Johnson Outdoors (NASDAQ:JOUT) Reports Sales Below Analyst Estimates In Q1 Earnings

Outdoor recreational products company Johnson Outdoors (NASDAQ:JOUT) fell short of analysts' expectations in Q1 FY2024, with revenue down 22.3% year on year to $138.6 million. It made a GAAP profit of $0.38 per share, down from its profit of $0.57 per share in the same quarter last year.

Is now the time to buy Johnson Outdoors? Find out by accessing our full research report, it's free.

Johnson Outdoors (JOUT) Q1 FY2024 Highlights:

Revenue: $138.6 million vs analyst estimates of $140.4 million (1.3% miss)

Operating income: roughly breakeven, in-line with expectations

EPS: $0.38 vs analyst estimates of $0.15 ($0.23 beat)

Gross Margin (GAAP): 38.1%, up from 35.2% in the same quarter last year

Market Capitalization: $466 million

“We’re facing a tough marketplace with high inventory levels at retail and lower consumer demand resulting in soft first quarter sales. We are taking steps to outperform the challenging marketplace and improve our financial results,” said Helen Johnson-Leipold, Chairman and Chief Executive Officer.

Operating in locations worldwide, Johnson Outdoors (NASDAQ:JOUT) specializes in innovative outdoor recreational products for adventurers worldwide.

Leisure Facilities and Products

Consumers have lots of choices when it comes to how they spend their free time and extra money, so the companies offering leisure products and experiences must highlight their value proposition. Fitness companies may be riding the wellness trend, for example, while those selling boats and toys may have to lean into innovation to stand out. Either way, all leisure companies must compete against the 800-pound gorilla of social media and streaming entertainment, which offer instant gratification and have been taking share of consumers’ free time for over a decade.

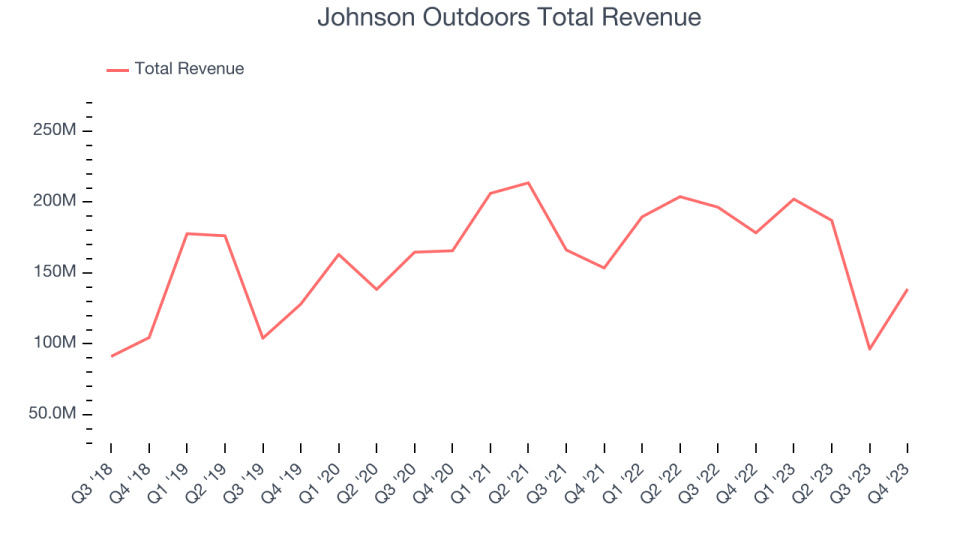

Sales Growth

A company’s long-term performance can give signals about its business quality. Even a bad business can shine for one or two quarters, but a top-tier one may grow for years. Johnson Outdoors's annualized revenue growth rate of 3.7% over the last 5 years was weak for a consumer discretionary business.

