Can KB Home's Recent Outperformance Continue?

KB Home (NYSE:KBH) has delivered strong results for shareholders over the past three years. Over this time period, the stock has delivered a total return of around 76% compared to a total return of approximately 31.5% delivered by the S&P 500 (SPY).

This outperformance is especially impressive given the fact 30-year mortgage rates have risen from around 2.7% to 6.6% during that time period. The impact of higher rates has driven a massive slowdown in the housing market with the annual pace of existing home sales having dropped from 6.6 million to 3.8 million over the past three years. The annual rate of new home sales has fallen to 590,000 as of November 2023, down from a rate of roughly 1,000,000 three years ago.

Despite KB Home's strong run over the past three years, I believe the stock remains fairly attractive based on valuation. I believe the shares are poised to continue their recent outperformance as the company is likely to benefit from falling interest rates.

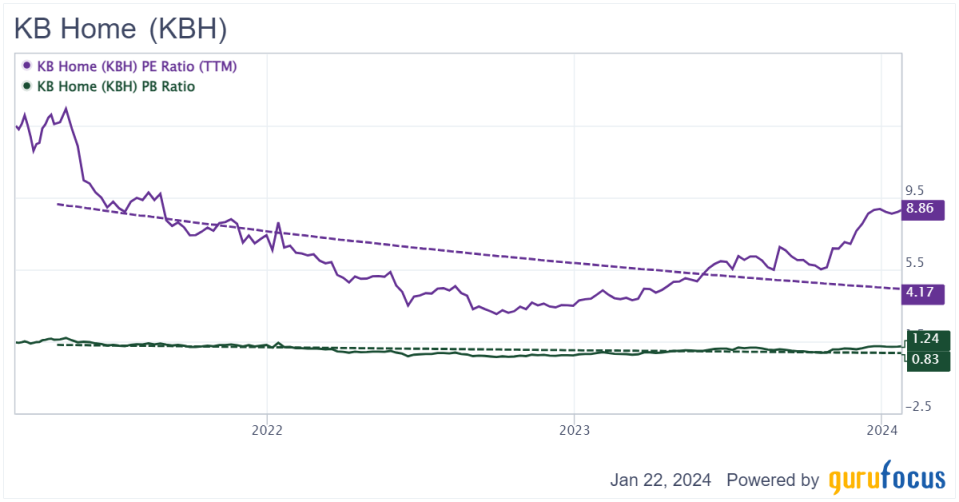

KBH Data by GuruFocus

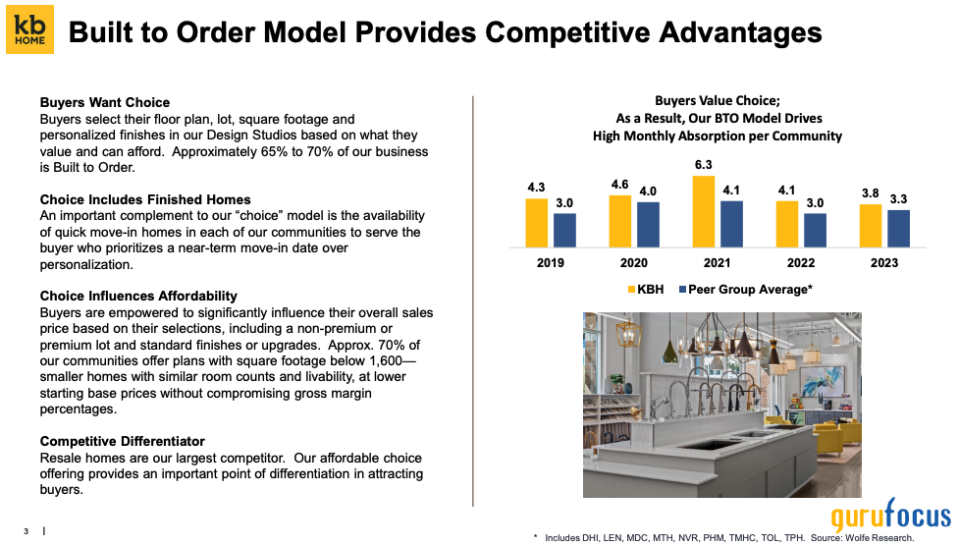

Built-to-order model is key differentiator versus peers

KB Home is one of the largest homebuilders in the U.S. with a focus on growth markets such as California, Arizona, Nevada, Colorado, Texas, Florida and North Carolina.

The company's core business strategy is to scale within each geographic area it operates in to become a top five player in each market served.

It focuses on a built-to-order home buying process, which has a number of key advantages. The process allows KB Home to reduce earnings volatility as it minimizes the number of finished but unsold homes in inventory. Additionally, higher levels of visibility allow the company to reinforce a preferred position with contractors.

This strategy has helped allow KB Home to outperform peers, as represented by the SPDR S&P Homebuilders ETF (XHB), over the past 10, five, three and one-year periods.

Strong historical financial performance

KB Home operates in a highly cyclical industry, but has been able to deliver solid growth over long periods of time. The company has grown revenue per share at a 13.2% 10-year annual growth rate and earnings per share at a 31.4% 10-year annual growth rate. Moreover, it has grown its five-year trailing earnings per share at a 39.90% growth rate.

Strong financial performance has been driven by strong operational performance as well as strong demand for new housing due to a secular housing bull market in the U.S. due to a shortage of new homes relative to population growth.

The structural supply-demand imbalance in the U.S. housing market is expected to continue for the foreseeable future, which should prove a tailwind for KB Home.

Recent decline in mortgage rates is a positive

Over the past three months, U.S. mortgage rates have fallen sharply to around 6.60% from levels above 7.70% previously. The move has been driven by lower-than-expected inflation numbers and increasing optimism that the Federal Reserve is done hiking rates and will start cutting rates later this year.

