Johnson & Johnson Faces a 1.03% Portfolio Impact in Eaton Vance Worldwide Health Sciences ...

Eaton Vance's N-PORT Filing Highlights Key Investment Changes in Q4 2023

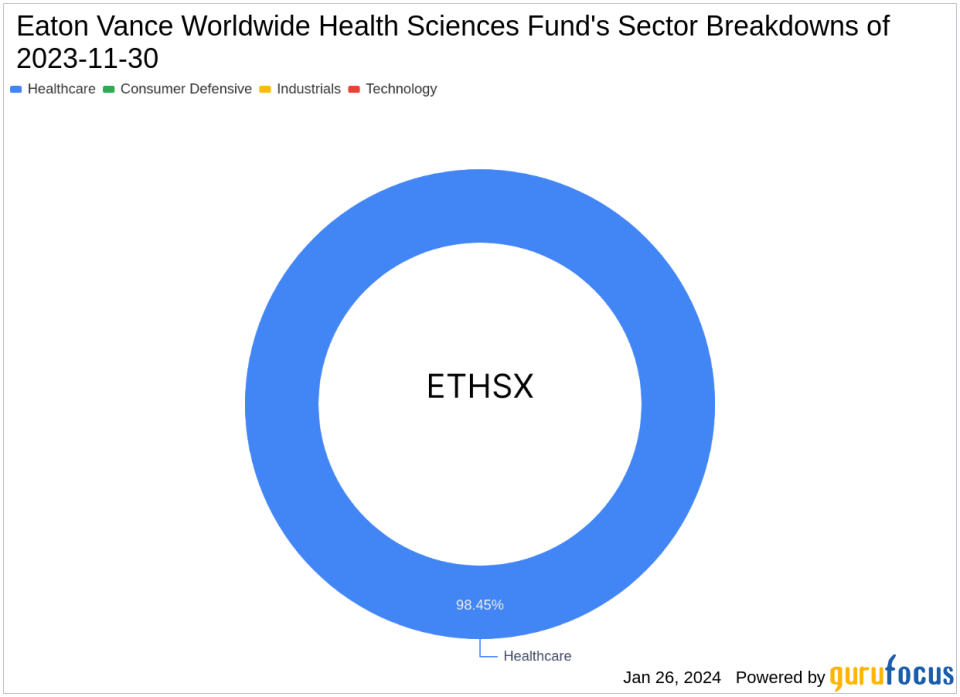

Eaton Vance Worldwide Health Sciences Fund (Trades, Portfolio), known for its strategic investments in the health care sector, has revealed its N-PORT filing for the fourth quarter of 2023. The fund focuses on companies that are at the forefront of health care innovation, including biotechnology, pharmaceuticals, and medical equipment. With an investment philosophy centered on long-term growth and fundamental value, the fund's latest portfolio adjustments offer valuable insights to investors.

Summary of New Buys

Eaton Vance Worldwide Health Sciences Fund (Trades, Portfolio) initiated a position in one new stock during the quarter:

Align Technology Inc (NASDAQ:ALGN) was the standout addition with 24,197 shares, representing 0.54% of the portfolio and a total value of $5.17 million.

Key Position Increases

The fund also bolstered its holdings in three companies:

McKesson Corp (NYSE:MCK) saw an increase of 8,581 shares, bringing the total to 40,237 shares. This represents a 27.11% increase in share count and a 0.42% impact on the current portfolio, with a total value of $18.93 million.

Thermo Fisher Scientific Inc (NYSE:TMO) had an additional 6,709 shares added, resulting in a total of 92,204 shares. This adjustment marks a 7.85% increase in share count, with a total value of $45.71 million.

Summary of Sold Out Positions

The fund exited its positions in three companies:

Kenvue Inc (NYSE:KVUE) was completely sold off with 221,852 shares, impacting the portfolio by -0.51%.

R1 RCM Inc (NASDAQ:RCM) also saw a complete liquidation of 289,096 shares, causing a -0.5% impact on the portfolio.

Key Position Reductions

Significant reductions were made in six stocks, with notable changes in:

Johnson & Johnson (NYSE:JNJ) was reduced by 63,613 shares, leading to a -21.99% decrease in shares and a -1.03% impact on the portfolio. The stock traded at an average price of $154.91 during the quarter and has seen a 7.90% return over the past three months and 1.76% year-to-date.

Novo Nordisk A/S (OCSE:NOVO B) was cut by 52,893 shares, resulting in an -8.45% reduction and a -0.49% portfolio impact. The stock's average trading price was kr676.25 for the quarter, with a 4.55% return over the past three months and 3.70% year-to-date.

