JPMorgan (JPM) Mulls to Cut 1% Jobs in Consumer Division

Per Bloomberg, JPMorgan JPM is planning to lay off nearly 1% of the employees from the consumer unit to manage costs. The bank intends to inform the affected employees on Feb 6, who can then apply for other roles in the firm.

The company’s Consumer & Community Banking (“CCB”) segment serves clients through Consumer & Business Banking, Mortgage Banking, and Card, Commerce Solution & Auto businesses. Notably, CCB segment constituted 45% of JPMorgan’s net income in 2019.

Expense management has been the bank’s co-president and CEO of CCB segment Gordon Smith’s key focus for a long time. From 2014 to 2018, the company slashed 7,000 jobs in the segment. The total headcount for the segment at the end of 2019 was 127,137, down 2% from the prior year.

Another reason behind the move is to adapt to the changing consumer behavior due to shift to digital technology. JPMorgan has been investing billions of dollars in technology to help its clients transact online. The bank's technology, communications and equipment expenses witnessed a four-year compound annual growth rate of 12.7% (2016-2019).

Nonetheless, the bank has been opening branches in new states in order to expand footprint, enhance customer base and strengthen cross-selling opportunities. Notably, the CCB segment had 4,976 branches in 2019.

These efforts, along with improving loan demand, are expected to continue supporting JPMorgan’s profitability amid lower interest rates.

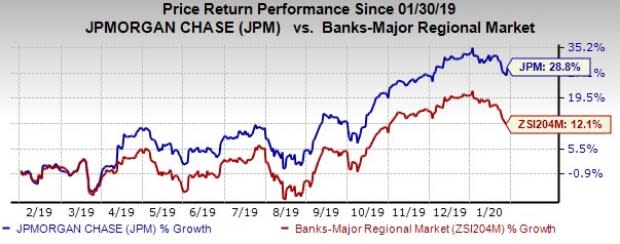

Shares of this Zacks Rank #1 (Strong Buy) company have rallied 28.8% over the past year, outperforming the industry’s rise of 12.1%. You can see the complete list of today’s Zacks #1 Rank stocks here.

JPMorgan is not the only financial institution which is retrenching jobs. In the recent past, several other companies like UBS Group AG UBS, Morgan Stanley MS and State Street Corporation STT have taken similar measures to boost profitability.

Looking for Stocks with Skyrocketing Upside?

Zacks has just released a Special Report on the booming investment opportunities of legal marijuana.

Ignited by new referendums and legislation, this industry is expected to blast from an already robust $6.7 billion to $20.2 billion in 2021. Early investors stand to make a killing, but you have to be ready to act and know just where to look.

See the pot trades we're targeting>>

Want the latest recommendations from Zacks Investment Research? Today, you can download 7 Best Stocks for the Next 30 Days. Click to get this free report

State Street Corporation (STT) : Free Stock Analysis Report

JPMorgan Chase & Co. (JPM) : Free Stock Analysis Report

UBS Group AG (UBS) : Free Stock Analysis Report

Morgan Stanley (MS) : Free Stock Analysis Report

To read this article on Zacks.com click here.

Zacks Investment Research