The Jubilee Metals Group (LON:JLP) Share Price Is Up 91% And Shareholders Are Holding On

Generally speaking the aim of active stock picking is to find companies that provide returns that are superior to the market average. And while active stock picking involves risks (and requires diversification) it can also provide excess returns. For example, long term Jubilee Metals Group PLC (LON:JLP) shareholders have enjoyed a 91% share price rise over the last half decade, well in excess of the market return of around 6.3% (not including dividends). However, more recent returns haven't been as impressive as that, with the stock returning just 10% in the last year.

See our latest analysis for Jubilee Metals Group

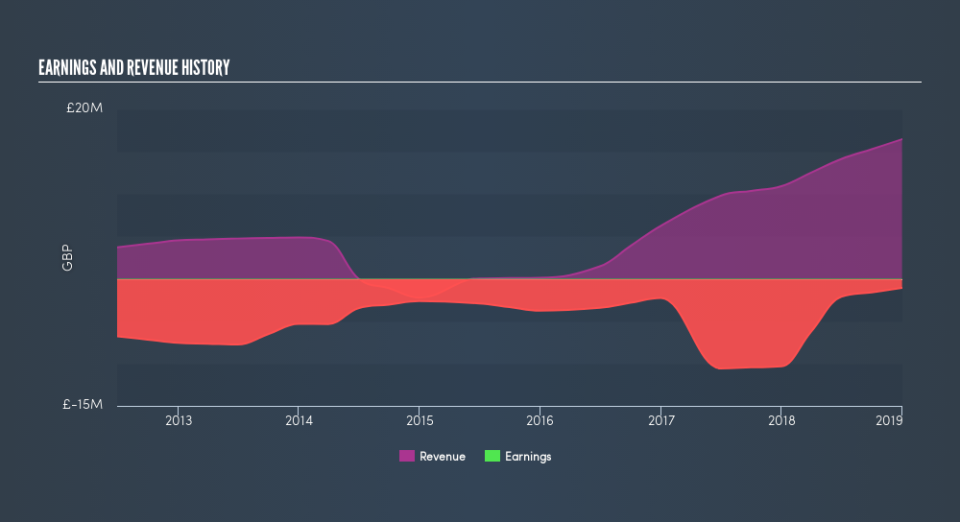

Given that Jubilee Metals Group didn't make a profit in the last twelve months, we'll focus on revenue growth to form a quick view of its business development. Generally speaking, companies without profits are expected to grow revenue every year, and at a good clip. As you can imagine, fast revenue growth, when maintained, often leads to fast profit growth.

In the last 5 years Jubilee Metals Group saw its revenue grow at 51% per year. Even measured against other revenue-focussed companies, that's a good result. It's good to see that the stock has 14%, but not entirely surprising given revenue shows strong growth. If the strong revenue growth continues, we'd expect the share price to follow, in time. Of course, you'll have to research the business more fully to figure out if this is an attractive opportunity.

You can see how revenue and earnings have changed over time in the image below, (click on the chart to see cashflow).

You can see how its balance sheet has strengthened (or weakened) over time in this free interactive graphic.

A Different Perspective

It's good to see that Jubilee Metals Group has rewarded shareholders with a total shareholder return of 10% in the last twelve months. However, the TSR over five years, coming in at 14% per year, is even more impressive. You might want to assess this data-rich visualization of its earnings, revenue and cash flow.

For those who like to find winning investments this free list of growing companies with recent insider purchasing, could be just the ticket.

Please note, the market returns quoted in this article reflect the market weighted average returns of stocks that currently trade on GB exchanges.

We aim to bring you long-term focused research analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material.

If you spot an error that warrants correction, please contact the editor at editorial-team@simplywallst.com. This article by Simply Wall St is general in nature. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. Simply Wall St has no position in the stocks mentioned. Thank you for reading.