Kahn Brothers Adjusts Holdings with Notable Moves in BP PLC and CSX Corp

Insight into Kahn Brothers (Trades, Portfolio)' Latest 13F Filings for Q3 2023

Kahn Brothers (Trades, Portfolio) Group, a seasoned investment firm with a legacy dating back to 1978, has recently disclosed its 13F holdings for the third quarter of 2023. The firm, which was co-founded by Irving Kahn, a former teaching assistant to the legendary Benjamin Graham, is known for its value investing approach. Kahn Brothers (Trades, Portfolio) Advisors LLC, the investment management arm, along with Kahn Brothers (Trades, Portfolio) LLC, a member of the New York Stock Exchange, collectively boast over a century of investment experience. The firm's investment strategy is deeply rooted in Graham's philosophies, focusing on undervalued equities with solid long-term prospects.

New Additions to the Portfolio

Kahn Brothers (Trades, Portfolio) expanded its portfolio with two new stock additions in the latest quarter:

The most significant new holding is CSX Corp (NASDAQ:CSX), with 50,428 shares valued at $1.55 million, making up 0.24% of the portfolio.

SEI Investments Co (NASDAQ:SEIC) also joined the portfolio with 6,600 shares, representing 0.06% and valued at $398,000.

Key Position Increases

The firm bolstered its positions in seven stocks, with notable increases in:

GSK PLC (NYSE:GSK), where 18,831 additional shares were acquired, bringing the total to 1,282,289 shares. This represents a 1.49% increase in share count and a 0.11% portfolio impact, with a total value of $46.48 million.

Citigroup Inc (NYSE:C) also saw an increase of 8,878 shares, totaling 1,215,684 shares, marking a 0.74% increase in share count and a portfolio value of $50 million.

Positions Completely Exited

Kahn Brothers (Trades, Portfolio) exited two positions entirely in the third quarter of 2023:

All 31,000 shares of Hope Bancorp Inc (NASDAQ:HOPE) were sold, impacting the portfolio by -0.04%.

The firm also liquidated its 4,320-share position in Glacier Bancorp Inc (NYSE:GBCI), which had a -0.03% portfolio impact.

Significant Reductions in Holdings

The investment firm reduced its stake in 24 stocks, with the most significant reductions in:

BP PLC (NYSE:BP), where 68,857 shares were sold, resulting in a 3.74% decrease in shares and a -0.36% portfolio impact. BP's stock price averaged $37.12 during the quarter, with a -3.80% return over the past three months and a 5.53% year-to-date return.

Patterson-UTI Energy Inc (NASDAQ:PTEN) saw a reduction of 195,748 shares, a 5.1% decrease, impacting the portfolio by -0.34%. The stock's average price was $14.63 for the quarter, with a -19.39% three-month return and a -26.58% year-to-date return.

