John Paulson Bolsters Stake in Novagold Resources Inc

On December 31, 2023, Paulson & Co., led by renowned investor John Paulson (Trades, Portfolio), made a significant addition to its investment portfolio by acquiring 23,541,483 shares of Novagold Resources Inc (NG). This transaction, which saw an increase of 1,315,183 shares, represents a 5.92% change in the firm's holdings and has a 0.44% impact on the portfolio. The shares were purchased at a price of $3.74, reflecting a strong belief in the future prospects of the mineral exploration company.

John Paulson (Trades, Portfolio)'s Investment Acumen

John Paulson (Trades, Portfolio), the President and Portfolio Manager of Paulson & Co. Inc., is a prominent figure in the investment world. With a portfolio managed to the tune of approximately $29 billion, Paulson's firm specializes in merger, event, and distressed strategies. A graduate of Harvard Business School and New York University, Paulson has a storied career that includes a tenure at Gruss Partners and Bear Stearns before founding his own firm in 1994. Paulson & Co.'s investment philosophy is rooted in merger arbitrage, focusing on opportunities arising from company takeovers and utilizing a mix of equity market analysis and credit default swaps research.

Novagold Resources Inc: A Glimpse into the Company

Novagold Resources Inc, trading under the symbol NG, is a USA-based mineral exploration entity that has been publicly traded since December 2, 2003. The company is primarily involved in the exploration and development of the Donlin Gold project in Alaska. With a market capitalization of $834.691 million, Novagold Resources Inc operates within the Metals & Mining industry, a sector that is closely watched by investors for its potential for high returns.

Impact of Paulson's Trade on Portfolio

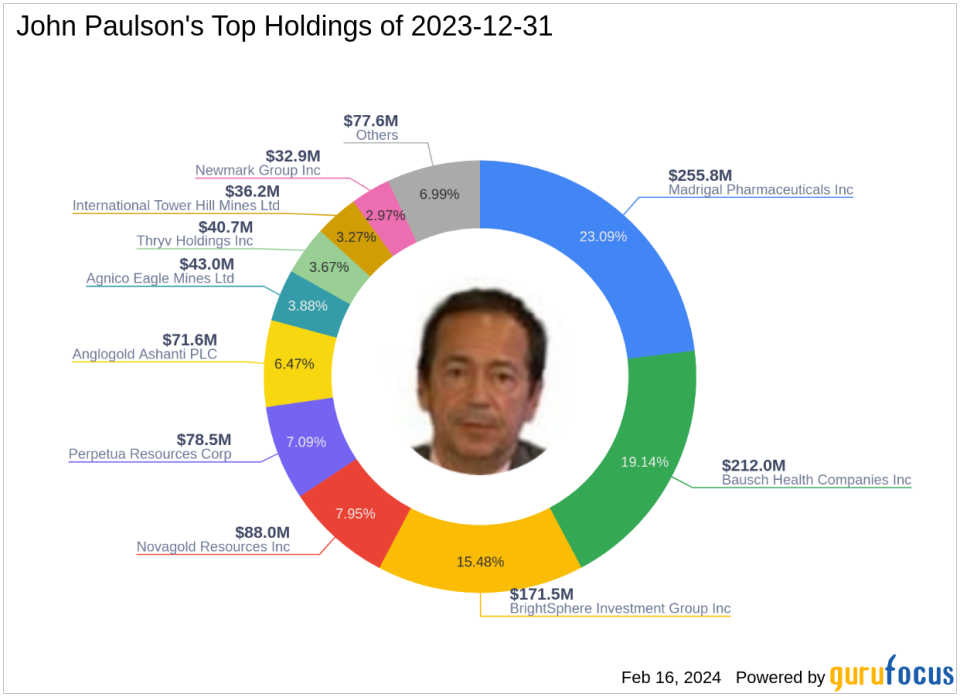

The recent acquisition of Novagold Resources Inc shares has increased Paulson & Co.'s position in the company to 7.84% of the portfolio, with a 7.00% holding in the traded stock. This move underscores the firm's confidence in Novagold Resources Inc and its alignment with Paulson's investment strategy, which heavily favors the healthcare and basic materials sectors.

