KB Home (KBH) Posts Revenue Growth and Robust Order Increase in Q1 2024

Revenue: Increased by 6% to $1.47 billion year-over-year.

Net Income: Rose by 10% to $138.7 million compared to the previous year.

Diluted Earnings Per Share (EPS): Grew by 21% to $1.76.

Net Orders: Surged by 55% with a net order value increase of 58% to $1.58 billion.

Balance Sheet: Total liquidity stood at $1.75 billion, with a healthy increase in stockholders' equity to $3.88 billion.

Guidance: Anticipates housing revenues between $6.50 billion to $6.90 billion for the full year 2024.

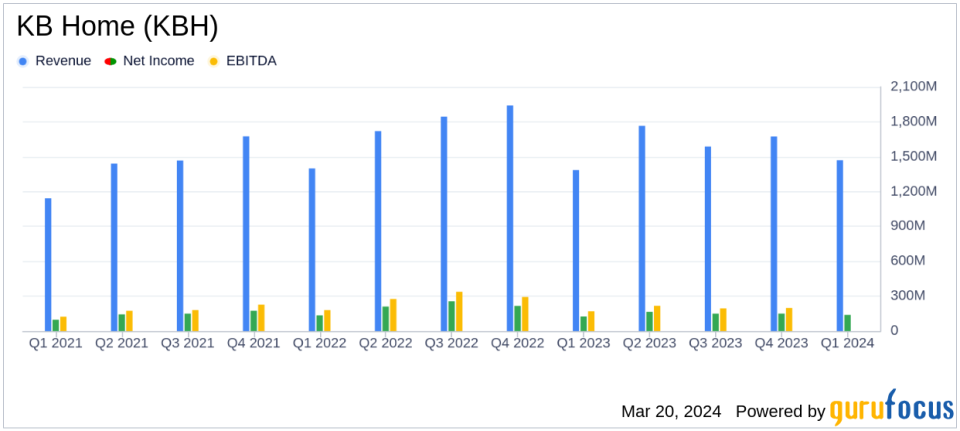

On March 20, 2024, KB Home (NYSE:KBH) released its 8-K filing, announcing its financial results for the first quarter of fiscal year 2024. The company, a prominent player in the residential construction industry in the United States, reported a 6% increase in revenues to $1.47 billion and a significant 21% increase in diluted earnings per share to $1.76. KB Home, known for its focus on building single-family homes and communities, caters to first-time and move-up homebuyers across various geographical segments, with the West Coast being a major revenue contributor.

Performance and Market Position

KB Home's performance in the first quarter reflects a robust housing market, with net orders climbing by 55% and net order value increasing by 58% to $1.58 billion. The company's Chairman and Chief Executive Officer, Jeffrey Mezger, attributed this growth to improved market conditions and a strong demand for personalized homes at attractive price points. The company's strategic investments in land acquisition and development, coupled with a focus on expanding community count, have positioned it to capitalize on the current market momentum.

Financial Achievements and Challenges

Despite facing challenges such as increased marketing and advertising costs, which led to a slight uptick in selling, general, and administrative expenses, KB Home managed to deliver a solid financial performance. The company's homebuilding operating income marginally increased to $157.7 million from $156.5 million year-over-year, while the housing gross profit margin remained steady at 21.5%. Financial services pretax income saw a significant rise to $11.6 million, primarily driven by a higher volume of loan originations through the company's mortgage banking joint venture.

KB Home's balance sheet remains robust, with total liquidity of $1.75 billion, including cash and cash equivalents and available capacity under its unsecured revolving credit facility. The company's debt to capital ratio improved both sequentially and year-over-year, reflecting its strong financial position. Notably, the company repurchased $50 million of its common stock, demonstrating its commitment to returning capital to shareholders and creating long-term value.

Outlook and Guidance

Looking ahead, KB Home provided guidance for the full year 2024, with housing revenues expected to be in the range of $6.50 billion to $6.90 billion and an average selling price between $480,000 to $490,000. The company anticipates a homebuilding operating income margin between 10.9% to 11.3%, assuming no inventory-related charges, and an effective tax rate of approximately 23.0%. With an ending community count projected to increase by 7% year over year, KB Home is poised for continued growth.

KB Home's first-quarter results underscore its ability to navigate a dynamic housing market and maintain a trajectory of growth. The company's strategic focus on personalized home offerings, sustainable building practices, and prudent financial management continues to resonate with homebuyers and investors alike, setting a positive tone for the remainder of 2024.

For more detailed information on KB Home's financial results, investors and interested parties are encouraged to visit the Investor Relations section of the company's website at kbhome.com.

Explore the complete 8-K earnings release (here) from KB Home for further details.

This article first appeared on GuruFocus.