JPMorgan (JPM) to Outsource Hong Kong, Taiwan Custody Business

JPMorgan JPM is planning to exit the local custodian business in Hong Kong and Taiwan by the end of next year. The news was reported by Reuters, citing people with knowledge of the matter.

This lucrative business has attracted Citigroup, HSBC and Standard Chartered among probable candidates. The financial details of the potential transaction are not known.

JPM is currently providing custodial services, both globally and locally, to clients in Hong Kong and Taiwan but has decided to stop providing services on the local level as the cost-income ratio has gone up amid a fall in custodian assets. Notably, the company will continue to offer global custody services in those two markets.

As a local custodian in those two North Asian markets, JPMorgan has nearly $520 billion worth of client assets under custody (AUC), per the people familiar with the matter.

In recent years, JPM exited its lower-margin local custodian business from other markets in the Asia Pacific region, including Australia. Although the bank stopped offering local custody services to external clients in Australia, it still maintained itself as one of the largest global custodian operations in the market. Further, in the region, the company offers local custodian services in India.

For the nine months ended Sep 30, 2023, JPMorgan recorded a year-over-year rise of 8% in revenues from securities services (including custody operations), attributable to $29.7 trillion AUC worldwide.

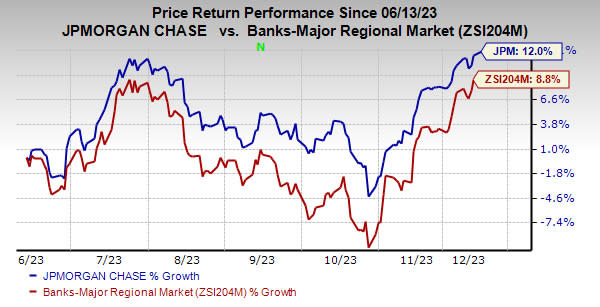

Over the past six months, shares of JPMorgan have gained 12% compared with the industry’s rise of 8.8%.

Image Source: Zacks Investment Research

Currently, JPM sports a Zacks Rank #1 (Strong Buy).

Other Stocks to Consider

A couple of other top-ranked stocks from the banking space are Mercantile Bank MBWM and Byline Bancorp BY.

MBWM’s earnings estimates for 2023 have been revised 5.1% upward over the past 60 days. In the past six months, Mercantile’s shares have gained 24.8%. Currently, it sports a Zacks Rank #1. You can see the complete list of today’s Zacks #1 Rank stocks here.

Earnings estimates for BY have been revised 1.4% upward for 2023 in the past 30 days. Shares of Byline Bancorp have rallied 11.9% in the past six months. The company currently carries a Zacks Rank #2 (Buy).

Want the latest recommendations from Zacks Investment Research? Today, you can download 7 Best Stocks for the Next 30 Days. Click to get this free report

JPMorgan Chase & Co. (JPM) : Free Stock Analysis Report

Mercantile Bank Corporation (MBWM) : Free Stock Analysis Report

Byline Bancorp, Inc. (BY) : Free Stock Analysis Report