Novagold Resources Inc Stock Trajectory

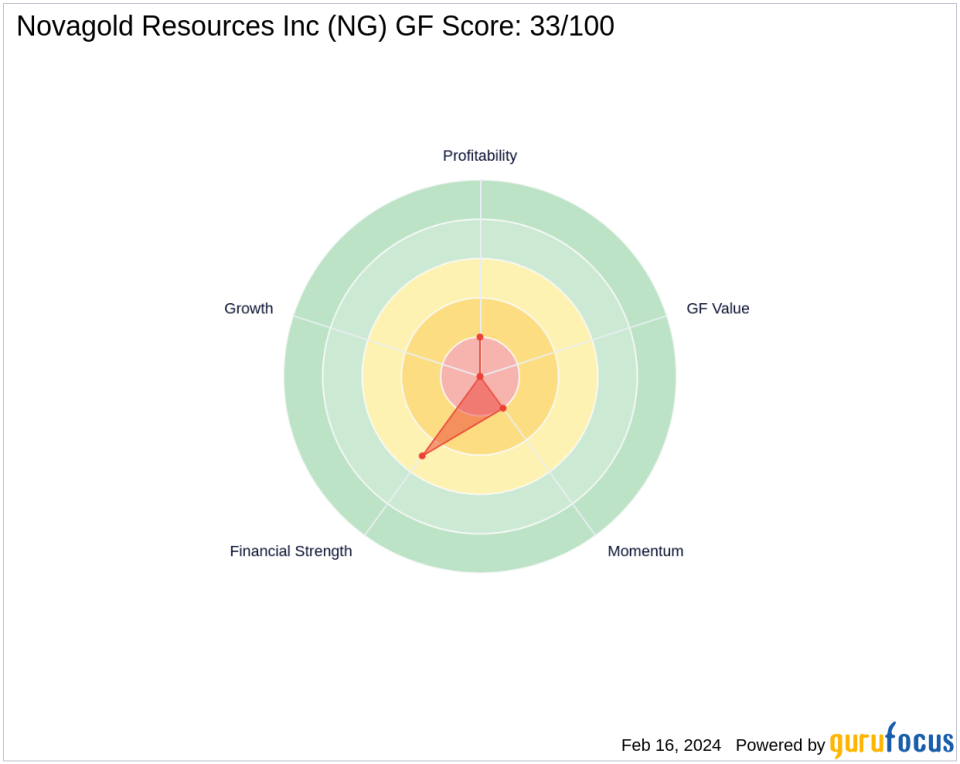

Since the trade date, Novagold Resources Inc's stock has experienced a downturn, with the current price standing at $2.53, representing a -32.35% change. The company's financial health and market performance indicators, including a GF Score of 33/100, suggest a cautious outlook. The stock's Profitability Rank and Growth Rank are notably low, at 2/10 and 0/10 respectively, indicating challenges in these areas.

Paulson's Sector Strategy and Market Context

John Paulson (Trades, Portfolio)'s top sectors include healthcare and basic materials, with Novagold Resources Inc fitting into the latter category. The firm's investment strategy often involves identifying undervalued opportunities within these sectors, leveraging Paulson's expertise in event-driven scenarios to capitalize on market movements.

Comparative Guru Holdings

While Paulson & Co. is the largest guru shareholder of Novagold Resources Inc, other notable investors such as First Eagle Investment (Trades, Portfolio) also maintain positions in the company. This collective interest from multiple investment gurus can be indicative of the stock's potential or inherent value.

Concluding Analysis of Paulson's Novagold Resources Inc Trade

In summary, John Paulson (Trades, Portfolio)'s recent trade to increase the firm's stake in Novagold Resources Inc is a strategic move that aligns with the firm's investment philosophy and sector preferences. Despite the current stock performance challenges, Paulson & Co.'s significant position in NG reflects a long-term perspective and a belief in the company's future growth potential. Investors will be watching closely to see how this trade influences both the stock's trajectory and the firm's portfolio in the coming months.

This article, generated by GuruFocus, is designed to provide general insights and is not tailored financial advice. Our commentary is rooted in historical data and analyst projections, utilizing an impartial methodology, and is not intended to serve as specific investment guidance. It does not formulate a recommendation to purchase or divest any stock and does not consider individual investment objectives or financial circumstances. Our objective is to deliver long-term, fundamental data-driven analysis. Be aware that our analysis might not incorporate the most recent, price-sensitive company announcements or qualitative information. GuruFocus holds no position in the stocks mentioned herein.

This article first appeared on GuruFocus.