John Rogers' Ariel Investment Adjusts Portfolio, Cuts Back on Philip Morris International

Insights from the Latest 13F Filing Reveal Strategic Moves in Q4 2023

John Rogers (Trades, Portfolio), the esteemed founder of Ariel Investment, LLC, and a renowned value investor, has made significant changes to his investment portfolio in the fourth quarter of 2023. With a storied career that began in 1983, Rogers has built a reputation for his patient investment approach, focusing on undervalued small and mid-cap companies. His investment philosophy emphasizes patience, independent thinking, and a long-term outlook, with a keen eye for companies that boast high barriers to entry, sustainable competitive advantages, and the potential for double-digit cash earnings growth. Rogers' strategy involves buying into companies at low valuations relative to their potential earnings or intrinsic worth.

Summary of New Buys

John Rogers (Trades, Portfolio) expanded his portfolio with 8 new stock additions in the latest quarter:

DaVita Inc (NYSE:DVA) emerged as the most significant new holding, with 658,818 shares valued at approximately $69.02 million, making up 0.69% of the portfolio.

Intel Corp (NASDAQ:INTC) was the second-largest addition, comprising 1,324,437 shares, which represent 0.66% of the portfolio, with a total value of $66.55 million.

Truist Financial Corp (NYSE:TFC) rounded out the top three new positions, with 1,067,702 shares valued at $39.42 million, accounting for 0.39% of the portfolio.

Key Position Increases

Rogers also bolstered his stakes in 48 existing holdings, with notable increases in:

Check Point Software Technologies Ltd (NASDAQ:CHKP), where he added 416,758 shares, bringing the total to 1,500,122 shares. This represents a 38.47% increase in share count and a 0.63% impact on the current portfolio, valued at $229.20 million.

Envista Holdings Corp (NYSE:NVST) saw an addition of 1,761,364 shares, resulting in a total of 7,096,942 shares. This adjustment marks a 33.01% increase in share count, with a total value of $170.75 million.

Summary of Sold Out Positions

In a strategic move, John Rogers (Trades, Portfolio) exited 9 positions during the fourth quarter of 2023:

Itau Unibanco Holding SA (NYSE:ITUB) was completely sold off, with 10,161,278 shares liquidated, impacting the portfolio by -0.58%.

Nokia Oyj (NYSE:NOK) also saw a complete exit, with all 2,290,872 shares sold, resulting in a -0.09% portfolio impact.

Key Position Reductions

Concurrently, Rogers reduced his positions in 53 stocks. The most significant reductions include:

Philip Morris International Inc (NYSE:PM) was cut by 1,164,768 shares, a -47.36% decrease, affecting the portfolio by -1.14%. The stock traded at an average price of $92.13 during the quarter and has seen a 0.19% return over the past 3 months and a -5.04% year-to-date performance.

Baidu Inc (NASDAQ:BIDU) saw a reduction of 618,355 shares, a -28.81% decrease, with a -0.88% impact on the portfolio. The average trading price during the quarter was $115.54, with a -3.56% return over the past 3 months and -11.29% year-to-date.

