Jones Lang's (JLL) Q4 Earnings & Revenues Beat Estimates

Jones Lang LaSalle Incorporated JLL — popularly known as JLL — reported fourth-quarter 2023 adjusted earnings per share (EPS) of $4.23, beating the Zacks Consensus Estimate of $3.70. The reported figure declined 3% from the prior-year quarter. Shares of JLL were up 1.1% during the Feb 27 regular trading session on the NYSE.

Results reflect better-than-anticipated revenues. The company benefited from the continued strength in its resilient lines of business. However, transaction-based businesses, specifically the Capital Markets, were hit by higher interest rates and rapid changes in the economic sentiment globally.

Revenues of $5.88 billion increased 4.9% from the year-ago quarter’s $5.60 billion and surpassed the Zacks Consensus Estimate of $5.68 billion.

The quarterly adjusted EBITDA margin dipped 120 basis points to 14.1% (USD) from the prior-year period. Lower transaction-based revenues and the change in equity earnings/losses led to this fall, which was partially offset by the resilient revenue growth and the benefit received from recent cost reduction actions executed in the last year.

Per Christian Ulbrich, CEO of JLL, “JLL's fourth-quarter and full-year 2023 operating results reflected strong growth within our resilient business lines in the face of the market-wide pullback in transaction activity and elevated geopolitical uncertainty. With a focus on operating efficiency, we drove improved cash generation while continuing to invest in our platform.”

Segment-Wise Performance

During the fourth quarter, the Markets Advisory segment’s revenues and fee revenues came in at $1.20 billion and $895.6 million, respectively, reflecting a year-over-year gain of 1% (in USD) in the segment’s revenues but a fall of 2% in fee revenues. The transaction volume was up in industrial but down in most other asset classes amid continued economic uncertainty, which has delayed commercial real estate decision-making, particularly for large-scale leasing actions.

Revenues and fee revenues for the Capital Markets segment were $537.1 million and $532.2 million, respectively, decreasing 11.6% and 11.1% (in USD) year over year. The fall was mainly due to muted transaction volume compared with 2022 due to the rapid rise in interest rates and elevated uncertainty. This chiefly affected JLL’s Investment Sales and Debt/Equity Advisory businesses across most asset classes and regions compared with the prior-year quarter.

JLL’s Work Dynamics segment reported revenues and fee revenues of $3.97 billion and $582.2 million, respectively, up 9.1% and 9% (in USD) year over year. The uptick in revenues and fee growth was broad-based across service lines and geographies. Momentum from increased project demand drove strong Project Management results, while an increase in recent wins and mandate expansions in the second half of the year aided Workplace Management’s growth.

JLL Technologies segment reported revenues and fee revenues of $65.5 million and $62 million, respectively, rising 14.3% and 14.4% (in USD) from the prior-year quarter levels. The growth in solutions and service offerings, largely from existing enterprise clients, supported the uptick.

The revenues and fee revenues in the LaSalle segment fell 2.9% and 2.7% (in USD) year over year to $115.3 million and $108.4 million, respectively. The decline in revenues was mainly due to advisory fees, as lower asset valuations over the past twelve months impacted assets under management. Lower transaction fees reflected the global trends of dampened investment sales transaction volumes.

As of Dec 31, 2023, LaSalle had $73.9 billion of real estate AUM, down from $77.7 billion as of Sep 30, 2023. This resulted from decreases in net valuation and foreign currency and dispositions and withdrawals, partially offset by the rise in acquisitions.

Balance Sheet

JLL exited the fourth quarter with cash and cash equivalents of $410 million, up from $389.5 million as of Sep 30, 2023.

As of Dec 31, 2023, the net leverage ratio was 1.6, down from 2.2 as of Sep 30, 2023, but up from 1.0 as of Dec 31, 2022. The corporate liquidity was $3.1 billion as of the fourth quarter's end.

The company repurchased 147,805 shares during the reported quarter for $21.9 million. As of Dec 31, 2023, $1,093.6 million remained authorized for repurchase under the share repurchase program.

JLL currently carries a Zacks Rank #4 (Sell).

You can see the complete list of today’s Zacks #1 Rank (Strong Buy) stocks here.

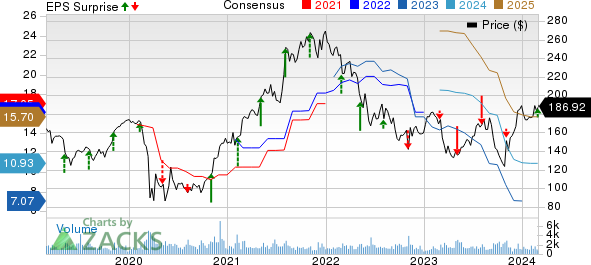

Jones Lang LaSalle Incorporated Price, Consensus and EPS Surprise

Jones Lang LaSalle Incorporated price-consensus-eps-surprise-chart | Jones Lang LaSalle Incorporated Quote

Performance of Other Broader Real Estate Market Stocks

CBRE Group Inc.’s CBRE fourth-quarter 2023 core EPS of $1.38 surpassed the Zacks Consensus Estimate of $1.21. Quarterly revenues of $8.95 billion also compared favorably with the Zacks Consensus Estimate of $8.62 billion.

Results reflect growth in its resilient lines of business, led by Global Workplace Solutions (“GWS”). Despite growth in GWS and other resilient businesses, commercial real estate capital markets were under significant pressure. It also witnessed year-over-year growth in operating profit across all three business segments.

Ventas, Inc. VTR reported a fourth-quarter 2023 normalized funds from operations (FFO) per share of 76 cents, in line with the Zacks Consensus Estimate. The reported figure increased 4.1% from the prior-year quarter’s tally.

Results reflect better-than-anticipated revenues. Also, Ventas’ same-store cash NOI increased year over year on strong performance across the portfolio.

Healthpeak Properties, Inc. PEAK reported fourth-quarter 2023 FFO as adjusted per share of 46 cents, beating the Zacks Consensus Estimate by a whisker. The reported figure rose 4.5% year over year.

Results reflected better-than-anticipated revenues. Moreover, growth in same-store portfolio cash (adjusted) net operating income was witnessed across the portfolio. The company also issued its 2024 outlook.

Want the latest recommendations from Zacks Investment Research? Today, you can download 7 Best Stocks for the Next 30 Days. Click to get this free report

Ventas, Inc. (VTR) : Free Stock Analysis Report

Jones Lang LaSalle Incorporated (JLL) : Free Stock Analysis Report

CBRE Group, Inc. (CBRE) : Free Stock Analysis Report

Healthpeak Properties, Inc. (PEAK) : Free Stock Analysis Report