Jones Lang LaSalle Inc (JLL) Reports Mixed Financial Outcomes Amid Market Challenges

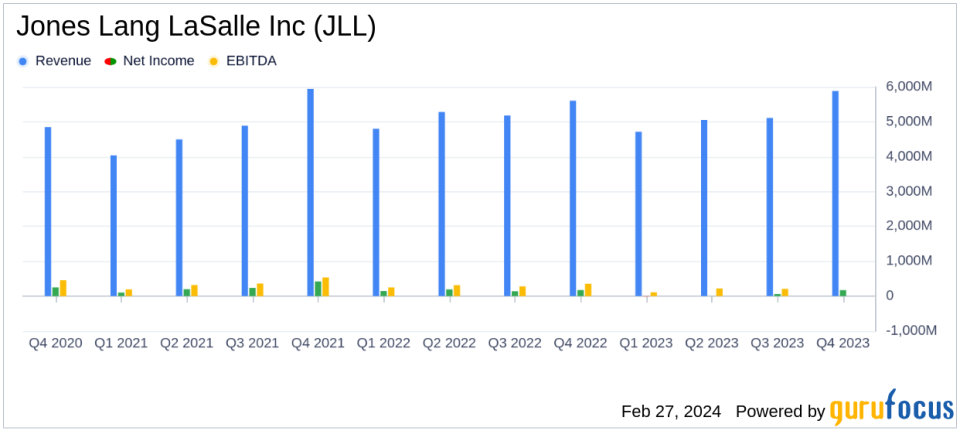

Revenue: Fourth-quarter revenue increased by 4% in local currency to $5.9 billion, while full-year revenue remained flat at $20.8 billion.

Net Income: Net income attributable to common shareholders saw a year-over-year decline, dropping to $172.4 million in Q4 and $225.4 million for the full year.

Earnings Per Share: Diluted earnings per share for Q4 stood at $3.57, with a full-year figure of $4.67, reflecting a significant decrease from the previous year.

Adjusted EBITDA: Adjusted EBITDA for Q4 was $306.4 million, a 9% decrease in local currency, and $736.7 million for the full year, down 41%.

Free Cash Flow: Free cash flow showed a positive trend, with a 28% increase to $680.2 million in Q4 and a significant improvement to $388.9 million for the full year.

Operating Efficiency: JLL's focus on operating efficiency led to improved cash generation despite market-wide transaction activity slowdown.

On February 27, 2024, Jones Lang LaSalle Inc (NYSE:JLL) released its 8-K filing, revealing a mixed financial performance for the fourth quarter and full year of 2023. The global real estate services firm, which provides a comprehensive suite of services to real estate owners, occupiers, and investors, reported operating income growth in Q4 but a decrease for the full year. JLL's resilient business lines, such as Work Dynamics and Property Management, demonstrated growth, which helped mitigate the broader market's pullback in transaction activity.

Financial Performance Overview

JLL's fourth-quarter revenue rose to $5.9 billion, a 4% increase in local currency, while fee revenue slightly decreased by 2%. The full-year revenue remained relatively stable at $20.8 billion, but fee revenue saw an 11% decline. The company's net income for common shareholders decreased by 1% in Q4 and a significant 66% for the full year, reflecting the challenging market conditions.

Despite these challenges, JLL's resilient business lines, such as Work Dynamics, which includes Workplace Management, and Property Management within Markets Advisory, continued to grow. JLL Technologies also saw a 14% increase in the fourth quarter. However, transaction-based businesses, particularly Investment Sales and Debt/Equity Advisory within Capital Markets, and Leasing within Markets Advisory, were adversely impacted by economic uncertainty and elevated interest rates.

Segment Performance and Challenges

Within the Markets Advisory segment, Property Management delivered double-digit growth, while Leasing faced a single-digit decline, primarily in the U.S. office sector. The Capital Markets segment had a solid performance despite the lowest fourth-quarter investment sales market volumes since 2011. Work Dynamics and JLL Technologies both achieved growth across their service lines.

However, the company's operating margin was affected by lower transaction-based revenues and unrealized investment losses associated with certain JLL Technologies portfolio investments. These were partially offset by growth in resilient revenue and recent cost mitigation actions.

Capital Allocation and Liquidity

JLL generated nearly $130 million of incremental cash from operating activities in Q4 and over $375 million for the full year. The company also repurchased shares, returning capital to shareholders, and maintained a healthy corporate liquidity position of $3.1 billion as of December 31, 2023.

Management Commentary

JLL's fourth-quarter and full-year 2023 operating results reflected strong growth within our resilient business lines in the face of the market-wide pullback in transaction activity and elevated geopolitical uncertainty. With a focus on operating efficiency, we drove improved cash generation while continuing to invest in our platform," said Christian Ulbrich, JLL CEO.

Looking forward, JLL anticipates an improvement in transaction activity over the course of the year as business confidence globally begins to stabilize alongside interest rates.

Conclusion

While Jones Lang LaSalle Inc (NYSE:JLL) faced a challenging market environment in 2023, the company's diversified service offerings and focus on operational efficiency allowed it to navigate the headwinds effectively. The firm's ability to generate cash and maintain a solid liquidity position, coupled with the expected recovery in transaction activity, positions JLL to capitalize on future growth opportunities in the commercial real estate industry.

Explore the complete 8-K earnings release (here) from Jones Lang LaSalle Inc for further details.

This article first appeared on GuruFocus.