Portfolio Overview

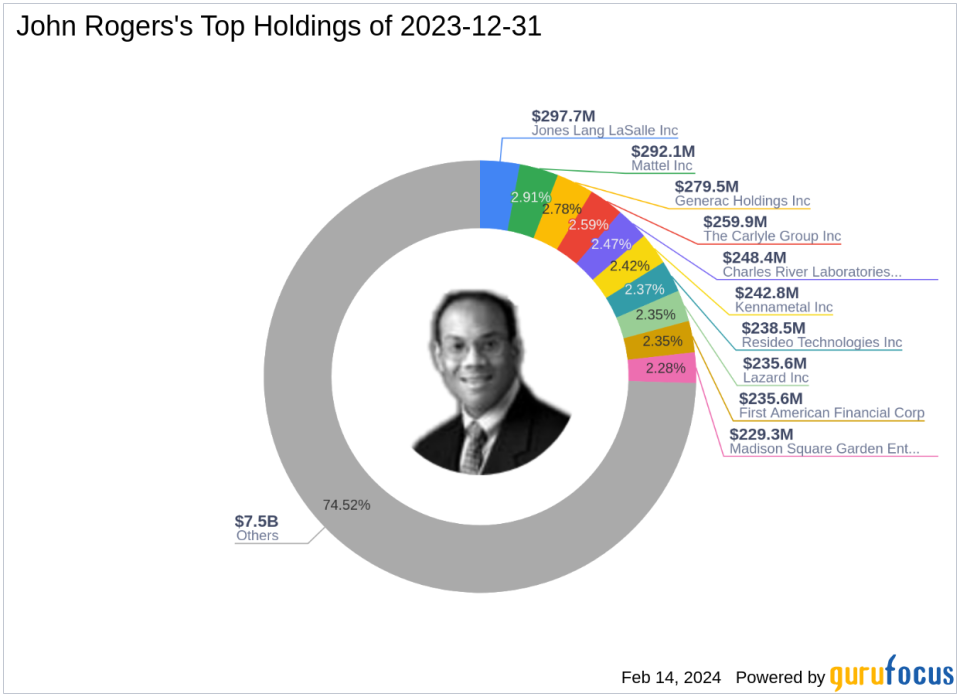

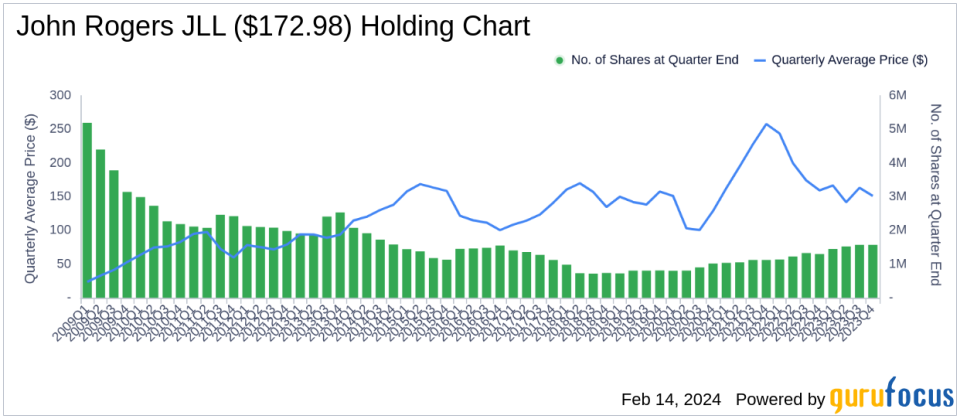

As of the end of Q4 2023, John Rogers (Trades, Portfolio)'s investment portfolio comprised 114 stocks. The top holdings included 2.96% in Jones Lang LaSalle Inc (NYSE:JLL), 2.91% in Mattel Inc (NASDAQ:MAT), 2.78% in Generac Holdings Inc (NYSE:GNRC), 2.59% in The Carlyle Group Inc (NASDAQ:CG), and 2.47% in Charles River Laboratories International Inc (NYSE:CRL). The investments span across 10 of the 11 industries, with a focus on Consumer Cyclical, Financial Services, Industrials, Communication Services, Healthcare, Technology, Real Estate, Consumer Defensive, Basic Materials, and Energy sectors.

This article, generated by GuruFocus, is designed to provide general insights and is not tailored financial advice. Our commentary is rooted in historical data and analyst projections, utilizing an impartial methodology, and is not intended to serve as specific investment guidance. It does not formulate a recommendation to purchase or divest any stock and does not consider individual investment objectives or financial circumstances. Our objective is to deliver long-term, fundamental data-driven analysis. Be aware that our analysis might not incorporate the most recent, price-sensitive company announcements or qualitative information. GuruFocus holds no position in the stocks mentioned herein.

This article first appeared on GuruFocus.