Karat Packaging (KRT) Q4 Earnings Miss Mark, Revenues Up Y/Y

Karat Packaging, Inc. KRT reported fourth-quarter 2023 adjusted earnings per share of 24 cents, missing the Zacks Consensus Estimate of 40 cents. The bottom line declined 20% from earnings of 30 cents per share reported in the year-ago quarter.

Including one-time items, earnings per share were 19 cents compared with the year-ago quarter’s 23 cents.

Total revenues increased 3% year over year to $95.6 million in the reported quarter. The top line surpassed the Zacks Consensus Estimate of $95.5 million. The year-over-year improvement included the impact of $6.4 million from the adjustment of online sales platform fees and volume growth of 7.3%. However, year-over-year unfavorable pricing comparisons and start-up delays into 2024 by several new national and regional chain accounts negated some of these gains.

Karat Packaging Inc. Price, Consensus and EPS Surprise

Karat Packaging Inc. price-consensus-eps-surprise-chart | Karat Packaging Inc. Quote

Operational Update

The cost of sales decreased 2.5% year over year to $61 million. Gross profit increased 15% year over year to $34 million. The gross margin was 35.7% in the reported quarter compared with the year-ago quarter’s 32%. The margin expansion was attributed to the company’s continued scale-back of manufacturing operations in favor of imports and improved operating efficiencies.

Operating expenses in the quarter were $29.5 million compared with $24.9 million in the year-ago quarter. The 18% increase was due to higher labor costs and rent and warehouse expenses from workforce expansion and additional leased warehouses, partially offset by a decrease in shipping and transportation costs, and stock compensation expenses.

Adjusted EBITDA declined 13% year over year to $8.6 million in the fourth quarter. Adjusted EBITDA margin was 9% in the quarter under review compared with 10.7% in the fourth quarter of 2022.

Cash Position

Karat Packaging reported cash and cash equivalents of $23 million as of Dec 31, 2023, up from $16 million as of Dec 31, 2022. The company generated $53 million of cash flow from operations in 2023 compared with $29 million in the last year.

2023 Results

Karat Packaging’s adjusted earnings per share improved 41% year over year to $1.83 in 2023. The figure missed the Zacks Consensus Estimate of $2.13. Including one-time items, the company delivered earnings per share of $1.63 in 2023 compared with $1.19 in 2022. Sales dipped 4% year over year to $405.6 million, in line with the consensus estimate.

Guidance for 2024

Karat Packaging anticipates a low to mid-single-digit year-over-year increase in net sales for the first quarter of 2024. The projected gross margin for the quarter falls within the range of 37% to 39%, which is slightly below 39.8% recorded in the first quarter of 2023.

For 2024, sales growth is forecasted to range between 8% and 15% compared with the previous year. The targeted gross margin for the year is set between 35% and 38%, assuming there are no significant rises in ocean freight rates.

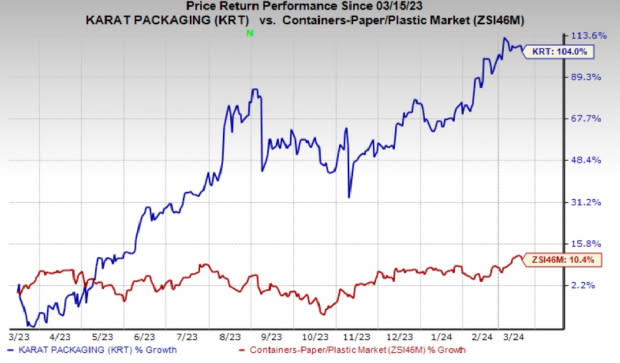

Price Performance

Shares of the company have gained 104% in the past year compared with the industry’s 10.4% rise.

Image Source: Zacks Investment Research

Zacks Rank and Other Stocks to Consider

Karat Packaging currently carries a Zacks Rank #2 (Buy).

Some other top-ranked stocks from the Industrial Products sector are Cadre Holdings, Inc. CDRE, Proto Labs, Inc. PRLB and Applied Industrial Technologies AIT. CDRE and PRLB currently sport a Zacks Rank #1 (Strong Buy) each, while AIT carries a Zacks Rank of 2. You can see the complete list of today's Zacks #1 Rank stocks here.

The Zacks Consensus Estimate for Cadre Holdings’ 2024 earnings is pegged at $1.15 per share. The consensus estimate for 2024 earnings has moved 5.5% north in the past 60 days and suggests year-over-year growth of 5.5%. The company has a trailing four-quarter average earnings surprise of 45.6%. CDRE shares have gained 81% in the past year.

The Zacks Consensus Estimate for Proto Labs’ 2024 earnings is pegged at $1.62 per share. The consensus estimate for 2024 earnings has moved 11% north in the past 60 days and suggests year-over-year growth of 1.9%. The company has a trailing four-quarter average earnings surprise of 42.2%. PRLB shares have gained 6% in the past year.

Applied Industrial has an average trailing four-quarter earnings surprise of 13.9%. The Zacks Consensus Estimate for AIT’s 2024 earnings is pinned at $9.43 per share, which indicates year-over-year growth of 7.8%. Estimates have been unchanged in the past 60 days. The company’s shares have gained 40% in the past year.

Want the latest recommendations from Zacks Investment Research? Today, you can download 7 Best Stocks for the Next 30 Days. Click to get this free report

Applied Industrial Technologies, Inc. (AIT) : Free Stock Analysis Report

Proto Labs, Inc. (PRLB) : Free Stock Analysis Report

Karat Packaging Inc. (KRT) : Free Stock Analysis Report

Cadre Holdings, Inc. (CDRE) : Free Stock Analysis Report