Is John Wood Group PLC’s (LON:WG.) Balance Sheet Strong Enough To Weather A Storm?

Stocks with market capitalization between $2B and $10B, such as John Wood Group PLC (LSE:WG.) with a size of UK£4.36B, do not attract as much attention from the investing community as do the small-caps and large-caps. Despite this, commonly overlooked mid-caps have historically produced better risk-adjusted returns than their small and large-cap counterparts. WG.’s financial liquidity and debt position will be analysed in this article, to get an idea of whether the company can fund opportunities for strategic growth and maintain strength through economic downturns. Note that this information is centred entirely on financial health and is a top-level understanding, so I encourage you to look further into WG. here. See our latest analysis for John Wood Group

Does WG. generate an acceptable amount of cash through operations?

WG.’s debt levels have fallen from US$1.17B to US$928.60M over the last 12 months , which is made up of current and long term debt. With this debt payback, WG.’s cash and short-term investments stands at US$579.50M for investing into the business. Additionally, WG. has generated US$189.50M in operating cash flow during the same period of time, resulting in an operating cash to total debt ratio of 20.41%, indicating that WG.’s debt is appropriately covered by operating cash. This ratio can also be a sign of operational efficiency for loss making businesses since metrics such as return on asset (ROA) requires a positive net income. In WG.’s case, it is able to generate 0.2x cash from its debt capital.

Can WG. pay its short-term liabilities?

At the current liabilities level of US$1.07B liabilities, it appears that the company has been able to meet these obligations given the level of current assets of US$1.58B, with a current ratio of 1.48x. Usually, for Energy Services companies, this is a suitable ratio as there’s enough of a cash buffer without holding too capital in low return investments.

Can WG. service its debt comfortably?

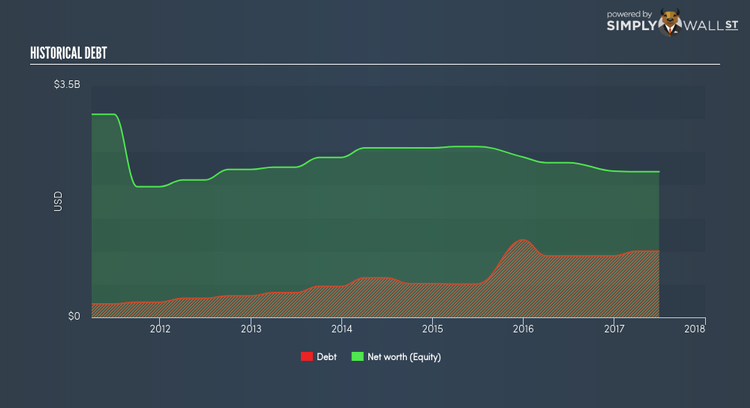

With a debt-to-equity ratio of 45.44%, WG. can be considered as an above-average leveraged company. This is not unusual for mid-caps as debt tends to be a cheaper and faster source of funding for some businesses. Though, since WG. is currently loss-making, sustainability of its current state of operations becomes a concern. Running high debt, while not yet making money, can be risky in unexpected downturns as liquidity may dry up, making it hard to operate.

Next Steps:

WG.’s cash flow coverage indicates it could improve its operating efficiency in order to meet demand for debt repayments should unforeseen events arise. However, the company exhibits proper management of current assets and upcoming liabilities. This is only a rough assessment of financial health, and I’m sure WG. has company-specific issues impacting its capital structure decisions. I suggest you continue to research John Wood Group to get a better picture of the stock by looking at:

Future Outlook: What are well-informed industry analysts predicting for WG.’s future growth? Take a look at our free research report of analyst consensus for WG.’s outlook.

Valuation: What is WG. worth today? Is the stock undervalued, even when its growth outlook is factored into its intrinsic value? The intrinsic value infographic in our free research report helps visualize whether WG. is currently mispriced by the market.

Other High-Performing Stocks: Are there other stocks that provide better prospects with proven track records? Explore our free list of these great stocks here.

To help readers see pass the short term volatility of the financial market, we aim to bring you a long-term focused research analysis purely driven by fundamental data. Note that our analysis does not factor in the latest price sensitive company announcements.

The author is an independent contributor and at the time of publication had no position in the stocks mentioned.