Johnson Outdoors Inc (JOUT) Faces Decline in Q1 Sales and Earnings Amid Market Challenges

Net Sales: Decreased by 22% to $138.6 million in Q1.

Operating Profit: Dropped significantly to $0.05 million from $5.5 million in the prior year.

Net Income: Fell to $4.0 million, or $0.38 per diluted share, compared to $5.9 million, or $0.57 per diluted share year-over-year.

Gross Margin: Improved to 38.1% due to decreased material costs and lower freight expenses.

Balance Sheet: Strong cash and investments position at $114.2 million, an increase from the previous year.

Dividends: Continued payment of quarterly dividends, showcasing commitment to shareholder returns.

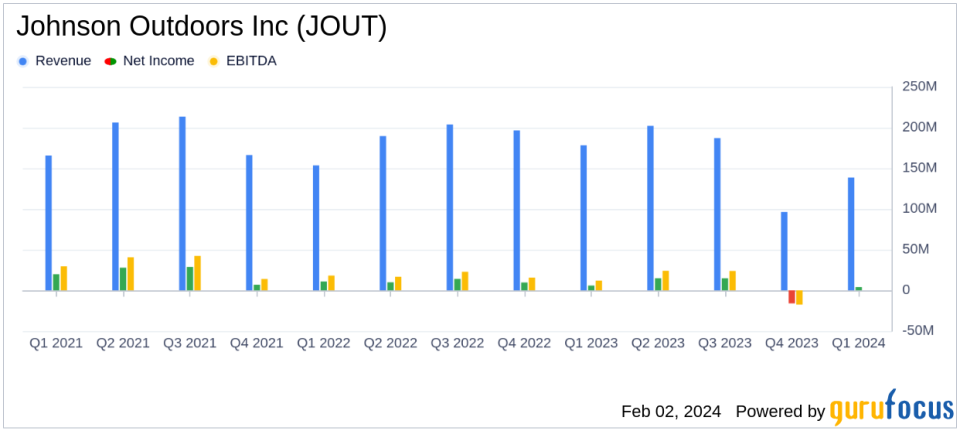

On February 2, 2024, Johnson Outdoors Inc (NASDAQ:JOUT) released its 8-K filing, reporting a challenging fiscal first quarter with decreased sales and earnings. The company, a renowned manufacturer and marketer of outdoor recreation products, experienced a 22 percent decline in net sales, which fell to $138.6 million compared to $178.3 million in the prior year's first fiscal quarter. This decline was attributed to high retail inventories and lower consumer demand across its segments, particularly in Fishing and Camping, which saw a 20 percent and 49 percent revenue decline, respectively.

Financial Performance and Strategic Focus

Despite the sales downturn, Johnson Outdoors managed to improve its gross margin to 38.1 percent, up from 35.2 percent in the previous year, primarily due to decreased material costs and lower inbound freight expenses. However, the company's operating profit plummeted to a mere $0.05 million, a stark contrast to the $5.5 million reported in the same quarter last year. Net income also decreased to $4.0 million, or $0.38 per diluted share, from $5.9 million, or $0.57 per diluted share in the prior year's first quarter.

Chairman and Chief Executive Officer Helen Johnson-Leipold commented on the results, stating,

Were facing a tough marketplace with high inventory levels at retail and lower consumer demand resulting in soft first quarter sales. We are taking steps to outperform the challenging marketplace and improve our financial results."

She emphasized the company's commitment to investing in innovation and marketing to position their brands for success.

Balance Sheet and Shareholder Returns

Johnson Outdoors' balance sheet remains robust, with cash and investments totaling $114.2 million, marking an increase from the previous year. The company's debt-free status and strong cash position enable strategic investments and consistent dividend payments to shareholders, reflecting confidence in its financial stability and future prospects.

David W. Johnson, Vice President and Chief Financial Officer, highlighted the company's strategic financial management, saying,

We remain focused on managing our high inventory levels, executing on our defined cost savings program, and managing our expenses to improve profitability."

He also pointed out the company's ability to continue investing in strategic opportunities to strengthen the business while maintaining shareholder dividends.

In summary, Johnson Outdoors Inc (NASDAQ:JOUT) faces a challenging market environment with decreased consumer demand and high retail inventory levels impacting its first-quarter performance. However, the company's improved gross margin and strong balance sheet, coupled with strategic cost management and innovation investments, position it to navigate the current headwinds and continue delivering value to its shareholders.

Explore the complete 8-K earnings release (here) from Johnson Outdoors Inc for further details.

This article first appeared on GuruFocus.