John Paulson's Strategic Moves: Horizon Therapeutics PLC Takes the Lead with 16.59% Portfolio Impact

Paulson & Co. Adjusts Holdings in Q3 2023, Revealing Key Investment Decisions

John Paulson (Trades, Portfolio), the renowned President and Portfolio Manager of Paulson & Co. Inc., has made notable changes to his investment portfolio in the third quarter of 2023. A seasoned investor, Paulson's expertise in merger, event, and distressed strategies has positioned his firm among the world's largest hedge funds. With a prestigious academic background and extensive experience in mergers and acquisitions, Paulson's investment moves are closely watched by the financial community for insights into market trends and opportunities.

New Acquisition in Paulson's Portfolio

John Paulson (Trades, Portfolio)'s latest 13F filing reveals a strategic addition to his portfolio:

Anglogold Ashanti PLC (NYSE:AU) stands out as the sole new buy, with Paulson acquiring 3,833,492 shares. This position represents 5.42% of the portfolio, with a total value of $60.57 million.

Significant Increases in Existing Holdings

Paulson has also bolstered his positions in two companies:

Horizon Therapeutics PLC (HZNP) saw a substantial increase of 1,603,046 shares, bringing the total to 2,103,046 shares. This move marks a 320.61% surge in share count and has a significant 16.59% impact on the current portfolio, valued at $243.30 million.

Madrigal Pharmaceuticals Inc (NASDAQ:MDGL) experienced a 42.78% increase in share count with an additional 149,800 shares, culminating in a total holding of 500,000 shares, valued at $73.02 million.

Strategic Exits from Paulson's Portfolio

The third quarter also saw Paulson exit several positions:

Anglogold Ashanti Plc (NYSE:AU) was completely sold off, with all 3,833,492 shares divested, impacting the portfolio by -7.89%.

Newmont Corp (NYSE:NEM) was another liquidation, with 452,000 shares sold, resulting in a -1.88% portfolio impact.

Overview of Paulson's Q3 2023 Portfolio

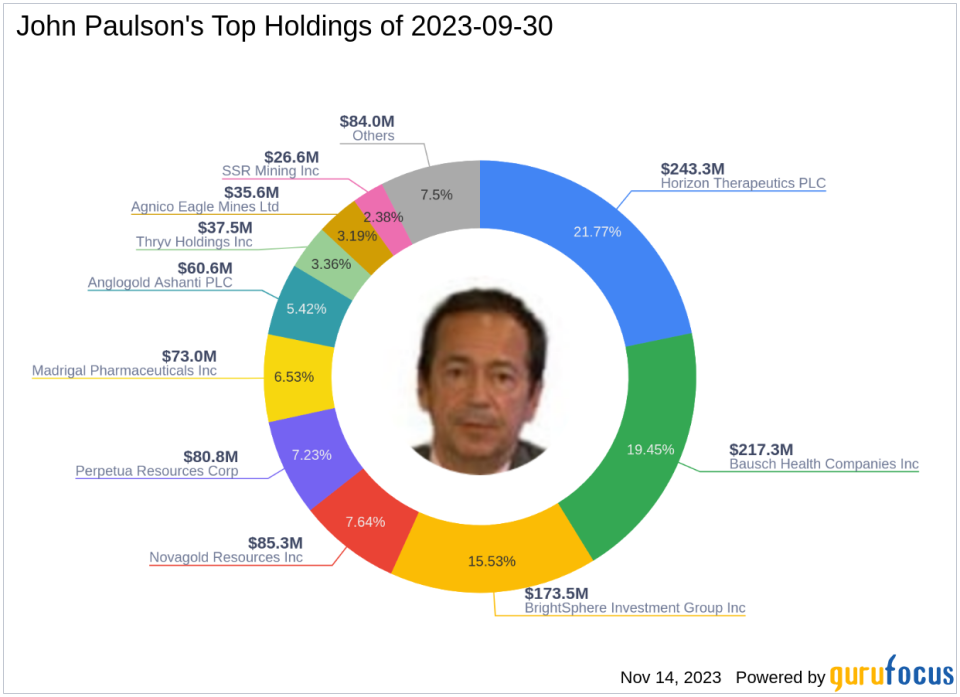

As of the third quarter of 2023, John Paulson (Trades, Portfolio)'s investment portfolio comprises 18 stocks. The top holdings are notably concentrated in Horizon Therapeutics PLC (HZNP) at 21.77%, Bausch Health Companies Inc (NYSE:BHC) at 19.45%, and BrightSphere Investment Group Inc (NYSE:BSIG) at 15.53%. Other significant positions include Novagold Resources Inc (NG) and Perpetua Resources Corp (NASDAQ:PPTA), with the portfolio mainly focused on seven industries: Healthcare, Basic Materials, Financial Services, Communication Services, Real Estate, Energy, and Consumer Cyclical.

This article, generated by GuruFocus, is designed to provide general insights and is not tailored financial advice. Our commentary is rooted in historical data and analyst projections, utilizing an impartial methodology, and is not intended to serve as specific investment guidance. It does not formulate a recommendation to purchase or divest any stock and does not consider individual investment objectives or financial circumstances. Our objective is to deliver long-term, fundamental data-driven analysis. Be aware that our analysis might not incorporate the most recent, price-sensitive company announcements or qualitative information. GuruFocus holds no position in the stocks mentioned herein.

This article first appeared on GuruFocus.