John Wiley & Sons (NYSE:WLY) Surprises With Q3 Sales But Full-Year Sales Guidance Misses Expectations

Educational publishing company John Wiley & Sons (NYSE:WLY) reported Q3 FY2024 results topping analysts' expectations , with revenue down 6.2% year on year to $460.7 million. On the other hand, the company's full-year revenue guidance of $1.61 billion at the midpoint came in 9.3% below analysts' estimates. It made a GAAP loss of $2.08 per share, down from its loss of $1.29 per share in the same quarter last year.

Is now the time to buy John Wiley & Sons? Find out by accessing our full research report, it's free.

John Wiley & Sons (WLY) Q3 FY2024 Highlights:

Revenue: $460.7 million vs analyst estimates of $392.6 million (17.3% beat)

EPS: -$2.08 vs analyst estimates of $0.26 (-$2.34 miss)

Guidance for the full year misses on revenue but beats on EPS

Gross Margin (GAAP): 68.8%, up from 64.6% in the same quarter last year

Market Capitalization: $1.82 billion

“As we finish out the year, we’re increasingly confident in our underlying momentum and recovery in Research and continued outperformance in Learning,” said Matthew Kissner, Interim President and CEO.

Established in 1807, John Wiley & Sons (NYSE:WLY) is a global leader in academic publishing, providing educational materials, scholarly research, and professional development resources.

Media

The advent of the internet changed how shows, films, music, and overall information flow. As a result, many media companies now face secular headwinds as attention shifts online. Some have made concerted efforts to adapt by introducing digital subscriptions, podcasts, and streaming platforms. Time will tell if their strategies succeed and which companies will emerge as the long-term winners.

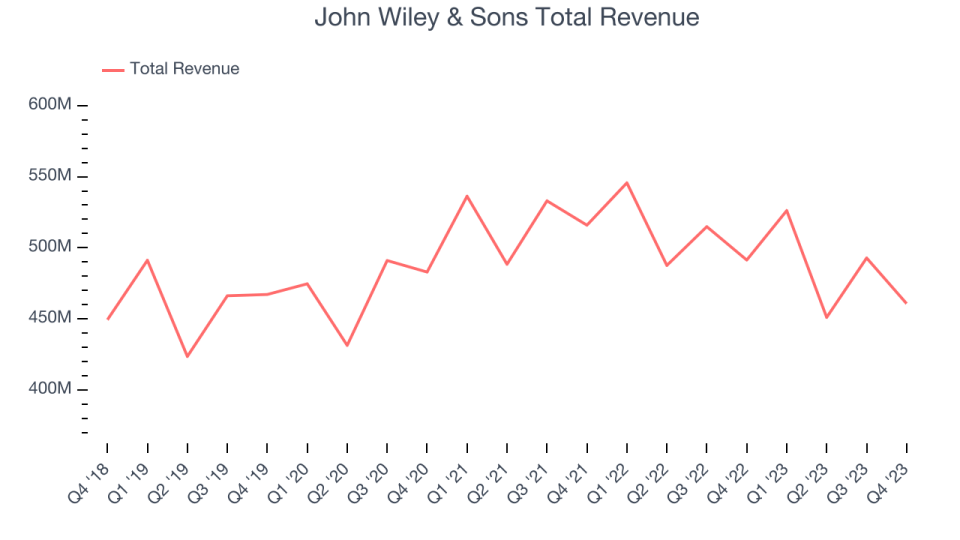

Sales Growth

A company’s long-term performance can give signals about its business quality. Any business can put up a good quarter or two, but many enduring ones muster years of growth. John Wiley & Sons's annualized revenue growth rate of 1.4% over the last five years was weak for a consumer discretionary business.

Within consumer discretionary, product cycles are short and revenue can be hit-driven due to rapidly changing trends. That's why we also follow short-term performance. John Wiley & Sons's recent history shows a reversal from its already weak five-year trend as its revenue has shown annualized declines of 3.5% over the last two years.

This quarter, John Wiley & Sons's revenue fell 6.2% year on year to $460.7 million but beat Wall Street's estimates by 17.3%.

Here at StockStory, we certainly understand the potential of thematic investing. Diverse winners from Microsoft (MSFT) to Alphabet (GOOG), Coca-Cola (KO) to Monster Beverage (MNST) could all have been identified as promising growth stories with a megatrend driving the growth. So, in that spirit, we’ve identified a relatively under-the-radar profitable growth stock benefitting from the rise of AI, available to you FREE via this link.

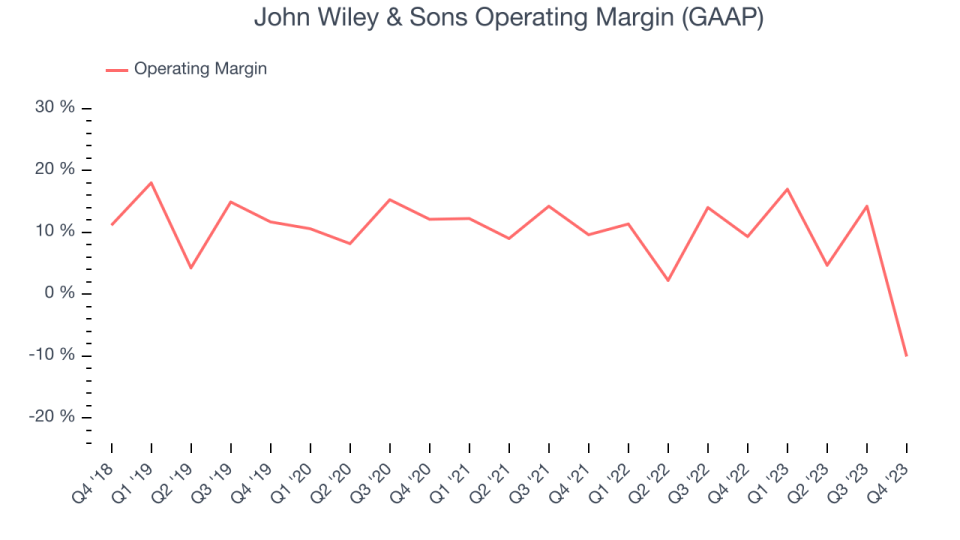

Operating Margin

Operating margin is an important measure of profitability. It’s the portion of revenue left after accounting for all core expenses–everything from the cost of goods sold to advertising and wages. Operating margin is also useful for comparing profitability across companies with different levels of debt and tax rates because it excludes interest and taxes.

John Wiley & Sons was profitable over the last two years but held back by its large expense base. It's demonstrated mediocre profitability for a consumer discretionary business, producing an average operating margin of 8.2%.

This quarter, John Wiley & Sons generated an operating profit margin of negative 10.1%, down 19.4 percentage points year on year. Note that GAAP results impacted by charges related to held for sale or sold assets, including goodwill and held for sale impairments of $82 million.

Key Takeaways from John Wiley & Sons's Q3 Results

We were impressed by how significantly John Wiley & Sons blew past analysts' revenue expectations this quarter. EPS guidance for the full was also above expectations, another big positive. On the other hand, its full-year revenue guidance missed and its operating margin fell short of Wall Street's estimates. Overall, this was a mixed quarter for John Wiley & Sons. The stock is up 2.2% after reporting and currently trades at $33.86 per share.

So should you invest in John Wiley & Sons right now? When making that decision, it's important to consider its valuation, business qualities, as well as what has happened in the latest quarter. We cover that in our actionable full research report which you can read here, it's free.