KB Home (KBH) Up on Robust Backlog Level Amid Supply Shortage

KB Home KBH has been constantly benefiting from the robust demand for homes and a strong backlog level. Also, a favorable pricing environment due to robust housing market demand bodes well for the company.

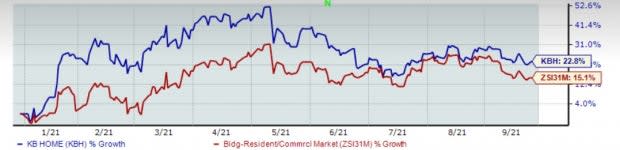

So far this year, shares of KB Home have gained 22.8% compared with the Zacks Building Products - Home Builders industry’s 15.1% rally.

However, higher land, labor and lumber costs, and supply-related limitations are likely to weigh on the bottom line.

Let’s take a look at the factors influencing this Zacks Rank #3 (Hold) company. You can see the complete list of today’s Zacks #1 Rank (Strong Buy) stocks here.

Major Growth Drivers

Strong Projection for Q4: The company reported stable third-quarter fiscal 2021 results, with a robust backlog level and a solid return-focused growth model. Backed by these factors, it has the potential of generating $1.65-$1.75 billion in housing revenues, up from $1.19 billion in the year-ago quarter. Homebuilding operating income margin (excluding the impact of any inventory-related charges) is expected to improve to 11.8% in the quarter, suggesting an increase from 10.7% a year ago. SG&A expense ratio will be approximately 10% during the fiscal fourth quarter. This suggests an improvement from 10.3% in the year-ago period.

Land-Acquisition Strategy: KB Home remains focused on land acquisition and development activities, mainly in high-end locations, which is critical for community count as well as top-line growth. During the third quarter of fiscal 2021, the company expanded its lot position to almost 81,000 lots owned or controlled, up from 60,278 lots reported in the year-ago period. KB Home has a strong land pipeline and thus expects its community count to be approximately 260 by 2022. In the first, second, and third quarter of fiscal 2021, it invested $575 million, $566 million, and $780 million, respectively, in land acquisitions and development.

Built-to-Order Approach: The company’s Built-to-Order model provides a vast range of choices to its customers, with a personalized experience through its in-house community teams. The client-focused approach helps homebuyers design a home with features and amenities of their choice.

The company’s built-to-order homes (first-time buyers represented 61% of fiscal third-quarter deliveries with the built-to-order approach) help it generate higher revenues from premiums (lots, plans, and elevations) as well as design studio and structural options. Owing to this model, even though net orders dropped 3% from the prior-year quarter to 4,085 homes during the fiscal third quarter, value of net orders rose 22% from the year-ago quarter to $2.01 billion, which in turn fueled the expansion of backlog value to $4.84 billion, reflecting a 58% year-over-year rise to roughly 10,694 units. Owing to this higher backlog, the company is confident of generating increased revenues for fiscal 2021.

Strategic Initiatives: KB Home has been focusing on driving revenues and home-building operating income margin, return on invested capital, return on equity and leverage ratio. For this, the company has been following a return-focused growth plan since 2016. The plan’s main components are executing the company’s core business strategy, improving asset efficiency and monetizing significant deferred tax assets. KB Home is now in a better position to expect meaningful growth in fiscal 2021, attributable to the increase in backlog and its ability to match housing starts to net orders. The company has returned approximately $188 million in cash to stockholders in the form of dividends and share repurchases from 2018 through third-quarter fiscal 2021. Looking ahead to 2022, KB Home expects another year of profitable growth with a sizable increase in its backlog value and community count.

Concerns

Rising labor costs are threatening margins, as they limit homebuilders’ pricing power. Labor shortages are leading to higher wages and delays in construction, which eventually affect the number of homes delivered. During the third quarter of fiscal 2021, KB Home witnessed challenges related to raw material shortages and municipal delays.

There is an ongoing pressure on the supply chain, both in materials and certain commodity categories. During the third quarter of fiscal 2021, the company witnessed supply chain challenges resulting in construction-related delays. The labor market has also tightened with limited availability of labor arresting the rapid growth in housing production.

Image Source: Zacks Investment Research

3 Robust Homebuilding Picks

A few better-ranked stocks in the same industry include M/I Homes, Inc. MHO, Meritage Homes Corporation MTH and Century Communities, Inc. CCS. M/I Homes and Meritage Homes carry a Zacks Rank #1, while Century Communities sports a Zacks Rank #2 (Buy).

M/I Homes and Meritage Homes’ 2021 earnings are expected to surge 63.3% and 72.4%, respectively.

Century Communities has a trailing four-quarter earnings surprise of 59.2%, on average.

Want the latest recommendations from Zacks Investment Research? Today, you can download 7 Best Stocks for the Next 30 Days. Click to get this free report

KB Home (KBH) : Free Stock Analysis Report

Meritage Homes Corporation (MTH) : Free Stock Analysis Report

Century Communities, Inc. (CCS) : Free Stock Analysis Report

MI Homes, Inc. (MHO) : Free Stock Analysis Report

To read this article on Zacks.com click here.

Zacks Investment Research