John Rogers's Ariel Investment Trims Stake in Resideo Technologies Inc

Overview of John Rogers (Trades, Portfolio)'s Recent Stock Transaction

John Rogers (Trades, Portfolio)'s Ariel Investment, LLC has recently adjusted its investment in Resideo Technologies Inc (NYSE:REZI), a notable player in the technology-driven products and solutions industry. On December 31, 2023, the firm reduced its holdings in REZI by 1,088,010 shares, which equated to a 7.91% decrease in their previous position. This transaction had a -0.22% impact on the firm's portfolio, reflecting a strategic move by the investment company.

Profile of John Rogers (Trades, Portfolio) and Ariel Investment, LLC

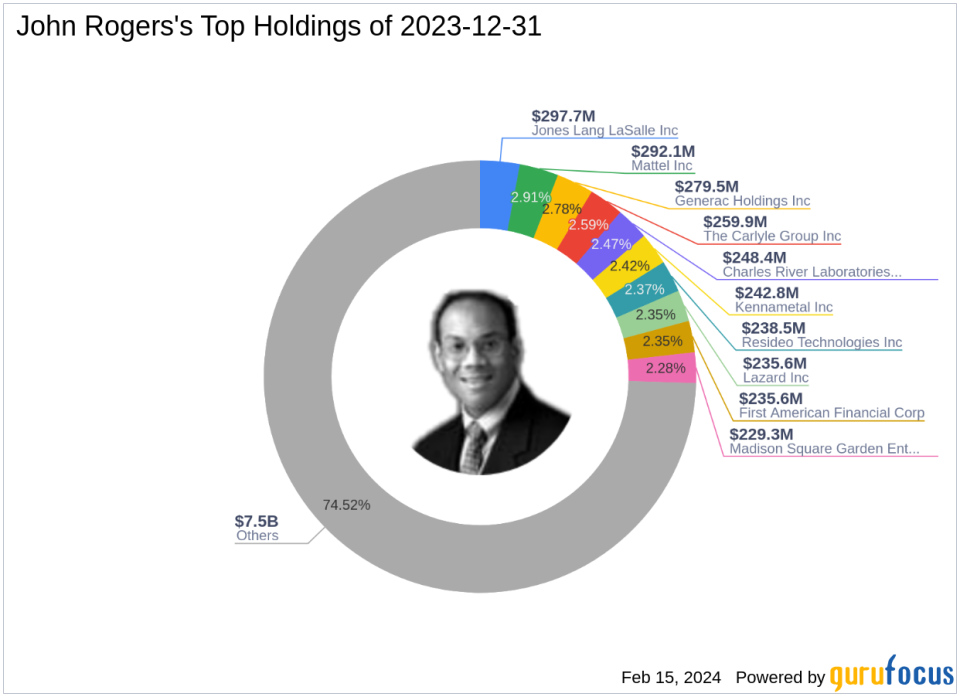

John Rogers (Trades, Portfolio), the founder of Ariel Investment, LLC, has been a prominent figure in the investment community since 1983. Managing both small and mid-cap institutional portfolios, Rogers is known for his "Patient Investor" column in Forbes and his leadership in managing the Ariel Fund (ARGFX) and Ariel Appreciation Fund (CAAPX). The firm's investment philosophy centers on identifying undervalued small and medium-sized companies and holding them for the long term. Ariel Investment's top holdings include The Carlyle Group Inc (NASDAQ:CG), Mattel Inc (NASDAQ:MAT), and Charles River Laboratories International Inc (NYSE:CRL), showcasing a diverse portfolio with a strong emphasis on Consumer Cyclical and Financial Services sectors.

Resideo Technologies Inc Company Overview

Resideo Technologies Inc, trading under the symbol REZI, is a company that specializes in manufacturing and developing products and components for comfort, energy management, safety, and security solutions. With its initial public offering on October 15, 2018, the company operates through two segments: ADI Global Distribution and Products and Solutions. The majority of its revenue is generated in the United States, and it holds a market capitalization of $3.06 billion. Resideo's stock is currently priced at $21.09, reflecting a modest undervaluation according to GuruFocus's GF Value metric.

Transaction Details

The transaction details reveal that Ariel Investment's trade price for REZI was $18.82 per share. Following the trade, the firm held a total of 12,672,096 shares, representing 2.53% of their portfolio and 8.70% of their holdings in the traded stock. This move indicates a significant adjustment in the firm's investment strategy regarding Resideo Technologies Inc.

Performance and Valuation of Resideo Technologies Inc

Since the trade date, Resideo Technologies Inc's stock price has experienced a gain of 12.06%, with a year-to-date increase of 14.99%. The stock's performance since its IPO, however, shows a decline of 34.09%. The current PE ratio stands at 18.83%, and the stock is considered modestly undervalued with a GF Value of $23.40 and a price to GF Value ratio of 0.90.

