John Bean (JBT) Submits Revised Proposal to Acquire Marel

John Bean Technologies Corporation JBT has submitted a revised and significantly improved proposal to acquire all of the outstanding common stock of Marel hf. ("Marel"). This move aligns with JBT’s goal of making acquisitions that offer significant synergy potential, while maintaining a healthy balance sheet and strategic flexibility in the future.

In November 2023, JBT submitted a non-binding initial proposal to Marel hf. for a voluntary takeover.

The amended offer from JBT to purchase all of Marel's outstanding common stock is pegged at €3.40 per share (ISK511 per share, based on an ISK/EUR exchange rate of 150.3), which represents a 46% premium over Marel's unaffected closing share price on Nov 23, 2023. This offer is 17% higher than Marel's closing share price on Dec 13, 2023.

Headquartered in Iceland, Marel is a multi-national food processing company. It manufactures equipment and provides other services to the poultry, meat and fish industries.

John Bean received an irrevocable undertaking and entered exclusivity regarding shares owned by Eyrir Invest hf., which holds 24.7% of Marel’s shares.

The merger of JBT and Marel brings together two companies with complementary product portfolios, market-leading brands and cutting-edge technologies. Customers of both companies will benefit considerably from a broader range of processing capabilities, supported by a strong global network for aftermarket parts and services.

JBT aims for a mutually beneficial agreement with Marel at the earliest. However, the finalization of this transaction is subject to JBT's board of directors’ approval.

John Bean maintains a solid and disciplined balance sheet. Its free cash flow in the first nine months of 2023 was around $62 million. At the end of the third quarter of 2023, the company’s leverage ratio was 0.5X net debt to trailing 12 months’ pro-forma adjusted EBITDA due to the sale of AeroTech. The company achieved a 107% free cash flow conversion in the third quarter of 2023. It expects the conversion rate to be more stable going forward.

In 2022, John Bean introduced its Elevate 2.0 strategy, which is expected to drive continued growth and margin expansion for the company. It reported adjusted earnings of $1.11 per share in third-quarter 2023, 16% higher than the prior-year quarter. The figure beat the Zacks Consensus Estimate of 99 cents per share. High order levels, pricing actions and gains from the company’s restructuring actions were instrumental in driving the improved quarterly results.

Revenues in the third quarter were $404 million, increasing 1.2% from the year-ago quarter. A 3% contribution from acquisitions was offset by a 2% decline in organic revenues. The top line lagged the Zacks Consensus Estimate of $419 million.

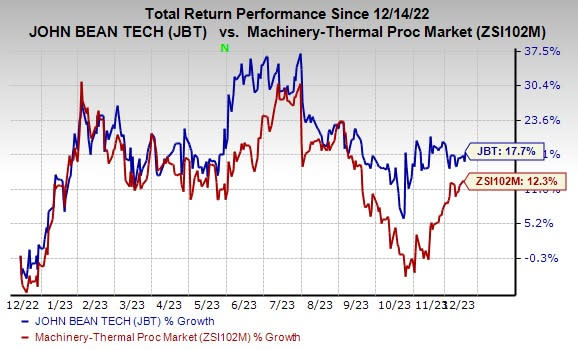

Price Performance

John Bean’s shares have gained 17.7% in the past year compared with the industry’s 12.3% growth.

Image Source: Zacks Investment Research

Zacks Rank & Stocks to Consider

John Bean currently carries a Zacks Rank #3 (Hold).

Some better-ranked stocks from the Industrial Products sector are Crane Company CR, Applied Industrial Technologies AIT and A. O. Smith Corporation AOS.

CR currently sports a Zacks Rank #1 (Strong Buy), and AIT and AOS carry a Zacks Rank #2 (Buy). You can see the complete list of today's Zacks #1 Rank stocks here.

The Zacks Consensus Estimate for Crane Company’s 2023 earnings per share is pegged at $4.18. The consensus estimate for 2023 earnings has been unchanged in the past 60 days. The company has a trailing four-quarter average earnings surprise of 29.8%. CR shares have rallied 33.7% in a year.

Applied Industrial has an average trailing four-quarter earnings surprise of 15%. The Zacks Consensus Estimate for AIT’s 2023 earnings is pinned at $9.43 per share, which indicates year-over-year growth of 7.8%. Estimates have moved up 4% in the past 60 days. The company’s shares have gained 27.2% in a year.

The Zacks Consensus Estimate for A. O. Smith’s 2023 earnings is pegged at $3.77 per share. The consensus estimate for 2023 earnings has moved 5% north in the past 60 days and suggests year-over-year growth of 20.1%. The company has a trailing four-quarter average earnings surprise of 14%. AOS shares have gained 29.4% in a year.

Want the latest recommendations from Zacks Investment Research? Today, you can download 7 Best Stocks for the Next 30 Days. Click to get this free report

A. O. Smith Corporation (AOS) : Free Stock Analysis Report

Applied Industrial Technologies, Inc. (AIT) : Free Stock Analysis Report

Crane Company (CR) : Free Stock Analysis Report

John Bean Technologies Corporation (JBT) : Free Stock Analysis Report