Joyce Leads Trio of Australian Dividend Stocks to Consider

In recent times, the Australian market has exhibited resilience amidst global economic fluctuations, maintaining a steady course with particular sectors showing promising stability. In this climate, investors often seek out reliable dividend stocks that not only provide regular income but also have the potential for capital appreciation – a combination that Joyce and two other companies exemplify in the current landscape.

Top 10 Dividend Stocks In Australia

Click here to see the full list of Top Dividend Stocks.

Name | Dividend Yield | Dividend Score |

Fiducian Group (ASX:FID) | 4.66% | ★★★★★☆ |

Nick Scali (ASX:NCK) | 4.85% | ★★★★★☆ |

nib holdings (ASX:NHF) | 3.70% | ★★★★☆☆ |

Centuria Capital Group (ASX:CNI) | 6.59% | ★★★★☆☆ |

Ansell (ASX:ANN) | 2.78% | ★★★★☆☆ |

Joyce (ASX:JYC) | 7.43% | ★★★★☆☆ |

Atlas Arteria (ASX:ALX) | 7.35% | ★★★★☆☆ |

BHP Group (ASX:BHP) | 5.45% | ★★★★☆☆ |

CTI Logistics (ASX:CLX) | 6.54% | ★★★★☆☆ |

Wesfarmers (ASX:WES) | 3.28% | ★★★★☆☆ |

We're going to check out 3 of the 31 best picks from our Top Dividend Stocks screener tool.

Joyce (ASX:JYC)

Simply Wall St Dividend Score: ★★★★☆☆

Overview: Joyce Corporation Ltd is an Australian company specializing in the retail of kitchen and wardrobe products, with a market capitalization of approximately A$97.79 million.

Operations: Joyce Corporation Ltd generates its revenue primarily from three segments: franchise operations for retail bedding, company-owned retail bedding stores, and kitchen and wardrobe showrooms, with the latter being the most significant at A$123.387 million.

Dividend Yield: 7.4%

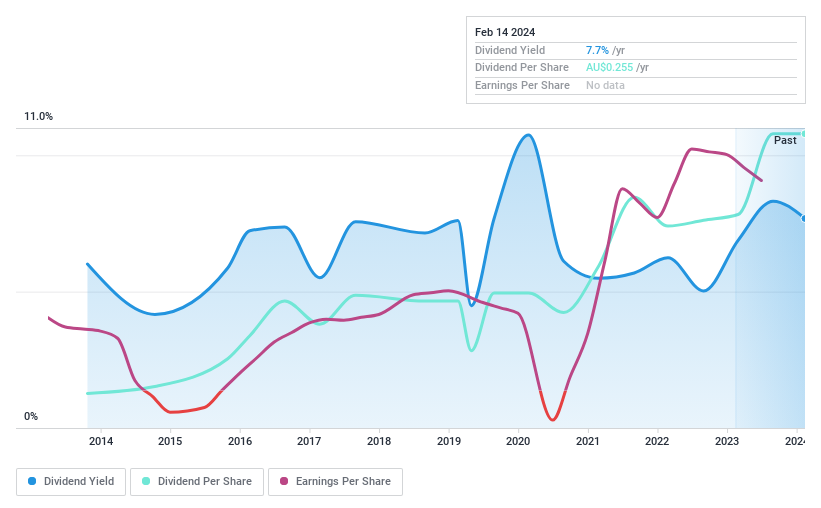

Joyce Corporation (ASX:JYC) presents a mixed picture for dividend-focused investors. The company has demonstrated commendable financial discipline by eliminating debt, as evidenced by a drop from a 37.3% debt-to-equity ratio five years ago to no debt currently. This positions JYC well in terms of financial stability. Earnings have grown at an impressive annual rate over the past five years, though recent performance shows negative growth compared to this average, indicating potential volatility ahead. While dividends have increased over the past decade, their sustainability is questionable with a high payout ratio of 91.1%, suggesting that earnings do not adequately cover dividend payments despite being better supported by cash flows with a lower cash payout ratio of 33.9%. Additionally, the history of unreliable and volatile dividends could be concerning for those seeking stable income streams despite its attractive yield being in the top quartile of Australian payers. Delve into the full analysis report here for a deeper understanding of Joyce.

Lycopodium (ASX:LYL)

Simply Wall St Dividend Score: ★★★★☆☆

Overview: Lycopodium Limited is a professional services company specializing in engineering and project delivery across the resources, infrastructure, and industrial processes sectors, with a market capitalization of approximately A$481 million.

Operations: Lycopodium Limited generates its revenue primarily from the minerals sector, with significant contributions from Minerals - Asia Pacific at A$175.9 million, followed by Minerals - North America at A$82.1 million and Minerals - Africa at A$62.7 million, along with earnings in the Process Industries and Project Services - Africa segments amounting to A$12.0 million and A$11.3 million respectively.