Resideo Technologies Inc's Financial Health and Market Position

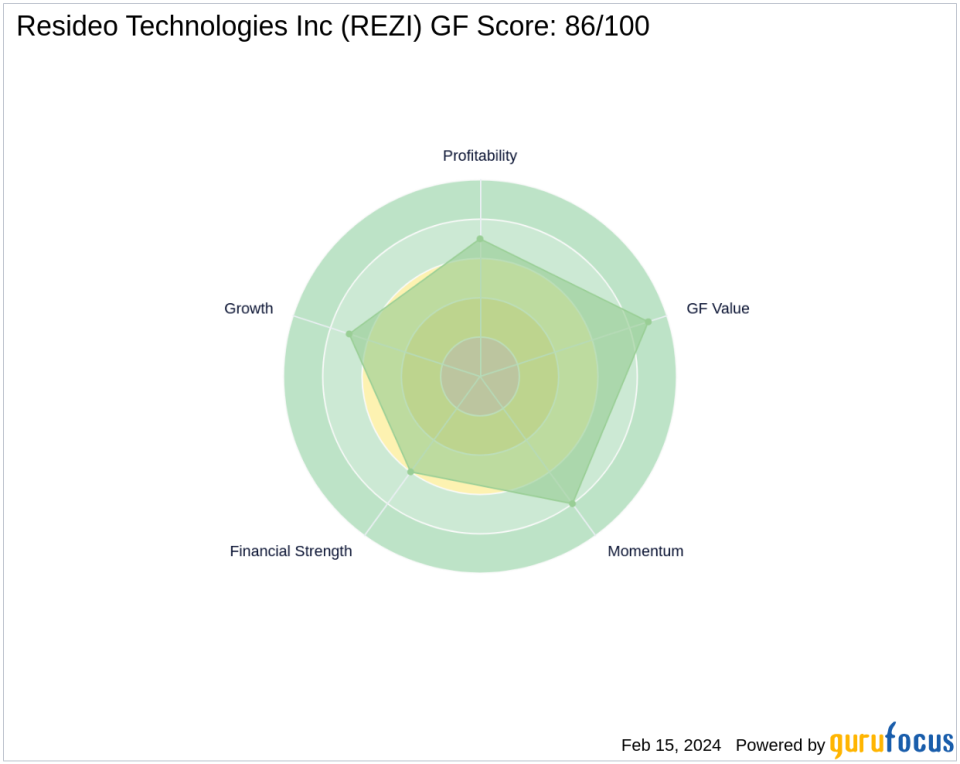

Resideo Technologies Inc's financial health is reflected in its key financial ratios and growth metrics. The company has a GF Score of 86/100, indicating good outperformance potential. Its Financial Strength is ranked 6/10, with an interest coverage of 8.21 and a Altman Z score of 1.92. The Profitability Rank is 7/10, and the Piotroski F-Score is 6, indicating a stable financial situation. The company's Operating Margin growth is 26.80%, and it has a Growth Rank of 7/10.

Sector and Market Context

John Rogers (Trades, Portfolio)'s Ariel Investment has a diverse portfolio with top holdings in various sectors, with Consumer Cyclical and Financial Services being the most prominent. Resideo Technologies Inc operates within the Business Services industry, which is a competitive sector that demands constant innovation and efficiency.

Other Notable Investors in Resideo Technologies Inc

Aside from John Rogers (Trades, Portfolio)'s Ariel Investment, other notable investors in Resideo Technologies Inc include Richard Pzena (Trades, Portfolio), Mario Gabelli (Trades, Portfolio), and Ken Fisher (Trades, Portfolio). Ariel Investment remains the largest guru shareholder, demonstrating confidence in the company's potential despite the recent reduction in shares.

Transaction Analysis

The recent transaction by John Rogers (Trades, Portfolio)'s Ariel Investment indicates a strategic shift in the firm's position on Resideo Technologies Inc. While the reduction in shares has slightly decreased the firm's exposure to REZI, the company's strong financial health and market position, coupled with its modest undervaluation, suggest that Ariel Investment may still see long-term value in the stock. Investors will be watching closely to see how this trade impacts both the stock's performance and the firm's portfolio in the future.

This article, generated by GuruFocus, is designed to provide general insights and is not tailored financial advice. Our commentary is rooted in historical data and analyst projections, utilizing an impartial methodology, and is not intended to serve as specific investment guidance. It does not formulate a recommendation to purchase or divest any stock and does not consider individual investment objectives or financial circumstances. Our objective is to deliver long-term, fundamental data-driven analysis. Be aware that our analysis might not incorporate the most recent, price-sensitive company announcements or qualitative information. GuruFocus holds no position in the stocks mentioned herein.

This article first appeared on GuruFocus.