The Joint Corp (JYNT) Faces Net Loss in 2023 Despite Revenue Growth

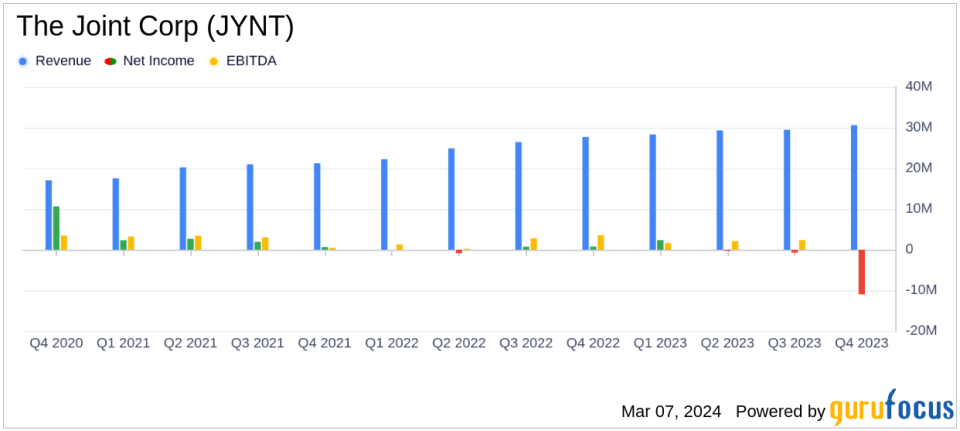

Revenue Growth: The Joint Corp (NASDAQ:JYNT) reported a 16% increase in annual revenue, reaching $117.7 million in 2023.

Net Loss: Despite revenue growth, JYNT faced a net loss of $9.8 million in 2023, including a significant non-cash valuation allowance.

System-wide Sales: System-wide sales rose by 12% to $488.0 million, with comp sales growing by 4%.

Clinic Expansion: JYNT increased its total clinic count to 935, with a strategic shift towards refranchising.

Adjusted EBITDA: Adjusted EBITDA showed a modest increase to $12.2 million from $11.5 million in the previous year.

Liquidity Position: Unrestricted cash improved to $18.2 million at year-end 2023, up from $9.7 million in the previous year.

2024 Guidance: JYNT projects system-wide sales to be between $530 and $545 million with mid-single digit comp sales growth.

The Joint Corp (NASDAQ:JYNT) released its 8-K filing on March 7, 2024, detailing its financial performance for the fourth quarter and full year ended December 31, 2023. The company, known for its chiropractic clinics across the United States, operates through two segments: Corporate Clinics and Franchise Operations, with the former generating the majority of its revenue.

Financial Performance and Challenges

JYNT's revenue growth is a positive indicator of the company's ability to expand its operations and attract more patients. However, the reported net loss, including a $10.8 million non-cash valuation allowance, reflects underlying challenges. The loss was primarily due to refranchising efforts and increased operating expenses, including costs to support clinic growth and competitive payroll in a tight labor market. These challenges underscore the importance of JYNT's strategic initiatives to improve profitability and cash flow.

Financial Achievements and Industry Impact

The growth in system-wide sales and comp sales demonstrates JYNT's strong brand and operational execution in the healthcare providers and services industry. The increase in the number of patient visits and new patients treated, with a significant portion being new to chiropractic care, highlights the company's role in expanding access to chiropractic services. The rise in Adjusted EBITDA, albeit modest, along with the improved liquidity position, suggests resilience in JYNT's business model amidst a challenging economic environment.

Key Financial Metrics

Key metrics from the income statement show an 11% increase in Q4 revenue to $30.6 million year-over-year, while the full-year revenue rose by 16%. The balance sheet reflects a stronger cash position, with unrestricted cash nearly doubling to $18.2 million. The cash flow statement indicates a healthy $14.7 million cash flow from operations, supporting the company's investment in clinic acquisitions and development.

Management Commentary

"During 2023, our team delivered growth in system-wide sales, revenue, Adjusted EBITDA, the number of patient visits, and the number of patients treated as well as improved new patient conversion and existing patient attrition rates in a market of ongoing uncertainty among our patient demographic," said Peter D. Holt, President and Chief Executive Officer of The Joint Corp.

Analysis of Company's Performance

The Joint Corp's strategic decision to initiate a refranchising program is aimed at enhancing profitability and cash flow. This move, coupled with marketing initiatives to drive new patient count and engagement, is expected to strengthen the company's position in the market. However, the net loss and operating challenges faced in 2023 highlight the need for careful execution of these strategies to ensure long-term success.

Overall, The Joint Corp's mixed financial results reflect a company in transition, focusing on growth and operational efficiency. As JYNT continues to navigate the complexities of the healthcare services industry, investors and stakeholders will be closely monitoring the impact of its refranchising efforts and marketing initiatives on the company's financial health and market position.

For more detailed analysis and up-to-date information on The Joint Corp (NASDAQ:JYNT) and other value investment opportunities, visit GuruFocus.com.

Explore the complete 8-K earnings release (here) from The Joint Corp for further details.

This article first appeared on GuruFocus.