Johnson Controls International PLC (JCI) Adjusts FY24 Guidance Amidst Flat Q1 Sales

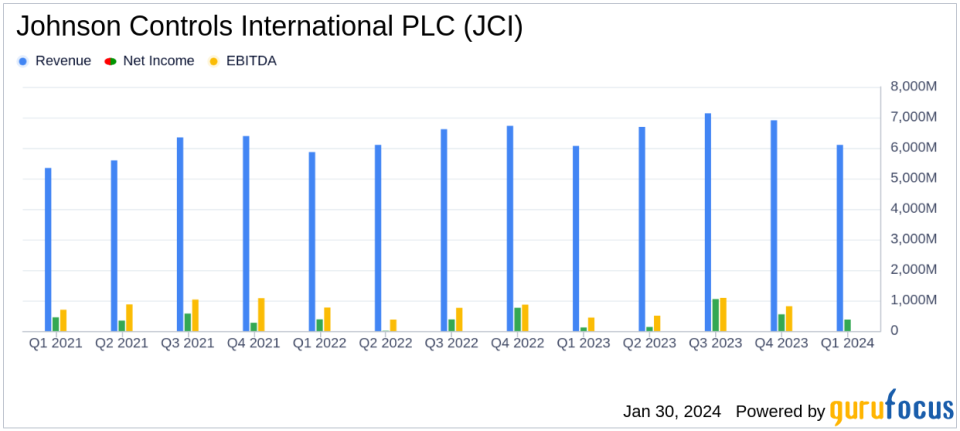

Revenue: Q1 reported sales remained flat year-over-year at $6.1 billion, with a slight 1% organic decline.

Net Income: GAAP net income from continuing operations stood at $374 million, with adjusted net income at $350 million.

Earnings Per Share (EPS): Q1 GAAP EPS was $0.55, with adjusted EPS at $0.51.

Backlog: Building Solutions backlog grew to $12.1 billion, marking a 7% organic increase year-over-year.

Guidance: FY24 Adjusted EPS guidance revised to approximately $3.60 to $3.75, from the previous range of $3.65 to $3.80.

Strategic Moves: JCI is exploring strategic alternatives for its non-commercial businesses to maximize shareholder value.

On January 30, 2024, Johnson Controls International PLC (NYSE:JCI) released its 8-K filing, reporting its financial results for the first quarter of fiscal year 2024. The company, a global leader in smart, healthy, and sustainable buildings, generated nearly $27 billion in revenue in fiscal 2023, with its portfolio including HVAC systems, building management systems and controls, industrial refrigeration systems, and fire and security solutions.

Financial Performance and Challenges

Despite flat sales, JCI's backlog increased significantly, suggesting a strong future demand for its services. However, the 1% organic decline in sales indicates potential challenges in market conditions or competitive pressures. The company's revised full-year guidance reflects a cautious outlook, potentially due to these market dynamics.

Financial Achievements and Industry Significance

JCI's solid backlog growth is a positive indicator for the construction industry, as it reflects confidence in the company's ability to deliver on its smart building initiatives. The increase in backlog, particularly in the Building Solutions segment, underscores the industry's shift towards more sustainable and intelligent infrastructure solutions.

Key Financial Metrics

Johnson Controls reported a mixed performance across its segments. Building Solutions North America saw a 5% increase in sales, while Asia Pacific experienced a 22% decline, largely due to weakness in China. The Global Products segment also faced a slight decline. The company's adjusted free cash flow improved by $180 million compared to Q1 2023, despite being negative at $(250) million. This improvement is a critical metric, as it indicates the company's ability to generate cash and fund operations, investments, and shareholder returns.

Management Commentary

"We continued to position Johnson Controls for the future, delivering solid first quarter results and appointing Marc Vandiepenbeeck as CFO," said Johnson Controls Chairman and CEO George Oliver. "Our value proposition of making buildings smarter, healthier and more sustainable is resonating with our customers and translating into record backlog."

"The management team continues to simplify and transform the company into a comprehensive solutions provider for commercial buildings. As part of the continuous evaluation of our portfolio, we are in the early stages of pursuing strategic alternatives of our non-commercial businesses, in line with our objective to maximize value to our shareholders," Oliver added.

Analysis of Company's Performance

Johnson Controls' performance in Q1 FY24 reflects resilience in its core commercial building solutions business, despite broader market challenges. The company's strategic focus on commercial buildings and exploration of alternatives for non-commercial segments suggest a sharpened focus on areas with the strongest growth prospects. However, the decline in organic sales and the need for revised guidance indicate that JCI is not immune to the economic pressures facing the global market.

For a more detailed analysis of Johnson Controls International PLC's financial results, including segment performance and management's strategic outlook, investors and interested parties can access the full earnings report and accompanying materials on the company's investor relations website.

Stay tuned to GuruFocus.com for further updates and expert analyses on JCI and other key players in the construction and building solutions industry.

Explore the complete 8-K earnings release (here) from Johnson Controls International PLC for further details.

This article first appeared on GuruFocus.