Portfolio Overview

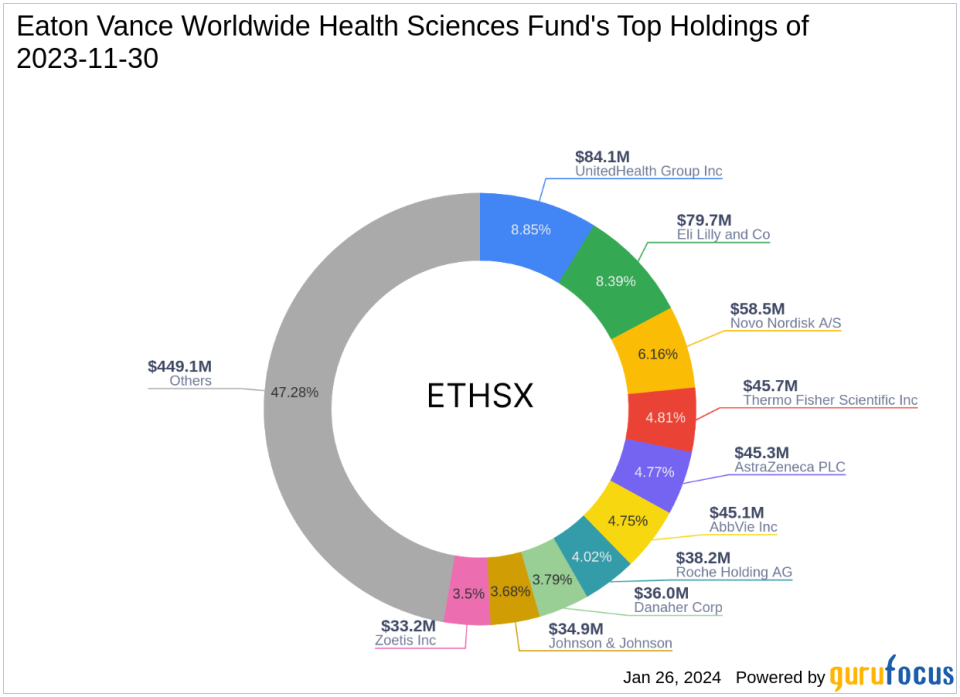

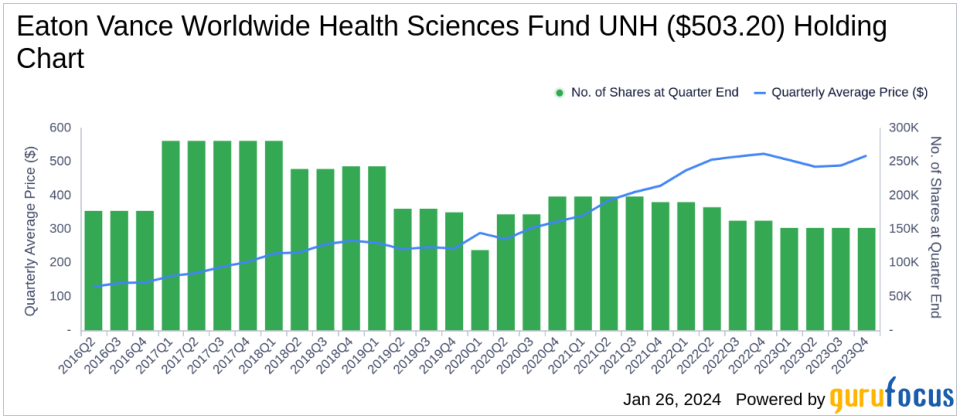

As of the fourth quarter of 2023, the Eaton Vance Worldwide Health Sciences Fund (Trades, Portfolio)'s portfolio comprised 41 stocks. Leading the pack were UnitedHealth Group Inc (NYSE:UNH) at 8.85%, Eli Lilly and Co (NYSE:LLY) at 8.39%, Novo Nordisk A/S (OCSE:NOVO B) at 6.16%, Thermo Fisher Scientific Inc (NYSE:TMO) at 4.81%, and AstraZeneca PLC (LSE:AZN) at 4.77%. The fund's investments are heavily concentrated in the Healthcare sector, reflecting its specialized focus.

This article, generated by GuruFocus, is designed to provide general insights and is not tailored financial advice. Our commentary is rooted in historical data and analyst projections, utilizing an impartial methodology, and is not intended to serve as specific investment guidance. It does not formulate a recommendation to purchase or divest any stock and does not consider individual investment objectives or financial circumstances. Our objective is to deliver long-term, fundamental data-driven analysis. Be aware that our analysis might not incorporate the most recent, price-sensitive company announcements or qualitative information. GuruFocus holds no position in the stocks mentioned herein.

This article first appeared on GuruFocus.