KALA Up on Fast Track Designation to Lead Ocular Candidate

Kala Pharmaceuticals, Inc. KALA, a clinical-stage biopharmaceutical company’s shares were up 2.52% after the company announced that the FDA has granted Fast Track designation to its lead candidate KPI-012 for the treatment of persistent corneal epithelial defects (PCED).

This designation from FDA facilitates the rapid development and expedites the review of drug candidates that are being developed to treat serious conditions and for which nonclinical and/or clinical data demonstrate the potential to address unmet medical needs. The goal is to make these treatments rapidly available to patients in need.

The Fast Track Designation allows frequent interactions with FDA to discuss the product development plan and the designated candidates may also be eligible for priority review and accelerated approval if supported by clinical data.

KPI-012 is a human mesenchymal stem cell secretome (MSC-S), which contains numerous human-derived biofactors, such as growth factors, protease inhibitors, matrix proteins and neurotrophic factors that can potentially correct the impaired corneal healing that is an underlying etiology of multiple severe ocular diseases.

Kala dosed the first patient in its CHASE (Corneal Healing After SEcretome therapy) phase IIb study evaluating KPI-012 for the treatment of PCED.

PCED is a rare disease that can have various etiologies, including neurotrophic keratitis, surgical epithelial debridement, microbial/viral keratitis, corneal transplant, limbal stem cell deficiency and mechanical and chemical trauma and, if left untreated, can lead to infection, corneal ulceration or perforation, scarring, opacification and significant vision loss.

Last month, the company announced positive safety data from the first cohort of two patients who were treated with a high dose of KPI-012 (3 U/mL) four times per day (QID). Both patients successfully completed at least one week of dosing with no safety issues observed. Consequently, the study has now advanced to Cohort 2.

The second cohort is a multicenter, randomized, double-masked, vehicle-controlled, parallel-group study to evaluate the safety and tolerability of two doses of KPI-012 in ophthalmic solution (3 U/mL and 1 U/mL) versus vehicle-dosed topically QID for 56 days in approximately 90 patients. The primary endpoint of the study is the complete healing of the PCED as measured by corneal fluorescein staining.

Top-line safety and efficacy data is expected in the first quarter of 2024. Assuming the study achieves the targeted objective, Kala believes this study could serve as the first of two pivotal trials required to support the submission of a biologics license application (BLA) to the FDA.

KPI-012 also enjoys Orphan Drug status in the United States for PCED. Kala is also targeting the potential development of KPI-012 for the treatment of limbal stem cell deficiency and ocular manifestations of moderate-to-severe Sjögren's and has initiated preclinical studies to evaluate the potential utility of its MSC-S platform for retinal degenerative diseases, such as retinitis pigmentosa and stargardt disease.

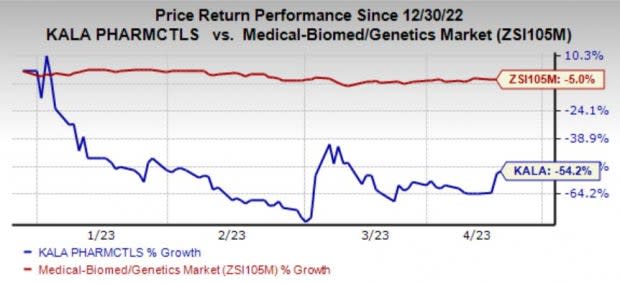

Shares of Kala have plunged 54.2% in the year so far compared with the industry’s 5% decline.

Image Source: Zacks Investment Research

The successful development and commercialization of KPI-012 will be a significant boost for Kala.

The company completed the sale of Eysuvis and Inveltys to Alcon Inc. in the third quarter of 2022 to focus on KPI-012. Under the terms of the transaction, Kala received an upfront payment of $60 million in cash at closing and is eligible to receive commercial-based milestone payments.

Zacks Rank & Other Stocks to Consider

Kala Pharmaceuticals currently has a Zacks Rank #2 (Buy). You can see the complete list of today’s Zacks #1 Rank (Strong Buy) stocks here.

Other well-placed stocks in the overall healthcare sector are Novo Nordisk NVO and Ligand Therapeutics LGND, both sporting a Zacks Rank #1 at present.

In the past 30 days, estimates for Novo Nordisk’s 2023 earnings per share have risen from $4.20 to $4.43 and estimates for 2024 have gone up by 29 cents to $5.19.

Ligand’s earnings per share estimates for 2023 increased to $4.32 from $3.30 in the past 30 days. LGND beat earnings estimates in one of the last four reported quarters and missed in the remaining three.

Want the latest recommendations from Zacks Investment Research? Today, you can download 7 Best Stocks for the Next 30 Days. Click to get this free report

Novo Nordisk A/S (NVO) : Free Stock Analysis Report

Ligand Pharmaceuticals Incorporated (LGND) : Free Stock Analysis Report

Kala Pharmaceuticals, Inc. (KALA) : Free Stock Analysis Report