John Bean (JBT) Submits Non-Binding Proposal to Buy Marel

John Bean Technologies Corporation JBT has submitted a non-binding initial proposal to Marel hf. for a potential voluntary takeover offer. This move aligns with JBT’s goal of making acquisitions that offer significant synergy potential while maintaining a healthy balance sheet and strategic flexibility in the future.

Headquartered in Iceland, Marel is a multinational food processing company. It manufactures equipment and provides other services to the poultry, meat and fish industries.

John Bean received an irrevocable undertaking and entered into exclusivity regarding the shares owned by Eyrir Invest hf. , which holds 24.7% of Marel’s shares.

The company added that these considerations are at a preliminary stage as of now and do not guarantee any formal offer.

John Bean maintains a solid and disciplined balance sheet. Its free cash flow in the first nine months of 2023 was around $62 million. At the end of the third quarter of 2023, the company's leverage ratio was 0.5X net debt to trailing 12 months’ pro-forma adjusted EBITDA due to the sale of AeroTech. The company achieved a 107% free cash flow conversion in the third quarter of 2023 and expects the conversion rate to be more stable going forward.

In 2022, John Bean introduced its Elevate 2.0 strategy, which is expected to drive continued growth and margin expansion for the company. It reported adjusted earnings of $1.11 per share in third-quarter 2023, which came in 16% higher than the prior-year quarter. The figure beat the Zacks Consensus Estimate of 99 cents per share. High order levels, pricing actions and gains from the company’s restructuring actions were instrumental in driving the improved quarterly results.

Revenues in the third quarter were $404 million, increasing 1.2% from the year-ago quarter. A 3% contribution from acquisitions was offset by a 2% decline in organic revenues. The top-line figure lagged the Zacks Consensus Estimate of $419 million.

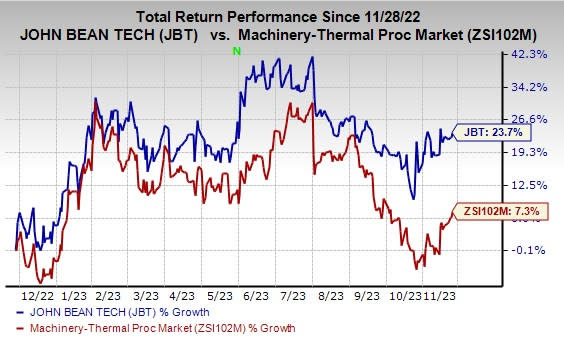

Price Performance

John Bean’s shares have gained 23.7% in the past year compared with the industry’s 7.3% growth.

Image Source: Zacks Investment Research

Zacks Rank & Stocks to Consider

John Bean carries a Zacks Rank #5 (Strong Sell).

Some better-ranked stocks from the Industrial Products sector are Brady BRC, Applied Industrial Technologies AIT and A. O. Smith Corporation AOS.

BRC currently sports a Zacks Rank #1 (Strong Buy) and AIT and AOS each carry a Zacks Rank #2 (Buy). You can see the complete list of today's Zacks #1 Rank stocks here.

The Zacks Consensus Estimate for Brady’s 2023 earnings per share is pegged at $4.00. The consensus estimate for 2023 earnings has moved 13% north in the past 60 days and suggests year-over-year growth of 9.9%. The company has a trailing four-quarter average earnings surprise of 7.2%. Shares of BRC have rallied 15.3% in a year.

Applied Industrial has an average trailing four-quarter earnings surprise of 15%. The Zacks Consensus Estimate for AIT’s 2023 earnings is pinned at $9.43 per share, which indicates year-over-year growth of 7.8%. Estimates have moved up 4% in the past 60 days. The company’s shares have gained 26% in a year.

The Zacks Consensus Estimate for A. O. Smith’s 2023 earnings is pegged at $3.77 per share. The consensus estimate for 2023 earnings has moved 5% north in the past 60 days and suggests year-over-year growth of 20.1%. The company has a trailing four-quarter average earnings surprise of 14%. AOS shares have gained 26.6% in a year .

Want the latest recommendations from Zacks Investment Research? Today, you can download 7 Best Stocks for the Next 30 Days. Click to get this free report

A. O. Smith Corporation (AOS) : Free Stock Analysis Report

Applied Industrial Technologies, Inc. (AIT) : Free Stock Analysis Report

John Bean Technologies Corporation (JBT) : Free Stock Analysis Report

Brady Corporation (BRC) : Free Stock Analysis Report