Juniper Networks Inc (JNPR) Earnings Report: A Mixed Bag of Growth and Challenges

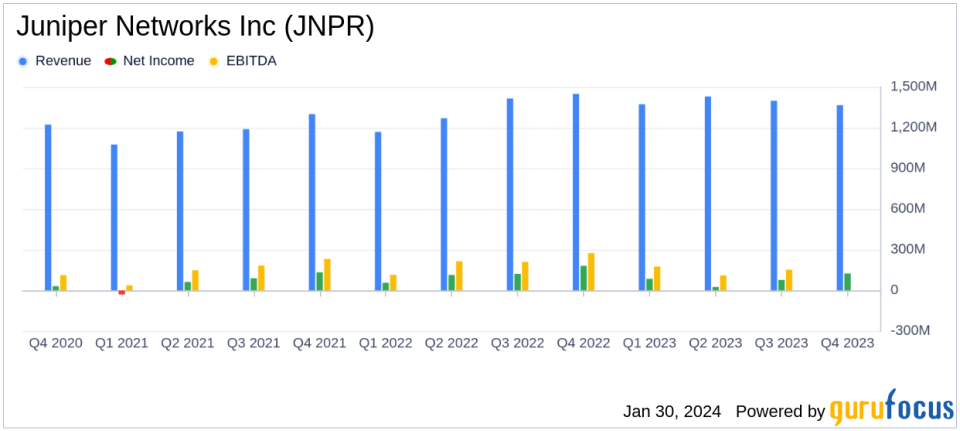

Net Revenues: Q4 net revenues decreased by 6% YoY to $1,364.8 million.

GAAP Operating Margin: Q4 GAAP operating margin fell to 9.2% from 14.0% in Q4 2022.

Non-GAAP Operating Margin: Improved sequentially to 18.3% in Q4 from 17.5% in Q3 2023.

GAAP Net Income: Decreased by 31% YoY to $124.3 million in Q4, with EPS of $0.38.

Non-GAAP Net Income: Increased by 2% sequentially to $196.9 million in Q4, with non-GAAP EPS of $0.61.

Full-Year Revenue Growth: FY 2023 net revenues increased by 5% YoY to $5,564.5 million.

Cash Position: Total cash, cash equivalents, and investments stood at $1,324.3 million as of December 31, 2023.

On January 30, 2024, Juniper Networks Inc (NYSE:JNPR) released its 8-K filing, detailing its financial performance for the fourth quarter and fiscal year 2023. The company, known for its high-performance network solutions, faced a challenging quarter with a decrease in net revenues and GAAP net income compared to the same period last year. However, the company also reported an increase in non-GAAP net income and a full-year revenue growth.

Company Overview

Juniper Networks Inc is a prominent player in the networking industry, offering a range of products and services designed to create scalable, reliable, and secure networks. Their portfolio includes routing, switching, Wi-Fi, network security, AI-driven networking operations, and software-defined networking technologies. Juniper's solutions are complemented by a suite of services, including maintenance, professional services, SaaS, and educational programs.

Financial Performance and Challenges

The company's financial performance in Q4 2023 was marked by a 6% year-over-year decrease in net revenues, which totaled $1,364.8 million. The GAAP operating margin also saw a decline from 14.0% in Q4 2022 to 9.2% in the same quarter of 2023. However, the non-GAAP operating margin showed resilience, improving sequentially from 17.5% in Q3 to 18.3% in Q4. GAAP net income took a significant hit, dropping by 31% year-over-year to $124.3 million, while non-GAAP net income saw a modest 2% sequential increase to $196.9 million.

Despite these challenges, Juniper Networks achieved a 5% year-over-year increase in full-year net revenues, which amounted to $5,564.5 million for FY 2023. The company's cash position remained strong, with total cash, cash equivalents, and investments reaching $1,324.3 million by the end of 2023.

Financial Achievements and Importance

Juniper Networks' ability to grow its full-year revenues amidst a challenging economic environment underscores the company's resilience and the demand for its networking solutions. The increase in non-GAAP net income and earnings per share reflects effective cost management and operational efficiency, which are crucial for sustaining profitability in the competitive hardware industry.

Key Financial Metrics

The company's balance sheet remains robust, with an increase in total cash and investments compared to the previous year. The net cash flows provided by operations for Q4 2023 were $9.1 million, a significant decrease from the previous year's quarter, indicating potential challenges in cash flow management. Capital expenditures were $35.4 million, and the company declared a cash dividend of $0.22 per share, demonstrating its commitment to returning value to shareholders.

Analysis and Future Prospects

While Juniper Networks faces headwinds with decreased net revenues and GAAP net income, the growth in non-GAAP measures and full-year revenues provides a more optimistic outlook. The proposed merger with Hewlett Packard Enterprise (HPE), expected to close in late 2024 or early 2025, could further reshape the company's future, potentially bringing new synergies and market opportunities.

Juniper's CEO, Rami Rahim, commented on the company's performance, stating:

"We delivered record revenue results in 2023 and grew our business on a year-over-year basis for a third consecutive year. These results reflect the strength of our enterprise business, which not only delivered a second consecutive year of solid double-digit revenue growth, but also achieved positive product order growth in the fourth quarter and on a full-year basis."

Juniper's CFO, Ken Miller, also highlighted the company's financial discipline:

"We achieved record non-GAAP earnings per share in 2023. This was achieved through a combination of healthy revenue growth, improved non-GAAP gross margin and disciplined cost management, which enabled us to exceed our goal of delivering at least 100 basis points of non-GAAP operating margin improvement in 2023."

In conclusion, Juniper Networks' latest earnings report presents a mixed picture, with certain financial metrics under pressure while others show growth. The company's strategic focus on enterprise business and cost management has helped it navigate a tough economic landscape, and the upcoming merger with HPE could mark a new chapter in its evolution.

Explore the complete 8-K earnings release (here) from Juniper Networks Inc for further details.

This article first appeared on GuruFocus.