John Bean Technologies Corp (JBT) Reports Strong Earnings Growth and Margin Expansion for Q4 ...

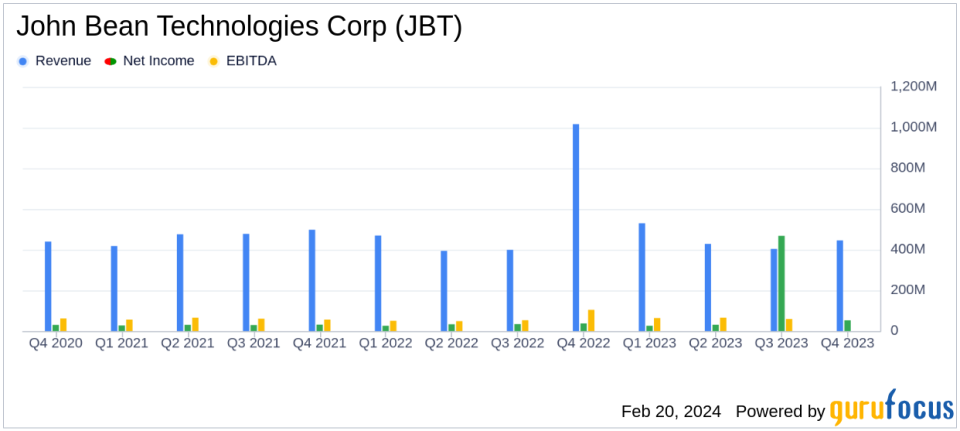

Revenue: Q4 revenue increased slightly to $444.6 million, with full-year revenue up 5% to $1,664.4 million.

Net Income: Income from continuing operations surged by 69% in Q4 to $53 million, and by 25% for the full year to $129 million.

Earnings Per Share (EPS): Q4 EPS from continuing operations rose to $1.64, a 69% increase, with adjusted EPS at $1.40, up 24%.

Adjusted EBITDA: Q4 adjusted EBITDA grew by 18% to $81 million, with a margin increase of 260 basis points to 18.2%.

Free Cash Flow: Full-year free cash flow was robust at $167 million, representing a conversion rate of 129%.

2024 Outlook: JBT anticipates mid-single-digit organic revenue growth and continued margin expansion.

On February 20, 2024, John Bean Technologies Corp (NYSE:JBT) released its 8-K filing, announcing its fourth quarter and full-year earnings for 2023. The company, a global technology solutions provider to the food & beverage industry, reported record results, demonstrating solid organic revenue growth and continued margin expansion.

John Bean Technologies, which spun out of FMC Technologies in August 2008, has a significant presence in the United States, accounting for over half of its sales. The FoodTech business segment offers customized and turnkey solutions across various stages of food and beverage production, emphasizing protein processing, packaging, fruit and juice extraction, and ready-to-eat solutions.

Financial Performance and Challenges

JBT's performance in the fourth quarter was particularly strong, with income from continuing operations reaching $53 million, a 69% increase compared to the same period in the previous year. This growth was attributed to an $11 million discrete tax benefit from the sale of a subsidiary. Adjusted earnings per share (EPS) also saw a significant rise of 24% to $1.40. For the full year, income from continuing operations was up by 25% to $129 million, and adjusted EPS increased by 12% to $4.10.

Despite these achievements, JBT faced challenges, including the transition of AeroTech's financial results to discontinued operations and the election to move to the FIFO inventory method. The company also incurred expenses related to ongoing restructuring but realized savings that contributed to its margin improvement.

Financial Achievements and Importance

The company's financial achievements are critical in the context of the Industrial Products industry, where operational efficiency and margin expansion are key indicators of performance. JBT's ability to increase its adjusted EBITDA margin by 260 basis points to 18.2% in Q4 and by 210 basis points to 16.4% for the full year reflects strong operational execution and successful supply chain initiatives.

Furthermore, JBT's focus on recurring revenue streams, which generate roughly half of its annual revenue, provides a stable foundation for growth and resilience against market fluctuations. The company's robust free cash flow of $167 million underscores its financial health and ability to invest in strategic initiatives.

Key Financial Metrics and Commentary

Key financial metrics from the income statement, balance sheet, and cash flow statement highlight JBT's solid financial position. The company's leverage ratio at year-end was a low 0.6x net debt to trailing twelve months adjusted EBITDA, indicating a strong balance sheet. JBT's President and CEO, Brian Deck, commented on the results:

"JBT delivered solid year-over-year earnings growth and continued margin expansion in 2023. Moreover, we made continued progress on our Elevate 2.0 strategy by becoming a pure-play food and beverage technology solutions provider, advancing the adoption of our digital solutions, and growing recurring revenue."

For the full year 2024, JBT expects mid-single-digit organic top line growth, driven by recurring revenue initiatives and a strengthening demand environment for equipment. The company also anticipates further margin expansion through supply chain and manufacturing efficiency initiatives and ongoing benefits from restructuring efforts.

Analysis of Company's Performance

JBT's performance in 2023 was marked by strategic decisions that positioned the company for future growth. The divestiture of AeroTech allowed JBT to focus on its core FoodTech business, where it sees greater opportunities for expansion. The company's guidance for 2024 reflects confidence in its business model and market position.

The potential merger with Marel, a complementary player in the industry, could further enhance JBT's scale, global reach, and technological capabilities, creating additional value for shareholders. However, this strategic move also introduces potential risks and uncertainties that will need to be managed carefully.

In conclusion, JBT's 2023 earnings report paints a picture of a company that is successfully navigating industry challenges and leveraging its strengths to deliver strong financial results. With a clear strategy and a focus on operational excellence, JBT is well-positioned for continued success in the year ahead.

Explore the complete 8-K earnings release (here) from John Bean Technologies Corp for further details.

This article first appeared on GuruFocus.