Juniper Investment Company, LLC Increases Stake in Bioventus Inc

In a recent transaction, Juniper Investment Company, LLC (Trades, Portfolio), a New York-based investment firm, has significantly increased its stake in Bioventus Inc. (NASDAQ:BVS). This article aims to provide a comprehensive analysis of this transaction, the profiles of both the investment firm and the traded company, and the potential implications for value investors.

Profile: Juniper Investment Company, LLC (Trades, Portfolio)

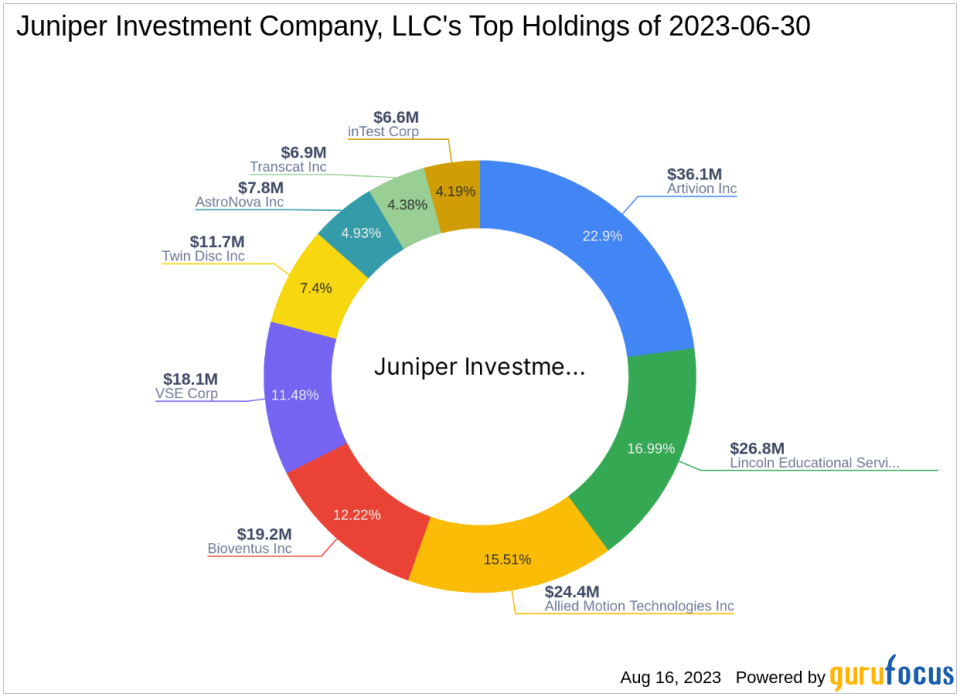

Juniper Investment Company, LLC (Trades, Portfolio), located at 555 Madison Ave, New York, NY, is a firm that manages a diverse portfolio of investments. The firm currently holds nine stocks, with a total equity of $157 million. Its top holdings include Allied Motion Technologies Inc (NASDAQ:AMOT), Bioventus Inc (NASDAQ:BVS), Lincoln Educational Services Corp (NASDAQ:LINC), VSE Corp (NASDAQ:VSEC), and Artivion Inc (NYSE:AORT). The firm's investments are primarily concentrated in the Healthcare and Technology sectors.

Transaction Details

The transaction took place on August 14, 2023, involving the purchase of 184,446 shares in Bioventus Inc, bringing the holding to 6,841,433 shares. The trade impacted the firm's portfolio by 0.53%. The shares were traded at a price of $4.52 each, making Bioventus Inc account for 19.53% of the firm's portfolio. This transaction also increased the firm's holdings in Bioventus Inc to 10.90%.

Bioventus Inc: The Traded Company

Bioventus Inc, a US-based medical technology company, specializes in developing and commercializing treatments that enhance the body's natural healing process. The company's diverse portfolio includes products for pain treatments, surgical solutions, and restorative therapies. As of August 16, 2023, the company has a market cap of $310.197 million.

