John Wiley & Sons Inc (WLY) Faces Headwinds Amidst Digital Transition: A Mixed Third ...

Revenue: Reported a 6% decrease to $461 million, with digital products and services remaining a core focus.

Operating Loss: Operating loss improved by $21 million, yet the company posted a GAAP operating loss of $46 million.

EPS: GAAP EPS showed a loss of $2.08, while adjusted EPS at constant currency was $0.59, down 27%.

Adjusted EBITDA: Slight increase to $92 million, up 1% at constant currency.

Balance Sheet and Cash Flow: Net Debt-to-EBITDA Ratio improved to 1.9, but Free Cash Flow less Product Development Spending showed a year-to-date use of $45 million.

Full Year Outlook: Adjusted Revenue and Adjusted EPS guidance raised, with revenue trending toward the mid-to-high end of the $1,580 to $1,630 million range.

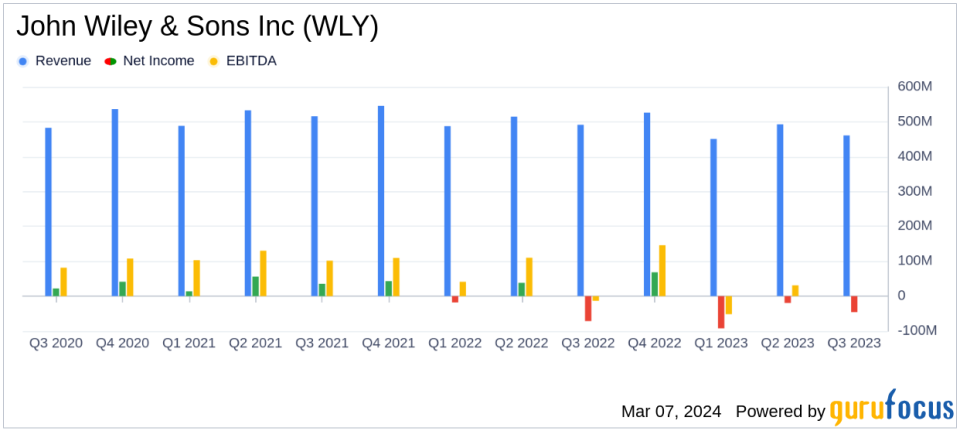

On March 7, 2024, John Wiley & Sons Inc (NYSE:WLY), a global leader in research and learning, released its 8-K filing, detailing the financial results for the third quarter ended January 31, 2024. The company, known for its digital products and tech-enabled services, reported a decrease in GAAP revenue by 6% to $461 million, primarily due to a completed divestiture and declines in other held-for-sale businesses. Despite this, the company's adjusted revenue at constant currency saw a slight increase of 1% to $403 million.

John Wiley & Sons Inc (NYSE:WLY) is navigating a period of transition, focusing on digital products and services which account for over 85% of its total revenue. The company has restructured its Education lines of business into two new segments: Academic, serving university customers, and Talent, focused on corporate training and upskilling solutions.

The company's GAAP results were significantly impacted by charges related to held-for-sale or sold assets, including goodwill and held-for-sale impairments of $82 million and $26 million, respectively, as well as a loss on a completed divestiture of $26 million. Restructuring charges of $15 million were also recorded. Adjusted EBITDA saw a modest increase, while adjusted EPS at constant currency decreased by 27% to $0.59, reflecting lower adjusted operating income, higher tax expense, and increased interest expense.

John Wiley & Sons Inc (NYSE:WLY) reported an operating loss of $46 million, an improvement from the previous year, and a GAAP EPS loss of $2.08, compared to a loss of $1.29 in the prior year. The adjusted EPS, which excludes held-for-sale or sold businesses, was down due to lower adjusted operating income and higher expenses.

The balance sheet showed a net debt-to-EBITDA ratio of 1.9, an improvement from 2.1 in the year-ago period. However, net cash provided by operating activities year-to-date was $24 million compared to $54 million in the prior year period, attributed to timing delays in closing journal subscription renewals, higher restructuring payments, and increased interest payments. Free cash flow less product development spending year-to-date was a use of $45 million, compared to a use of $22 million in the prior year period.

Matthew Kissner, Interim President and CEO, commented on the results:

As we finish out the year, were increasingly confident in our underlying momentum and recovery in Research and continued outperformance in Learning. Weve moved decisively on our improvement and optimization plans and expect a strong fourth quarter as Research continues to recover, Learning continues to outperform, and in-year cost savings accelerate. Our disciplined execution and positive momentum are allowing us to raise our earnings guidance this year and set us up well for material performance and profit improvement in Fiscal 2025 and 2026.

For the full year, John Wiley & Sons Inc (NYSE:WLY) has raised its outlook, with adjusted revenue trending toward the mid-to-high end of the $1,580 to $1,630 million range and adjusted EBITDA and EPS guidance increased to $335 to $355 million and $2.45 to $2.65, respectively.

The company's performance reflects the challenges of divestitures and restructuring within the industry. While the transition towards digital offerings is a strategic move aligning with current market trends, the associated costs and impairments have weighed on the company's financials in the short term. However, the raised guidance suggests a positive outlook, with expectations of a stronger fourth quarter and subsequent fiscal years.

Value investors may find the company's strategic focus on digital transformation and the improved outlook for the coming years to be of interest, particularly as John Wiley & Sons Inc (NYSE:WLY) continues to optimize its operations and cost structure. The company's commitment to returning value to shareholders through dividends and share repurchases, which totaled $87 million year-to-date, also remains a key consideration.

For more detailed information, investors are encouraged to review the full earnings report and financial statements provided by John Wiley & Sons Inc (NYSE:WLY).

Explore the complete 8-K earnings release (here) from John Wiley & Sons Inc for further details.

This article first appeared on GuruFocus.