Dividend Yield: 7.4%

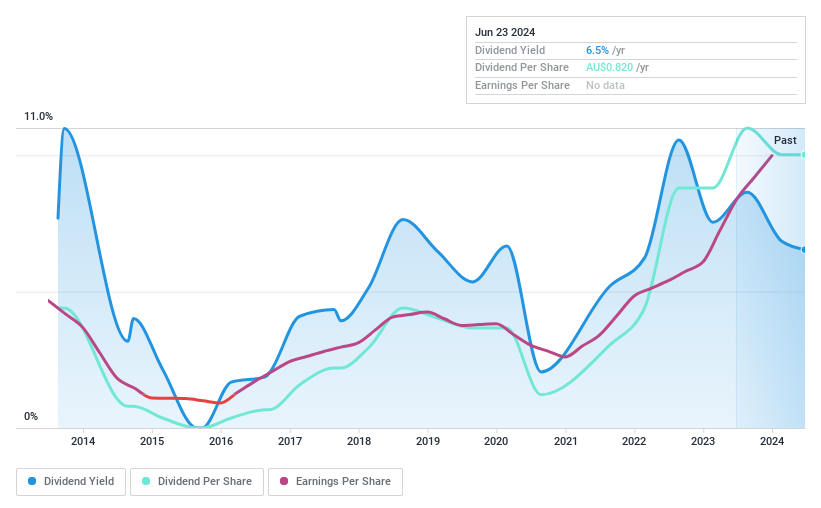

Lycopodium (ASX:LYL) showcases strong financial health for dividend investors, with no debt and a history of profit growth, including a 72.1% earnings increase over the past year outpacing its five-year annual average. While dividends have grown over the last decade, there's a contrast between earnings coverage and cash flow sufficiency; dividends are reasonably covered by earnings with a payout ratio of 68.8%, yet the high cash payout ratio at 249.1% raises concerns about their sustainability from free cash flows. Additionally, LYL's dividend yield stands in the top tier of Australian stocks, but investors should be wary of its historical volatility in payments. Click to explore a detailed breakdown of our findings on Lycopodium.

Wesfarmers (ASX:WES)

Simply Wall St Dividend Score: ★★★★☆☆

Overview: Wesfarmers Limited is a diversified retail conglomerate operating in Australia, New Zealand, and other international markets, with a market capitalization of approximately A$66.14 billion.

Operations: Wesfarmers Limited's revenue is primarily generated from its various retail segments, including Bunnings with A$18.54 billion, Kmart Group at A$10.64 billion, Health contributing A$5.31 billion, WesCEF at A$3.31 billion, Officeworks with A$3.36 billion, and Industrial and Safety (WIS) at nearly A$2 billion.

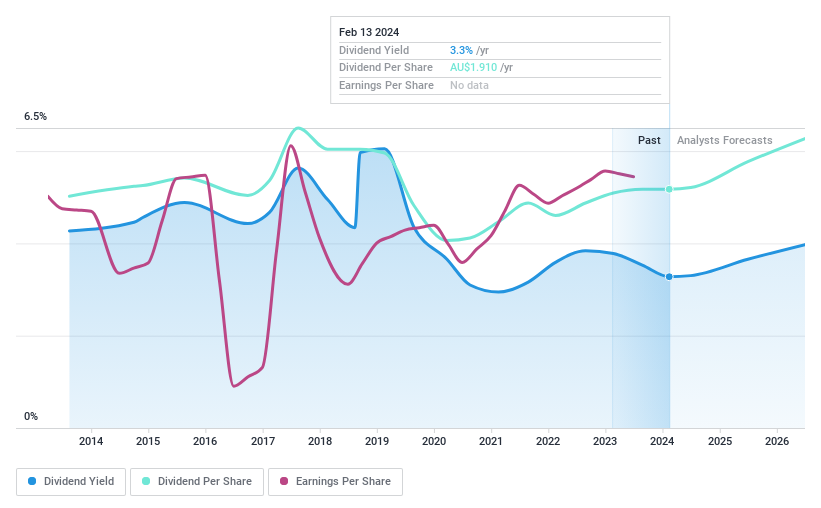

Dividend Yield: 3.3%

Wesfarmers presents a nuanced choice for dividend investors; its consistent dividend growth over the past decade is tempered by a yield that falls short of the Australian market's top payers. While the company's earnings have expanded at a steady pace, recent performance indicates a slowdown compared to its five-year trend. Debt levels have risen, but operational cash flow remains robust, covering both debt and dividends—albeit with payout ratios suggesting limited room for maneuver. Caution is warranted due to volatility in past dividends and modest expectations for future profit and revenue growth. Navigate through the intricacies of Wesfarmers with our comprehensive report here.

Where To Now?

The Simply Wall St Screener has been instrumental in pinpointing a selection of Australian dividend stocks that showcase robust financial health and shareholder returns. Access the full spectrum of 31 Top Dividend Stocks by clicking on this link.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com