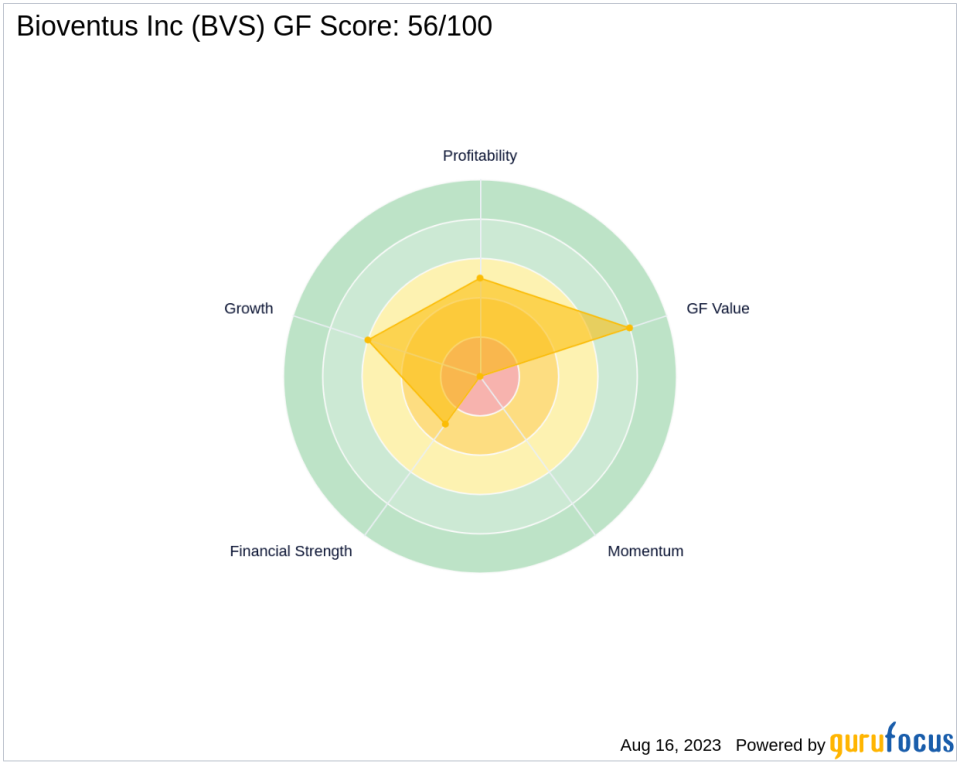

The company's stock price stands at $4.94, with a PE percentage of 0.00, indicating that the company is currently at a loss. The GF Value of the stock is $7.95, suggesting a price-to-GF-Value ratio of 0.61. The company's financial health, as indicated by its balance sheet rank of 3/10, profitability rank of 5/10, and growth rank of 6/10, is moderate.

Stock Performance and Valuation

Since its IPO on February 11, 2021, Bioventus Inc's stock has declined by 67.28%. However, the stock has gained 9.29% since the transaction and has increased by 89.27% year-to-date. The GF Score of the stock is 56/100, indicating a moderately poor future performance potential.

The company's financial ratios, including a cash to debt ratio of 0.08 and an interest coverage of 0.00, reflect its low financial stability. Additionally, GuruFocus labeled the stock a possible value trap due to the company's low Altman Z-score of -0.66, which suggests a high chance of financial distress.

The company's ROE and ROA of -95.63 and -24.81, respectively, indicate a negative return on equity and assets.

Industry Overview

Bioventus Inc operates in the Medical Devices & Instruments industry. Despite the challenging industry conditions, the company has managed to maintain a steady growth rate of 10.90% over the past three years.

Conclusion

In conclusion, Juniper Investment Company, LLC (Trades, Portfolio)'s recent acquisition of Bioventus Inc shares represents a significant addition to its portfolio. While Bioventus Inc's current financial health and stock performance present a mixed picture, the company's steady growth rate and the firm's increased stake suggest potential future gains. However, value investors should exercise caution due to the company's current GF Value and financial ratios.

All data and rankings are accurate as of August 16, 2023.

This article first appeared on GuruFocus.