Judicial Panel Orders Equifax Data Breach Cases Consolidated in Atlanta

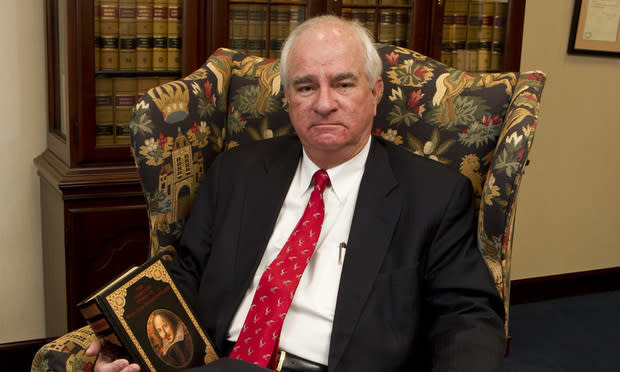

[caption id="attachment_4664" align="alignleft" width="620"]

Chief Judge Thomas Thrash, U.S. District Court for the Northern District of Georgia (Photo: John Disney/ ALM)[/caption] Multidistrict litigation related to the massive data security breach that took place earlier this year at Atlanta-based credit bureau Equifax will be adjudicated in the company’s hometown, the U.S. Judicial Panel on Multidistrict Litigation announced Wednesday. The panel has assigned the cases to U.S. District Chief Judge Thomas Thrash Jr., a veteran of MDL including the Home Depot data security breach MDL that compromised personal and financial data of an estimated 56 million customers in 2014. Thrash, appointed to the federal bench by President Bill Clinton in 1997, is known for his fondness for Shakespeare, fishing and tennis—the only three subjects about which the judge has said he is willing to speak freely. Thrash keeps a leather bound volume of Shakespeare's plays, embossed with a color portrait of the Bard, in his chambers and willingly pulls it out to look up and recite favorite passages, once telling the Daily Report, "I do not consider myself to be a Shakespeare scholar. I just love the stuff he writes." Thrash is also known for the strict time limits he imposes on all parties—limits that counsel agree to and Thrash expects them to honor—before a trial begins. Whenever an attorney engages either in direct or cross-examination before a jury, the clock runs. And Thrash keeps time. One lawyer who has practiced in his court called it akin to punching a chess clock. In consolidating hundreds of cases against Equifax, many of them proposed class actions, in Georgia, the multidistrict judicial panel rejected suggestions to have litigation stemming from the breathtaking data breach adjudicated in other federal districts across the nation, including Pennsylvania, Minnesota, California, Alabama, Florida, Illinois, Kentucky, Missouri New Jersey, Oklahoma, Texas and Virginia. The panel said that consolidating the cases in Georgia would not only be convenient to the parties and witnesses but also “promote the just and efficient conduct” of the litigation. “Equifax is headquartered in that district, and relevant documents and witnesses thus likely will be found there,” the order said. “Selection of the district is supported by defendants and the vast majority of responding plaintiffs. Far more actions are pending in this district than in any other court in the nation.” The panel also called Thrash “an experienced transferee judge who we are confident will steer this litigation on a prudent course.” Some of the plaintiff financial institutions had asked the panel that their cases not be consolidated with those filed on behalf of an estimated 145.5 million consumers whom Equifax has acknowledged may have been affected by the breathtaking security breach. Instead, the financial institutions suggested that “a separate track” be created for them, but the panel declined to do so, saying that it would leave to Thrash “the extent and manner of coordination or consolidation” of actions in the Equifax MDL. Thrash bifurcated the Home Depot data breach litigation into cases filed against the Atlanta-based home improvement chain by financial institutions and those filed by or on behalf of customers whose information was compromised. Equifax’s outside counsel at Atlanta’s King & Spalding had asked the federal panel to consolidate the data breach cases in Atlanta. So did the Barnes Law Group, headed by former Georgia Gov. Roy Barnes, which joined forces with John Yanchunis of Morgan & Morgan in Tampa and Norman Siegel of Stueve Siegel Hanson in Kansas City, Missouri, to file the first suit against Equifax in the Northern District of Georgia. Thrash was one of several judges on the Northern District bench that the Barnes Law Group recommended.