Kadant (KAI) Buys Balemaster, Boosts Material Handling Prospects

Kadant Inc. KAI announced that it successfully closed the acquisition of the United States-based manufacturer of balers and other automated waste-handling equipment, Balemaster. The buyout was settled with $54 million in cash.

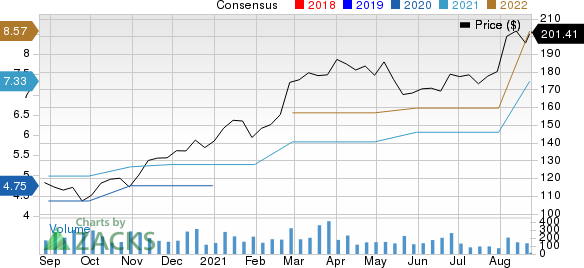

Notably, Kadant’s shares gained 2.68% yesterday, ending the trading session at $201.41.

Balemaster specializes in manufacturing horizontal and heavy-duty balers as well as fluffers, shredders, perforators, shredders and hoggers. The firm’s customer base belongs to multiple markets, including paper mills, cardboard and corrugated box, folding cartons, recycling, non-woven, and paper converting.

Inside the Headlines

Kadant anticipates that the Balemaster buyout will complement its existing baler production business. Balemaster’s solid market presence in North America, its healthy aftermarket business and exposure in diversified end markets will be advantageous, boosting growth opportunities in the secondary material processing industry for Kadant.

Balemaster’s skilled employee base, its manufacturing technologies and revenue-generation capabilities (revenues for 12 months, ended June 2021, totaled $22 million) are now part of Kadant. Specifically, the acquired business will be grouped under Kadant’s Material Handling segment.

The segment primarily offers balers as well as conveying and vibratory equipment for use in handling secondary processing. End markets served include waste management, mining, food and aggregates industries.

In second-quarter 2021, Kadant’s Material Handling segment’s sales expanded 18.3% year over year to $42.4 million, mainly benefiting from improving demand for baling products in Europe. It represented 21.6% of the company’s second-quarter revenues.

Kadant’s Buyout Activities

Acquiring businesses are effective ways for the company to gain access to new markets, expand its product line and enhance the customer base. It invested $0.2 million on business acquisitions (net of cash acquired) in the first half of 2021.

In the ongoing quarter, Kadant’s subsidiary, Kadant Germany Holding GmbH, acquired Joh. Clouth GmbH & Co. KG along with its affiliates. The acquisition was valued at $92 million, mainly funded through available cash on hand and borrowings. Clouth, a manufacturer of doctor blades and other related equipment, will form part of Kadant’s Flow Control segment.

Zacks Rank, Price Performance and Estimate Trend

With a $2.3-billion market capitalization, Kadant currently sports a Zacks Rank #1 (Strong Buy). The company is benefiting from strengthening end markets, solid bookings and backlog, effective operational execution, and buyout synergies.

In the past three months, its shares have gained 21% against the industry’s decline of 2.2%.

Image Source: Zacks Investment Research

Meanwhile, the Zacks Consensus Estimate for its earnings is pegged at $7.33 for 2021 and $8.57 for 2022, reflecting growth of 20.8% and 28.5% from the respective 30-day-ago figures. Also, earnings estimates of $1.63 for the third quarter represent an increase of 7.9% from the 30-day-ago figure.

Kadant Inc Price and Consensus

Kadant Inc price-consensus-chart | Kadant Inc Quote

Other Stocks to Consider

Some other top-ranked stocks in the industry are Helios Technologies, Inc. HLIO, Applied Industrial Technologies, Inc. AIT and Dover Corporation DOV. While Helios presently sports a Zacks Rank #1, both Applied Industrial and Dover carry a Zacks Rank #2 (Buy). You can see the complete list of today’s Zacks #1 Rank stocks here.

In the past 30 days, earnings estimates for these companies have improved for the current year. Further, positive earnings surprise for the last reported quarter was 39.53% for Helios, 27.97% for Applied Industrial and 11.96% for Dover.

Want the latest recommendations from Zacks Investment Research? Today, you can download 7 Best Stocks for the Next 30 Days. Click to get this free report

Dover Corporation (DOV) : Free Stock Analysis Report

Applied Industrial Technologies, Inc. (AIT) : Free Stock Analysis Report

Kadant Inc (KAI) : Free Stock Analysis Report

Helios Technologies, Inc (HLIO) : Free Stock Analysis Report

To read this article on Zacks.com click here.

Zacks Investment Research