KBR Inc (KBR) Reports Solid Fiscal 2023 Results and Provides Optimistic 2024 Outlook

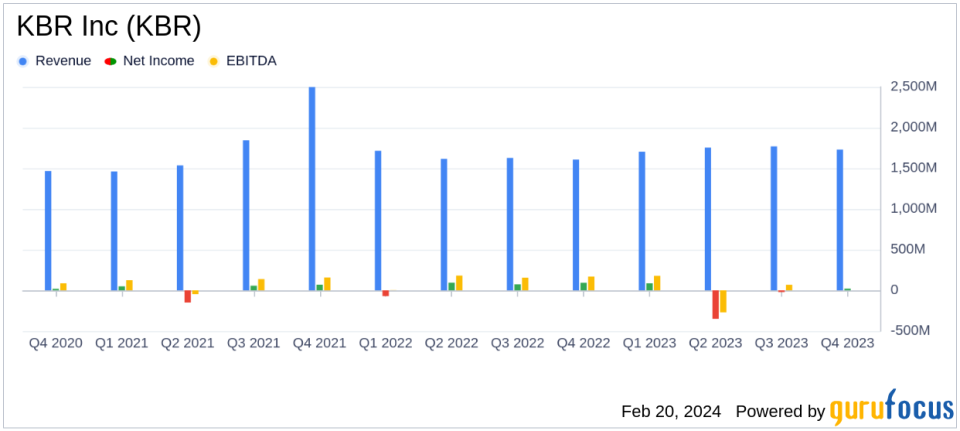

Revenue Growth: KBR Inc (NYSE:KBR) reported an organic revenue increase of 6% year-over-year, reaching $7.0 billion for fiscal 2023.

Adjusted EBITDA: The company achieved $747 million in Adjusted EBITDA, representing a 10.7% margin and a 12% increase from the previous year.

Net Income: KBR Inc (NYSE:KBR) recorded a net loss attributable to KBR of $(265) million for fiscal 2023, primarily due to non-cash charges related to convertible notes settlement.

Adjusted EPS: Adjusted earnings per share remained stable at $2.91, reflecting the company's core earnings performance.

Backlog Increase: The company's backlog and options grew by 10% to $21.7 billion, indicating a strong pipeline for future revenue.

Dividend Growth: KBR announced an 11% increase in its annual dividend, marking the fifth consecutive year of dividend increases.

Fiscal 2024 Guidance: KBR provided optimistic guidance for fiscal 2024, with revenue projected between $7.4 billion and $7.7 billion, and Adjusted EBITDA between $810 million and $850 million.

KBR Inc (NYSE:KBR) released its 8-K filing on February 20, 2024, detailing its financial results for the fourth quarter and fiscal year 2023. The company, a global provider of technology, engineering, procurement, and construction services, operates in more than 75 countries and employs approximately 34,000 people. KBR's business is segmented into government solutions and sustainable technology solutions, with a strong focus on safety, financial metrics, and backlog growth.

Fiscal Summary and Performance Insights

KBR's fiscal 2023 was marked by significant achievements, including an 8% organic revenue increase in the fourth quarter compared to the previous year, reaching $1.7 billion. The company's government solutions and sustainable technology solutions segments both delivered strong book-to-bill ratios, indicating healthy demand for KBR's services. Despite a net loss attributable to KBR, which was primarily due to non-cash charges related to the settlement of convertible notes, the company's adjusted EBITDA increased by 20% in the fourth quarter, reflecting robust operational performance.

President and CEO Stuart Bradie commented on the company's ability to deliver results while maintaining a strong commitment to safety and well-being. KBR's focus on innovation and sustainability, particularly in the military and energy sectors, has positioned it as a leader in its industry.

"The KBR team has shown their unwavering commitment and exceptional skills, leading to a remarkable performance this fiscal year," said Stuart Bradie, KBR president and CEO. "We achieved an industry leading safety record, met or exceeded our key financial metrics and delivered a 10% increase in backlog and options in 2023, a testament to our Team of Teams' ability to deliver results while ensuring the well-being of all involved."

Financial Achievements and Challenges

KBR's financial achievements in fiscal 2023 underscore the company's resilience and strategic focus. The settlement of convertible notes and related warrants in cash, avoiding dilution, and the extension of the maturity of term loans and revolving credit facilities, have strengthened KBR's balance sheet. The company's increased annual dividend and replenished share repurchase authorization to $500 million reflect confidence in its financial health and commitment to shareholder returns.

However, the reported net loss attributable to KBR, driven by non-cash charges, highlights the challenges associated with financial instruments and legacy legal matters. While these charges have impacted the bottom line, the company's adjusted financial metrics, which exclude these non-recurring charges, provide a clearer picture of KBR's underlying performance.

Looking Ahead: Fiscal 2024 Guidance

For fiscal 2024, KBR anticipates continued revenue growth, with projections between $7.4 billion and $7.7 billion. The company expects adjusted EBITDA to range from $810 million to $850 million, and adjusted earnings per share between $3.10 and $3.30. Operating cash flows are forecasted to be between $450 million and $480 million. This guidance reflects KBR's positive outlook and strategic initiatives aimed at driving growth and enhancing value for stakeholders.

KBR's solid fiscal 2023 performance and optimistic outlook for 2024 make it a company to watch for value investors and those interested in the construction and engineering sector. With a strong backlog, commitment to innovation, and strategic financial management, KBR is well-positioned for continued success.

For more detailed financial information and analysis, investors and interested parties are encouraged to visit the Investor Relations section of KBRs website at investors.kbr.com.

Explore the complete 8-K earnings release (here) from KBR Inc for further details.

This article first appeared on GuruFocus.