Kadant Inc (KAI) Reports Record Revenue and Cash Flow for Fiscal Year 2023

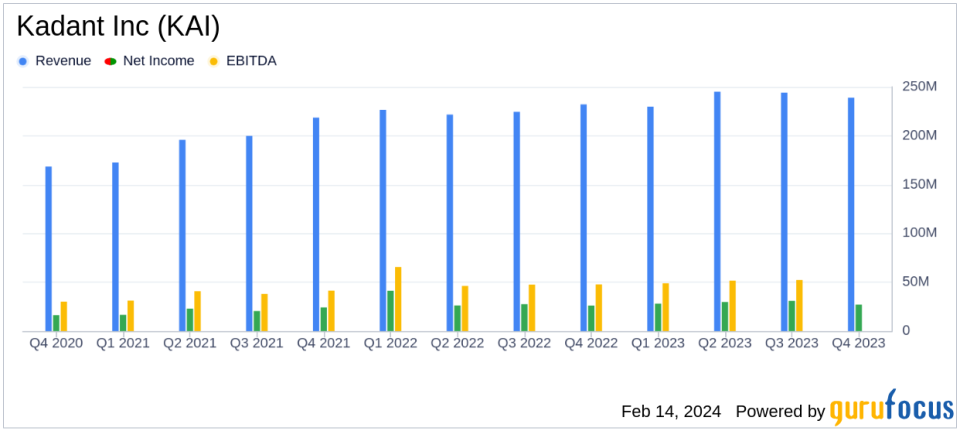

Revenue: Increased by 6% to a record $958 million for FY 2023.

Operating Cash Flow: Jumped 61% to a record $166 million for FY 2023.

Net Income: Decreased by 4% to $116 million for FY 2023.

GAAP EPS: Decreased by 4% to $9.90, while Adjusted EPS increased by 9% to a record $10.04 for FY 2023.

Adjusted EBITDA: Increased by 6% to a record $201 million, representing 21.0% of revenue for FY 2023.

Bookings: Decreased by 4% to $917 million for FY 2023.

Kadant Inc (NYSE:KAI) released its 8-K filing on February 14, 2024, detailing its financial performance for the fourth quarter and the fiscal year ended December 30, 2023. The company, a global supplier of critical process and engineering equipment for industries such as papermaking, recycling, and lumber manufacturing, reported a year of record revenue and cash flow, despite a slight dip in net income.

Kadant Inc's robust portfolio, including its Flow Control, Industrial Processing, and Material Handling segments, has contributed to its solid financial standing. The company's global presence, with significant revenue streams from the U.S., Europe, Asia, and Canada, has allowed it to navigate macroeconomic headwinds effectively.

Financial Performance and Challenges

For the fourth quarter, Kadant Inc reported a revenue increase of 3% to $239 million, with operating cash flow surging 68% to $59 million and free cash flow more than doubling to $49 million. Net income saw a modest rise of 5% to $27 million. However, adjusted EBITDA saw a slight decrease of 2% to $48 million, representing 20.3% of revenue. The company's bookings increased by 1% to $218 million.

The fiscal year 2023 was marked by a 6% increase in revenue to a record $958 million. Operating cash flow and free cash flow followed suit, with record increases of 61% and 80%, respectively. Despite these achievements, net income fell by 4% to $116 million, and GAAP EPS decreased by 4% to $9.90. Adjusted EPS, on the other hand, increased by 9% to a record $10.04. Adjusted EBITDA also hit a record at $201 million, up 6% from the previous year, and represented 21.0% of revenue. Bookings for the year decreased by 4% to $917 million, and the ending backlog was $310 million.

Management Commentary and Outlook

Jeffrey L. Powell, president and CEO of Kadant, commented on the company's performance, stating,

The fourth quarter was a solid finish to a record-setting year. Despite macroeconomic headwinds in certain regions, we had another well-executed quarter."

He highlighted the growth in the material handling segment and the strong cash flow in the fourth quarter.

Looking ahead, Powell expressed optimism for 2024, anticipating record revenue, cash flow, and adjusted EBITDA, despite increased borrowing costs and non-cash intangible amortization expenses from recent acquisitions. The company forecasts revenue of $1.040 billion to $1.065 billion, GAAP EPS of $9.55 to $9.85, and adjusted EPS of $9.75 to $10.05 for 2024.

Key Financial Metrics

Important metrics from Kadant Inc's financial statements include a gross profit margin decrease to 42.7% in Q4 2023 from 43.1% in the previous year. The company's strong cash flow performance is particularly noteworthy, with operating cash flow and free cash flow reaching record levels. These metrics are critical for Kadant Inc, as they reflect the company's ability to generate cash, fund operations, and pursue strategic initiatives.

The company's financial stability and growth prospects are further evidenced by its earnings per share (EPS) figures. While GAAP EPS saw a slight decrease, the record adjusted EPS points to the company's strong underlying profitability when excluding certain non-recurring items.

Kadant Inc's performance is a testament to its resilience and strategic execution in a challenging economic environment. The company's focus on innovation and efficiency in its core markets positions it well for continued success in the industrial products industry.

For more detailed information and to listen to the earnings call, investors and interested parties can visit Kadant Inc's website or register for the live question and answer session.

For a comprehensive understanding of Kadant Inc's financial health and future prospects, investors are encouraged to review the full earnings release and financial statements available on the SEC website.

Stay tuned to GuruFocus.com for further updates and analysis on Kadant Inc and other key players in the industrial products sector.

Explore the complete 8-K earnings release (here) from Kadant Inc for further details.

This article first appeared on GuruFocus.