Kaiser Aluminum Corp (KALU) Reports Solid Full Year 2023 Results with Net Income Rising to $47 ...

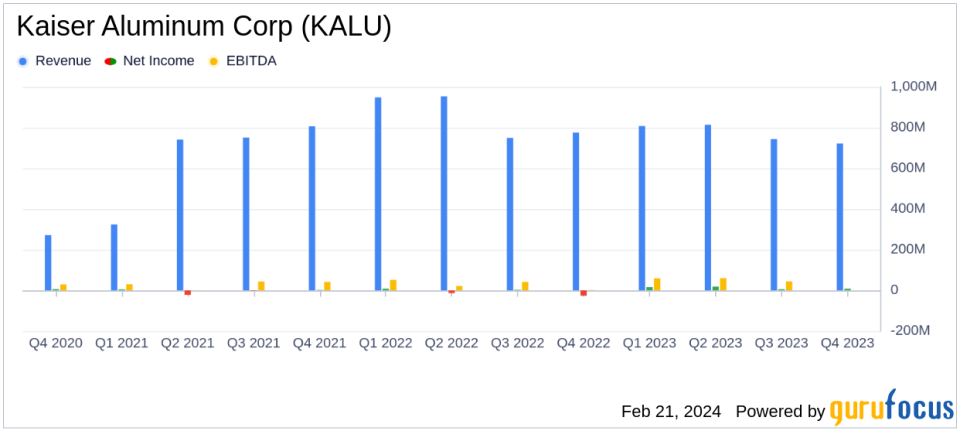

Net Sales: $3.1 billion for full year 2023, with a decrease compared to $3.4 billion in the prior year.

Net Income: Reported at $47 million for full year 2023, a significant improvement from a net loss of $30 million in the prior year.

Adjusted EBITDA: Reached $210 million, a 48% increase over 2022, with margins holding steady at 14.3%.

Liquidity: Remained strong at $599 million as of December 31, 2023.

Dividends: A quarterly cash dividend of $0.77 per share was paid on February 15, 2024.

Outlook: Conversion revenue for full year 2024 is expected to improve by 2-3%, with adjusted EBITDA margins projected to increase by 70-170 basis points over 2023.

On February 21, 2024, Kaiser Aluminum Corp (NASDAQ:KALU) released its 8-K filing, detailing the financial results for the fourth quarter and full year of 2023. The company, a prominent player in the production and sale of semi-fabricated specialty aluminum products, operates primarily in the United States and Canada, catering to a diverse range of industrial sectors including aerospace, automotive, and general engineering.

Performance and Challenges

Despite a modest decrease in net sales to $722 million in Q4 and $3.1 billion for the full year, down from $776 million and $3.4 billion in the respective periods of the previous year, Kaiser Aluminum navigated a challenging environment to end the year on a strong note. The company's net income for the full year stood at $47 million, a stark contrast to the net loss of $30 million in the previous year. Adjusted net income also saw a rise to $44 million, with adjusted net income per diluted share at $2.74.

President and CEO Keith A. Harvey highlighted the foundational year for Kaiser, emphasizing the record net sales and conversion revenue achieved in the aerospace/high strength sector. However, the company faced persistent reduced demand for general engineering plate products and destocking activities in the packaging operations. These challenges were mitigated by the company's ability to flex capacity at its Trentwood facility to support the robust aerospace demand.

Financial Achievements

The company's financial achievements are particularly noteworthy in the Metals & Mining industry, where managing costs and capitalizing on market demand are crucial for success. Kaiser's adjusted EBITDA margin of 14.3% reflects its ability to maintain profitability despite fluctuations in the market. The strong liquidity position, with nearly $600 million available, underscores the company's financial stability and capacity to pursue growth initiatives.

Key Financial Metrics

Key financial details from the income statement and balance sheet reveal that Kaiser's shipments for the full year amounted to 1,196 million lbs, a decrease from 1,254 million lbs in the previous year. The realized price per pound of net sales also decreased slightly from $2.73 to $2.58. The balance sheet shows a healthy liquidity position with $82.4 million in cash and cash equivalents and significant borrowing availability.

Our focused execution led us to end the year in a solid position with full year net income of $47 million and adjusted EBITDA increasing 48% over 2022 to approximately $210 million, said Keith A. Harvey, President and Chief Executive Officer.

Analysis of Performance

Kaiser's performance in 2023 reflects a resilient business model capable of adapting to market dynamics. The company's strategic focus on high-value sectors like aerospace/high strength and automotive extrusions, coupled with cost management and operational efficiency, has positioned it for sustainable growth. The outlook for 2024 is optimistic, with expectations of improved conversion revenue and adjusted EBITDA margins.

For a detailed analysis of Kaiser Aluminum Corp's financial performance and future prospects, investors and interested parties are encouraged to review the full 8-K filing.

Stay informed on the latest financial news and analysis by visiting GuruFocus.com for comprehensive coverage of your favorite companies and investment opportunities.

Explore the complete 8-K earnings release (here) from Kaiser Aluminum Corp for further details.

This article first appeared on GuruFocus.