Karat Packaging Inc (KRT) Reports Record Gross Margin and Net Income for Full Year 2023

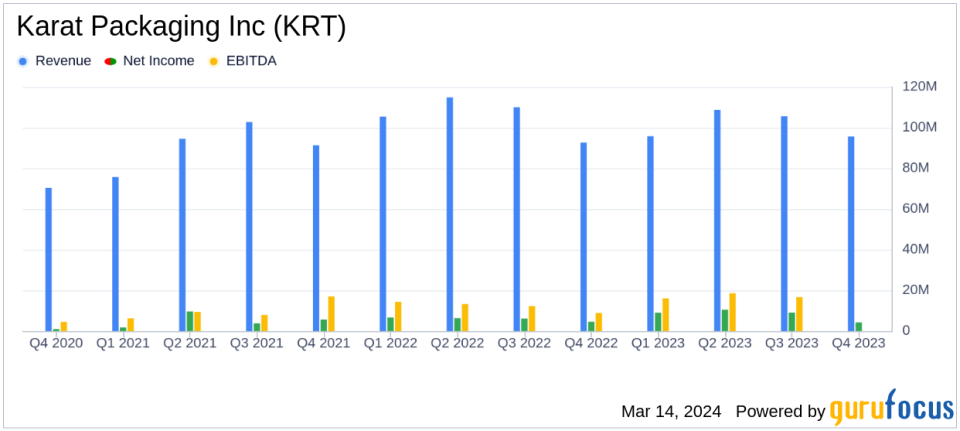

Net Sales: Increased by 3.1% to $95.6 million in Q4 2023, with full-year sales experiencing a slight decline.

Gross Profit: Grew by 14.9% to $34.1 million in Q4, contributing to a record annual gross margin of 37.7%.

Net Income: Q4 net income slightly decreased to $4.2 million, but full-year net income rose by 28.4% to $33.2 million.

Adjusted EBITDA: Reached $8.6 million in Q4, with a full-year increase to $59.1 million.

Dividend Increase: Quarterly cash dividend payment increased to $0.30 per share from $0.20 per share.

On March 14, 2024, Karat Packaging Inc (NASDAQ:KRT) released its 8-K filing, announcing its financial results for the fourth quarter and full year ended December 31, 2023. The company, a leading distributor and manufacturer of environmentally friendly disposable foodservice products, reported a record full-year gross margin and net income, signaling robust financial health despite encountering several challenges.

Company Overview

Karat Packaging Inc is renowned for its comprehensive range of disposable products tailored for the foodservice industry. Its portfolio includes food packaging, containers, tableware, cups, lids, cutlery, and straws, available in various materials including plastic, paper, and biopolymer-based compostable forms. The company's commitment to eco-friendly solutions is evident in its Karat Earth line, which focuses on sustainability and meets the growing demand for environmentally responsible products.

Financial Performance and Challenges

The fourth quarter of 2023 saw Karat Packaging Inc achieve net sales of $95.6 million, a 3.1% increase from the prior-year quarter, bolstered by a 7.3% growth in volume. However, the company faced headwinds such as a change of estimate on import duty reserve, a write-off of a vendor prepayment, and an out-of-period tax adjustment, which collectively impacted the cost of goods sold and general and administrative expenses. Despite these challenges, the company's gross profit rose to $34.1 million, up 14.9% from the prior-year quarter, with a gross margin of 35.7%.

For the full year, net sales slightly decreased by 4.1% to $405.7 million, primarily due to unfavorable pricing comparisons and lower logistics services. Nonetheless, the company's strategic decision to scale back U.S. manufacturing in favor of imports and improved operating efficiencies led to a significant increase in gross margin to 37.7% for the year.

Net income for the fourth quarter was $4.2 million, a slight decrease from $4.5 million in the prior-year quarter, while the full-year net income surged by 28.4% to $33.2 million. Adjusted EBITDA for the fourth quarter was $8.6 million, with a full-year increase to $59.1 million, reflecting the company's ability to maintain profitability amidst adversity.

Financial Achievements and Importance

The company's financial achievements are particularly noteworthy in the competitive Packaging & Containers industry. The record gross margin and net income demonstrate Karat Packaging Inc's operational efficiency and its ability to navigate through cost pressures and market fluctuations. The increase in the quarterly dividend payment underscores the company's strong cash flow position and commitment to delivering shareholder value.

Key Financial Metrics

Important metrics from the financial statements include:

"Net sales for the 2024 first quarter expected to increase low to mid-single digit from the prior-year quarter. Gross margin goal for the 2024 first quarter: 37 to 39 percent versus 39.8 percent for 2023 first quarter. Net sales for full year 2024 expected to increase 8 to 15 percent from the prior year. Gross margin goal for full year 2024: 35 to 38 percent assuming no significant increases in ocean freight rates."

These projections are crucial as they provide insight into the company's future expectations and strategic focus areas. The emphasis on maintaining and improving gross margin indicates a continued effort to enhance operational efficiency and cost management.

Analysis of Performance

Karat Packaging Inc's performance in 2023 reflects a resilient business model capable of achieving growth in challenging circumstances. The company's focus on eco-friendly products, which grew by 11% and comprised 33% of total net sales, aligns with consumer trends and positions it well for future growth. The expansion of its distribution network and the implementation of automation and AI technologies are strategic moves that are expected to drive further efficiencies and market penetration.

The company's solid balance sheet, with an increase in cash and cash equivalents to $23.1 million from $16.0 million the previous year, and the authorization of an increased cash dividend, signal confidence in its financial stability and outlook.

In conclusion, Karat Packaging Inc's financial results for the fourth quarter and full year 2023 demonstrate its ability to achieve profitability and growth despite facing several operational challenges. With a strong focus on eco-friendly products and strategic expansion, the company is well-positioned to continue its positive trajectory in the Packaging & Containers industry.

Explore the complete 8-K earnings release (here) from Karat Packaging Inc for further details.

This article first appeared on GuruFocus.