acquisitions to Aid Growth

John Bean Technologies has a strategic acquisition program focused on companies that add complementary products, which enable it to offer more comprehensive solutions to customers and meet the strict economic criteria for returns and synergies. In 2022, it acquired Prevenio, which expanded its recurring revenue stream, and Alco-food-machines GmbH & Co. KG (Alco), a leading provider of further food processing solutions and production lines. It also completed the acquisition of Bevcorp, augmenting its capabilities in the carbonated beverage processing and packaging market. Following the AeroTech divestment, the company will also look for strategic acquisitions that provide meaningful synergies with FoodTech’s existing products and solutions.

Upward Estimate Revisions

Earnings estimates for JBT have moved up over the past 60 days. The Zacks Consensus Estimate for both the 2023 and 2024 bottom line have increased 1%. The favorable estimate revisions instill investors’ confidence in the stock.

Key Picks

Some better-ranked stocks from the Industrial Products sector are W.W. Grainger, Inc., GWW, Allegion ALLE and AptarGroup ATR. Each of these stocks carries a Zacks Rank #2 (Buy). You can see the complete list of today’s Zacks #1 (Strong Buy) Rank stocks here.

The Zacks Consensus Estimate for Grainger’s 2023 earnings per share is pegged at $35.86, which projects 21% growth from the year-ago reported figure. The estimate has moved up 2% in the past 60 days.

GWW has a trailing four-quarter average earnings surprise of 9.1%. The company’s shares have gained 41% so far this year.

Allegion has an average trailing four-quarter earnings surprise of 12.5%. The Zacks Consensus Estimate for Allegion’s fiscal 2023 earnings has moved up 1% in the past 60 days to $6.63 per share. The consensus mark suggests year-over-year growth of 16.5%.

ALLE has an average trailing four-quarter earnings surprise of 12.5%. Its shares have gained 10.7% year-to-date.

The consensus estimate for AptarGroup’s 2023 earnings per share is currently at $4.16. The estimate has moved up 3% in the past 60 days. The estimate projects year-over-year growth of 9.8%. ATR has a trailing four-quarter average earnings surprise of 6.4%. AptarGroup’s shares have gained 2.7% so far this year.

Want the latest recommendations from Zacks Investment Research? Today, you can download 7 Best Stocks for the Next 30 Days. Click to get this free report

W.W. Grainger, Inc. (GWW) : Free Stock Analysis Report

AptarGroup, Inc. (ATR) : Free Stock Analysis Report

John Bean Technologies Corporation (JBT) : Free Stock Analysis Report

Allegion PLC (ALLE) : Free Stock Analysis Report