Within consumer discretionary, product cycles are short and revenue can be hit-driven due to rapidly changing trends. That's why we also follow short-term performance. Johnson Outdoors's recent history shows a reversal from its 5-year trend, as its revenue has shown annualized declines of 8.1% over the last 2 years.

This quarter, Johnson Outdoors missed Wall Street's estimates and reported a rather uninspiring 22.3% year-on-year revenue decline, generating $138.6 million of revenue.

Our recent pick has been a big winner, and the stock is up more than 2,000% since the IPO a decade ago. If you didn’t buy then, you have another chance today. The business is much less risky now than it was in the years after going public. The company is a clear market leader in a huge, growing $200 billion market. Its $7 billion of revenue only scratches the surface. Its products are mission critical. Virtually no customers ever left the company. You can find it on our platform for free.

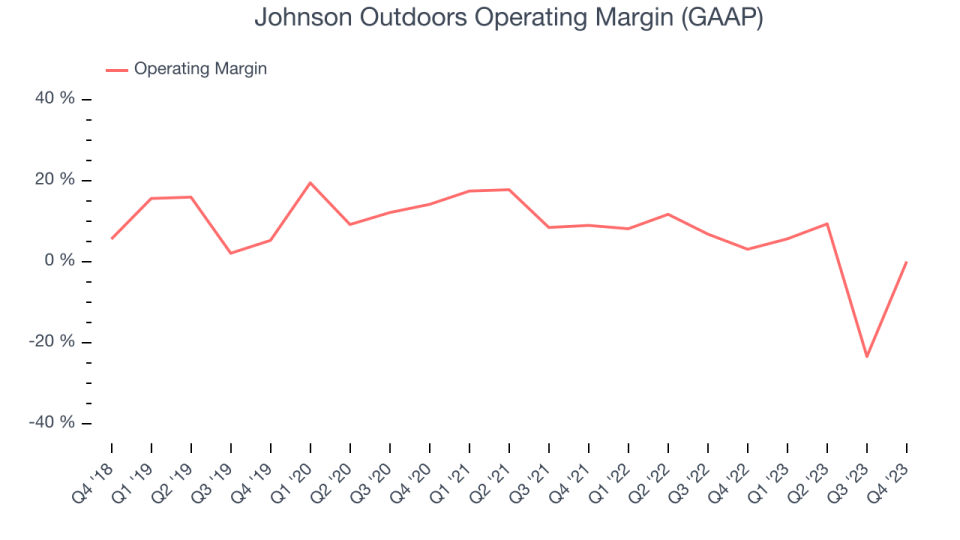

Operating Margin

Operating margin is a key measure of profitability. Think of it as net income–the bottom line–excluding the impact of taxes and interest on debt, which are less connected to business fundamentals.

Johnson Outdoors was profitable over the last two years but held back by its large expense base. Its average operating margin of 2.7% has been paltry for a consumer discretionary business.

This quarter, Johnson Outdoors generated an operating profit margin of 0%, down 3 percentage points year on year. This reduction indicates the company was less efficient with its expenses over the last year, spending more money in areas like corporate overhead and advertising.

Key Takeaways from Johnson Outdoors's Q1 Results

Revenue missed and was down meaningfully year on year. Operating profit was roughly breakeven, also a decrease from last year. However, gross margin improved year on year and beat, as did EPS beat, although this was driven by the 'other income' line. Overall, the results could have been better. The stock is up 1.8% after reporting and currently trades at $46.33 per share.

Johnson Outdoors may not have had the best quarter, but does that create an opportunity to invest right now? When making that decision, it's important to consider its valuation, business qualities, as well as what has happened in the latest quarter. We cover that in our actionable full research report which you can read here, it's free.

One way to find opportunities in the market is to watch for generational shifts in the economy. Almost every company is slowly finding itself becoming a technology company and facing cybersecurity risks and as a result, the demand for cloud-native cybersecurity is skyrocketing. This company is leading a massive technological shift in the industry and with revenue growth of 50% year on year and best-in-class SaaS metrics it should definitely be on your radar.