John Rogers' Q2 2023 13F Filing Analysis

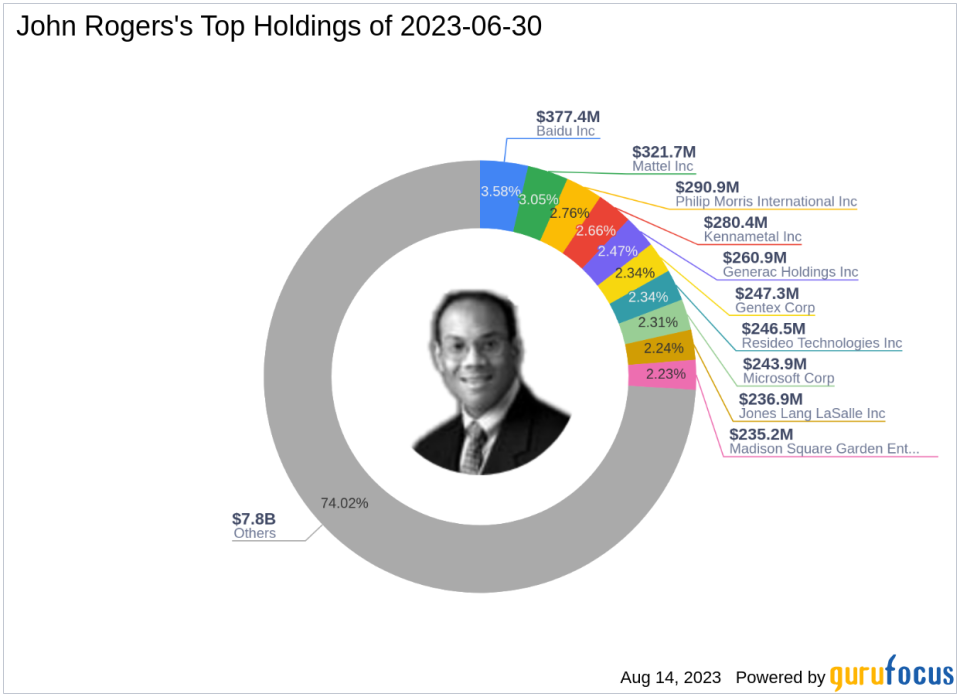

Renowned investor John Rogers has recently disclosed his firm's portfolio for the second quarter of 2023, which ended on June 30, 2023. Rogers is known for his value-oriented investment philosophy, focusing on undervalued companies with strong fundamentals and potential for long-term growth. His firm's portfolio for Q2 2023 comprised 118 stocks, with a total value of $10.55 billion.

The top holdings in the portfolio were BIDU (3.58%), MAT (3.05%), and PM (2.76%).

Top Three Trades of the Quarter

The following were the firm's top three trades of the quarter:

Leslies Inc (NAS:LESL)

During the quarter, John Rogers (Trades, Portfolio)' firm purchased 3,411,202 shares of Leslies Inc (NAS:LESL), bringing the total holding to 20,000,131 shares. This trade had a 0.21% impact on the equity portfolio. The stock traded for an average price of $6.37 during the quarter. As of August 14, 2023, LESL had a price of $7.165 and a market cap of $1.32 billion. The stock has returned -55.26% over the past year. GuruFocus gives the company a financial strength rating of 3 out of 10 and a profitability rating of 5 out of 10. In terms of valuation, LESL has a price-earnings ratio of 19.36, a EV-to-Ebitda ratio of 12.99, and a price-sales ratio of 0.87.

Sphere Entertainment Co (NYSE:SPHR)

John Rogers (Trades, Portfolio)' firm reduced its investment in Sphere Entertainment Co (NYSE:SPHR) by 313,158 shares, which had a 0.13% impact on the equity portfolio. The stock traded for an average price of $42.45 during the quarter. As of August 14, 2023, SPHR had a price of $38.74 and a market cap of $1.34 billion. The stock has returned 32.22% over the past year. GuruFocus gives the company a financial strength rating of 3 out of 10 and a profitability rating of 3 out of 10. In terms of valuation, SPHR has a price-book ratio of 0.66, a EV-to-Ebitda ratio of 58.30, and a price-sales ratio of 0.61.

OneSpaWorld Holdings Ltd (NAS:OSW)

During the quarter, John Rogers (Trades, Portfolio)' firm bought 101,887 shares of OneSpaWorld Holdings Ltd (NAS:OSW), bringing the total holding to 13,810,291 shares. This trade had a 0.01% impact on the equity portfolio. The stock traded for an average price of $12.845 during the quarter. As of August 14, 2023, OSW had a price of $11.985 and a market cap of $1.19 billion. The stock has returned 26.64% over the past year. GuruFocus gives the company a financial strength rating of 6 out of 10 and a profitability rating of 4 out of 10. In terms of valuation, OSW has a price-book ratio of 2.87, a EV-to-Ebitda ratio of 51.67, and a price-sales ratio of 1.60.

In conclusion, John Rogers (Trades, Portfolio)' Q2 2023 portfolio reveals a strategic mix of investments in various sectors. His firm's top trades reflect a balanced approach towards both buying and selling, in line with their value-oriented investment philosophy.

This article first appeared on GuruFocus.