Lower mortgage rates are typically a positive for home building companies as lower rates make home buying more affordable. The one major exception to this is if rates move lower due to fears of a sharp economic contraction. However, that has not been the case as risk markets such as U.S. equities have moved sharply higher over the past few weeks. During the company's fourth-quarter earnings call, management added additional color:

"As interest rates have now declined since the end of our fiscal year, demand has improved significantly. For the first five weeks of our first quarter, our net orders are 904 as compared to 403 in the comparable period of the prior year. Our orders in December were higher than in November which is unusual given that December is typically a slower sales month. To us, this speaks to the pent-up demand for homeownership."

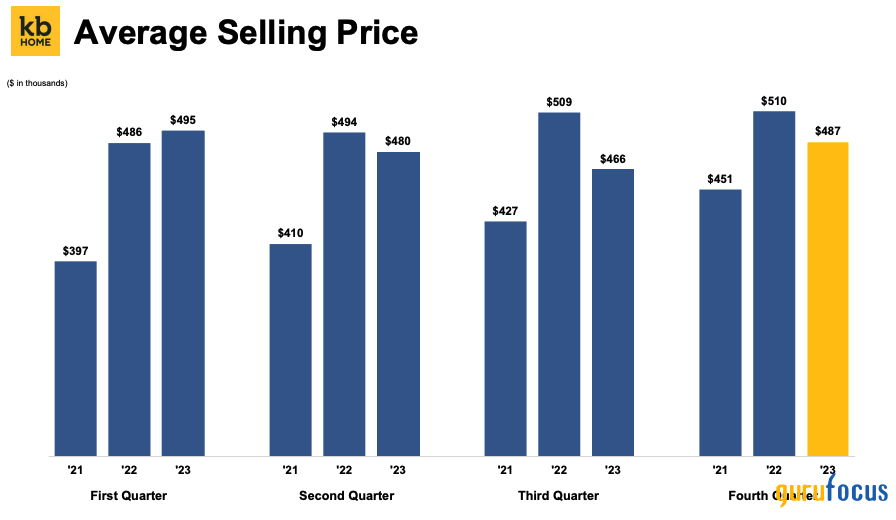

The company's average selling price during the fourth quarter was $487,300, which represents a 5% decline from $510,400 in the prior-year quarter. However, the average selling price increased 4.5%, suggesting the impact related to lower rates is already starting to be felt.

Aggressive share repurchase program

KB Home has been an aggressive buyer of its own stock over the past several years. The company has reduced its share count by 17.3% over the past three years.

During the fourthquarter, the company repurchased 3.60 million shares for a total cost of $161.80 million, implying an average price of $44.94. As of November 30, KB Home had $163.6 million remaining on its repurchase authorization. Based on a current market value of $4.80 billion, the repurchase authorization represents about 3.40% of shares outstanding.

I view the share repurchase program very favorably as it indicates the management team believes shares are undervalued.

Valuation remains attractive

KB Home trades at 8 times fiscal 2024 consensus earnings, 6.40 times consensus 2025 earnings and 6.80 times consensus 2026 earnings. Comparably, the S&P 500 is trading at 21.50 times estimated 2024 earnings. Thus, KB Home is trading at a significantly cheaper valuation.

I view the company's relative valuation as particularly attractive given its strong earnings per share growth rates over the past decade, including a 31.40% 10-year earnings per share CAGR.

If interest rates fall further from here, as I believe they will, KB Home is poised to generate earnings per share that are much higher than current estimates.

KB Home is trading broadly inline with its peer group and the entire sector is trailing at a fairly similar valuation.

Additionally, KB Home is trading at an attractive valuation relative to its own historical norm. Currently, the stock trades at just 1.20 times book value compared to a historical average of 1.65 times. The forward price-earnings ratio of 8 represents a modest discount to the company's average price-earnings ratio of 11.90 over the past decade.

KBH Data by GuruFocus

What could go wrong for the bull case

The biggest risk facing KB Home is a major economic downturn which results in a further slowdown in the housing market and a further drop in prices. While I do not expect a major economic downturn in the near term, it is a risk that investors should be aware of and monitor closely.

On the flip side, another risk that investors should be aware of is a resurgence in inflation and mortgage rates. I view this as fairly unlikely given the trajectory of recent inflation data. However, I would note the company has been able to navigate rising inflation and rates over the past few years, so I think it is possible that it does so again in a higher interest rate environment.

Conclusion

KB Home has outperformed the broader equity market over the past three years despite a significant increase in mortgage rates, which has weighed on the housing market. The company is poised to benefit from the recent drop in interest rates as well as a structural shortage of housing in the U.S.

Despite the recent rally, the stock trades at just 8 times estimated 2024 earnings per share. I find this valuation highly attractive versus the broader market given KB Home's history of delivering solid earnings growth over the long run and favorable hosuing markey dynamics. Moreover, the stock trades at just 1.20 times book value, which is fairly attractive relative to historical norms.

I view the company's aggressive share repurchase program as an important positive, suggesting management views the stock as undervalued.

Consensus estimates currently call for modest levels of earnings growth in 2024 compared to 2023. However, I believe the company is poised to post much better than expected earnings if interest rates fall further from here, thereby catalyzing a stronger housing market.

On the flip side, even if interest rates do not fall from here, I believe KBH is still capable of delivering very strong performance given the structural shortage of housing in the U.S. and the company's built-to-order strategy, which reduces earnings volatility.

For these reasons, I view KB Home as undervalued and an attractive investment opportunity at current levels.

This article first appeared on GuruFocus.