John Hussman's Strategic Moves Spotlight PepsiCo Inc with a 1.14% Portfolio Impact

Insight into John Hussman (Trades, Portfolio)'s Latest 13F Filing for Q4 2023

Dr. John Hussman (Trades, Portfolio), a seasoned economist and the strategic mind behind Hussman Strategic Advisors, has made notable changes to his investment portfolio in the fourth quarter of 2023. With a Ph.D. in economics from Stanford University and a background in academia, Dr. Hussman applies a unique approach to investing, focusing on valuation and market action to navigate through different "Market Climates." His latest 13F filing reveals a series of strategic decisions, reflecting his assessment of the current market conditions and his investment philosophy.

Summary of New Buys

John Hussman (Trades, Portfolio)'s portfolio welcomed 18 new stocks in the last quarter. Noteworthy additions include:

FedEx Corp (NYSE:FDX), a significant new holding with 15,750 shares valued at approximately $3.98 million, accounting for 0.91% of the portfolio.

ACM Research Inc (NASDAQ:ACMR), with 157,000 shares, making up about 0.7% of the portfolio and valued at $3.07 million.

Fastly Inc (NYSE:FSLY), comprising 168,000 shares, representing 0.68% of the portfolio with a total value of $2.99 million.

Key Position Increases

John Hussman (Trades, Portfolio) has also ramped up investments in 39 stocks, with the most significant increases being:

PepsiCo Inc (NASDAQ:PEP), where an additional 29,400 shares were acquired, boosting the total to 31,500 shares. This move marks a substantial 1,400% increase in share count and a 1.14% impact on the current portfolio, valued at $5.35 million.

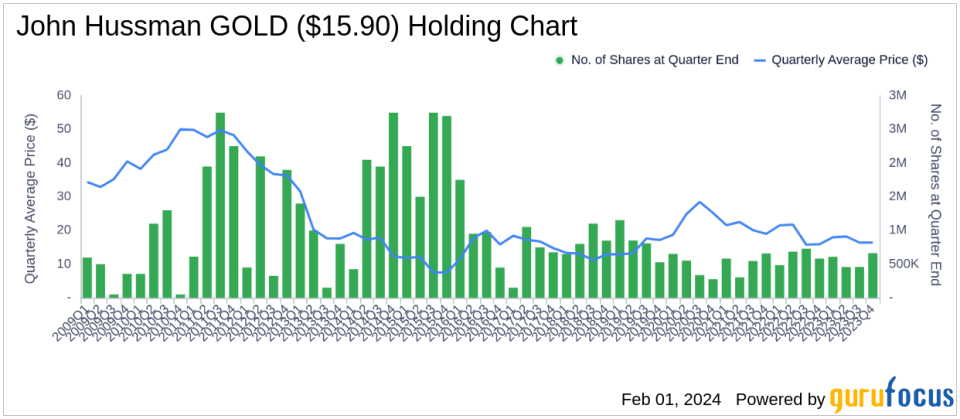

Barrick Gold Corp (NYSE:GOLD), with an additional 204,000 shares, bringing the total to 663,000 shares. This adjustment represents a 44.44% increase in share count, with a total value of $11.99 million.

Summary of Sold Out Positions

Exiting 93 holdings, John Hussman (Trades, Portfolio) has made clear strategic divestments, including:

VMware Inc (VMW), where all 29,400 shares were sold, impacting the portfolio by -0.93%.

Amkor Technology Inc (NASDAQ:AMKR), with a complete liquidation of 189,000 shares, causing a -0.82% impact on the portfolio.

Key Position Reductions

Reductions were made in 99 stocks, with significant cuts in:

Nutanix Inc (NASDAQ:NTNX), reduced by 105,000 shares, resulting in an -83.33% decrease in shares and a -0.7% impact on the portfolio. The stock traded at an average price of $40.47 during the quarter and has returned 56.26% over the past three months and 19.73% year-to-date.

Sprouts Farmers Market Inc (NASDAQ:SFM), reduced by 84,000 shares, leading to a -66.67% reduction in shares and a -0.69% impact on the portfolio. The stock traded at an average price of $43.75 during the quarter and has returned 25.73% over the past three months and 6.03% year-to-date.

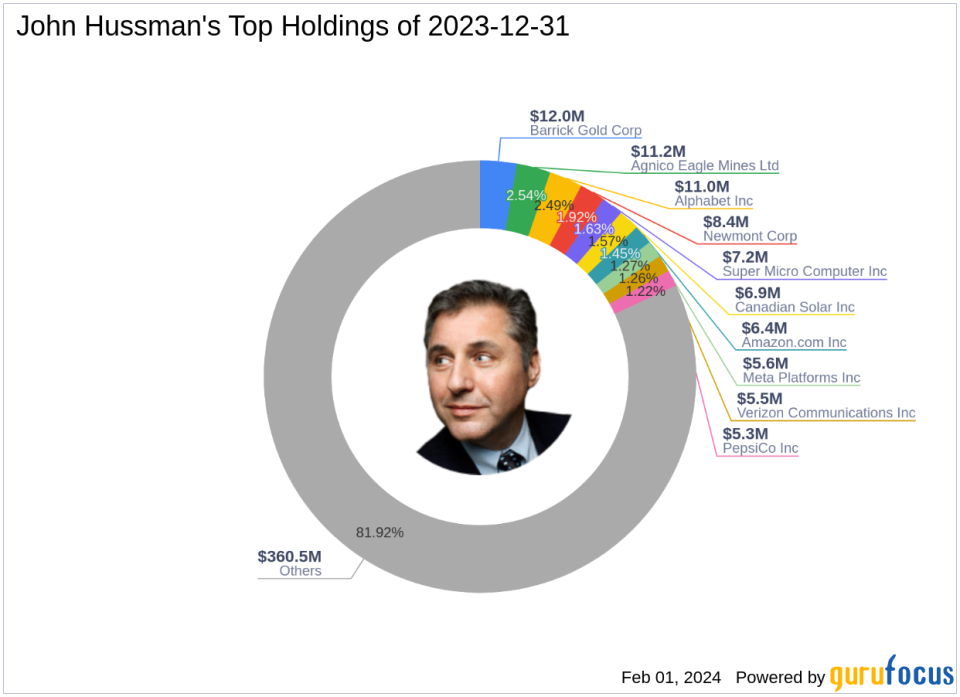

Portfolio Overview

As of the fourth quarter of 2023, John Hussman (Trades, Portfolio)'s portfolio is composed of 222 stocks. The top holdings include 2.73% in Barrick Gold Corp (NYSE:GOLD), 2.54% in Agnico Eagle Mines Ltd (NYSE:AEM), 2.49% in Alphabet Inc (NASDAQ:GOOG), 1.92% in Newmont Corp (NYSE:NEM), and 1.63% in Super Micro Computer Inc (NASDAQ:SMCI). The investments span across all 11 industries, with a focus on Technology, Healthcare, Consumer Cyclical, and other sectors, reflecting a diversified approach to value investing.

This article, generated by GuruFocus, is designed to provide general insights and is not tailored financial advice. Our commentary is rooted in historical data and analyst projections, utilizing an impartial methodology, and is not intended to serve as specific investment guidance. It does not formulate a recommendation to purchase or divest any stock and does not consider individual investment objectives or financial circumstances. Our objective is to deliver long-term, fundamental data-driven analysis. Be aware that our analysis might not incorporate the most recent, price-sensitive company announcements or qualitative information. GuruFocus holds no position in the stocks mentioned herein.

This article first appeared on GuruFocus.