Portfolio Overview

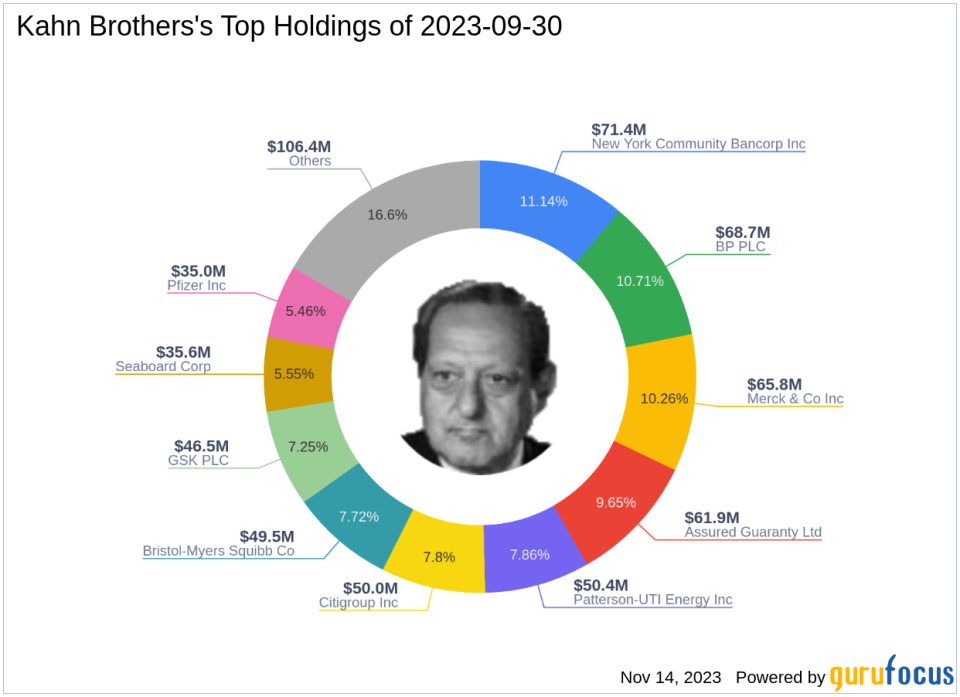

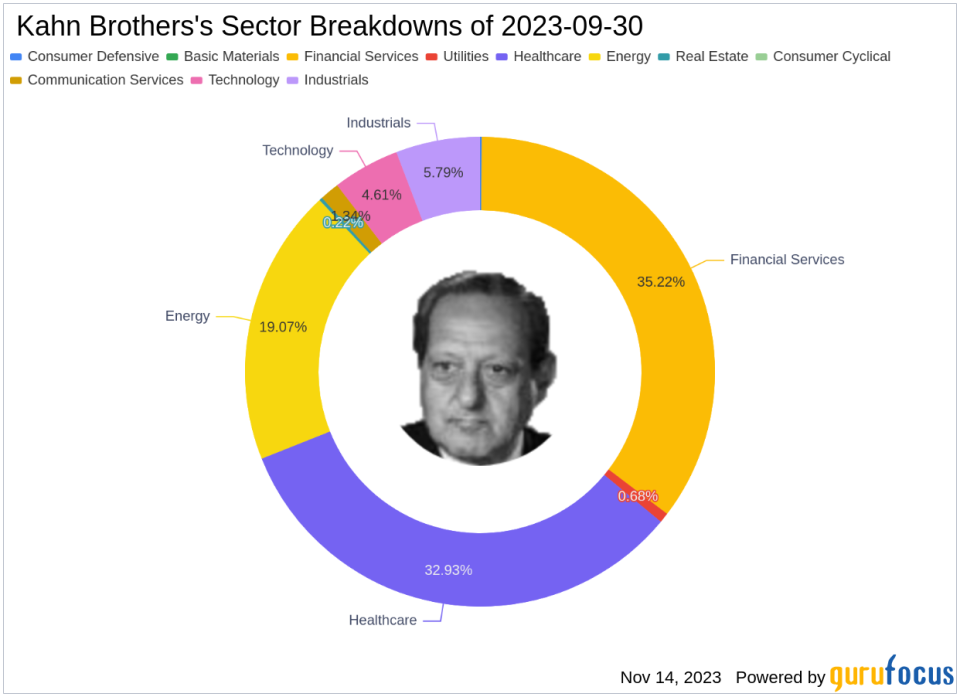

As of the third quarter of 2023, Kahn Brothers (Trades, Portfolio)'s portfolio comprised 44 stocks. The top holdings included 11.14% in New York Community Bancorp Inc (NYSE:NYCB), 10.71% in BP PLC (NYSE:BP), 10.26% in Merck & Co Inc (NYSE:MRK), 9.65% in Assured Guaranty Ltd (NYSE:AGO), and 7.86% in Patterson-UTI Energy Inc (NASDAQ:PTEN). The holdings are primarily concentrated across nine industries: Financial Services, Healthcare, Energy, Industrials, Technology, Communication Services, Utilities, Real Estate, and Consumer Defensive.

This article, generated by GuruFocus, is designed to provide general insights and is not tailored financial advice. Our commentary is rooted in historical data and analyst projections, utilizing an impartial methodology, and is not intended to serve as specific investment guidance. It does not formulate a recommendation to purchase or divest any stock and does not consider individual investment objectives or financial circumstances. Our objective is to deliver long-term, fundamental data-driven analysis. Be aware that our analysis might not incorporate the most recent, price-sensitive company announcements or qualitative information. GuruFocus holds no position in the stocks mentioned herein.

This article first appeared on GuruFocus.