KBR Q2 Earnings Beat Estimates, Revenues Miss, EBITDA View Up

KBR, Inc. KBR reported mixed second-quarter 2023 results, wherein earnings surpassed the Zacks Consensus Estimate but revenues missed the same. Earnings beat the consensus estimate for the seventh straight quarter. Revenues, on the other hand, surpassed the mark in three of the trailing seven quarters and missed on other four occasions.

Shares of the company declined 2.9% during the trading session and 1.2% in the after-hour trading session on Jul 27.

Although KBR’s quarterly earnings were impacted by losses related to convertible notes and a legacy legal matter, the company delivered a strong quarter of financial and environmental, social and governance or ESG performance, underpinned by its mission focus and operational discipline.

Furthermore, driven by robust performance in its core business, KBR raised its adjusted EBITDA guidance for 2023.

Inside the Headline Numbers

Adjusted earnings per share (EPS) of 74 cents surpassed the consensus estimate of 70 cents by 5.7% but decreased 2.6% from a year ago. The downside was due to losses in the second quarter associated with its convertible notes and the settlement of a legacy legal matter.

Total revenues inched up 8.5% year over year to $1.75 billion but missed the consensus mark of $1.76 billion by 0.3%. Revenues increased by 11%, excluding Operation Allies Welcome (“OAW”). The increase in performance was primarily driven by increased engagement in European Command activities, including exercises, training, and other initiatives. Additionally, there was notable growth in Science & Space and Defense on-contract projects, as well as rising demand for Sustainable Technology Solutions, particularly in engineering and professional services and technology licensing.

Adjusted EBITDA increased 3% year over year to $191 million in the quarter. Adjusted EBITDA margin (excluding gains) was up to 11% from 10% a year ago. Our model expected adjusted EBITDA to decline 6.5% year over year to $173.9 million in the quarter.

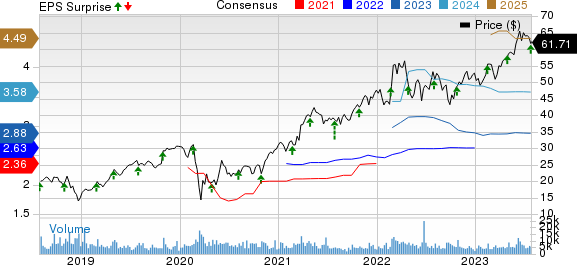

KBR, Inc. Price, Consensus and EPS Surprise

KBR, Inc. price-consensus-eps-surprise-chart | KBR, Inc. Quote

Segmental & Backlog Details

Revenues in the Government Solutions or GS segment increased 3.1% year over year to $1,352 million. Revenues were up 6%, excluding OAW. The upside was backed by increased activity in Readiness & Sustainment, Defense and Science & Space. Our model predicted the segment revenues to grow 5.6% to $1,385.9 million in the quarter.

Adjusted EBITDA (excluding OAW) increased to $143 million from $137 million, and adjusted EBITDA margin of 11% improved from 10% a year ago. The segment benefited from the favorable international mix, excellent award fees and strong project execution.

Sustainable Technology Solutions' (STS) revenues rose 31.9% year over year to $401 million, driven by increased sustainable services and technology. Meanwhile, the segment generated revenues more than we expected. Our model predicted the segment revenues to grow 19.7% to $364 million in the quarter.

Adjusted EBITDA increased to $80 million from $55 million a year ago. Adjusted EBITDA margin for the segment was up 20 basis points to 20%. This was attributable to a favorable revenue mix, the achievement of certain licensing milestones, joint venture performance and increased demand.

As of Jun 30, 2023, the total backlog (including award options) was $21.06 billion compared with $19.76 billion at 2022-end. Of the total backlog, Government Solutions booked $11.82 billion. The Sustainable Technology Solutions segment accounted for $5.06 billion of the total backlog.

At the second-quarter end, the company delivered trailing-12-months book-to-bill of 1.1x and recorded $2.2 billion in bookings and options.

Liquidity & Cash Flow

As of Jun 30, 2023, KBR’s cash and cash equivalents were $539 million, up from $389 million at 2022-end. Long-term debt was $1.63 million at June 2023-end, up from $1.38 million at 2022-end.

In the first six months of 2023, cash provided by operating activities totaled $288 million, up from $214 million in the year-ago period. It had an adjusted free cash flow of $234 million, up from $112 million a year ago.

2023 Guidance

KBR expects total revenues in the range of $6.9-$7.1 billion and an adjusted EBITDA between $730 and $750 million (versus $715 and $745 million of the prior expectation). Also, it expects an effective tax rate between 24% and 25% and adjusted EPS in the band of $2.76-$2.96. Adjusted operating cash flow is projected in the range of $425-$460 million.

Zacks Rank

KBR currently carries a Zacks Rank #4 (Sell).

You can see the complete list of today’s Zacks #1 Rank (Strong Buy) stocks here.

Recent Construction Releases

Masco Corporation MAS reported strong earnings for second-quarter 2023. The bottom line surpassed the Zacks Consensus Estimate and increased from the prior year. Strong pricing actions and operational efficiency helped it deliver solid results.

Masco’s quarterly net sales topped the consensus mark but declined on a year-over-year basis. The benefits received from pricing actions were more than offset by lower volumes.

Otis Worldwide Corporation’s OTIS second-quarter 2023 earnings and sales surpassed the Zacks Consensus Estimate. Its quarterly results reflected 11th consecutive quarters of organic sales growth and solid operating margin expansion contributing to mid-single digit adjusted EPS growth.

The company remains focused on strong portfolio growth and generating a solid New Equipment backlog. It also intends to expand operating margins, return cash to shareholders through a capital-allocation strategy and pursue additional progress toward ESG goals.

Armstrong World Industries, Inc. AWI reported mixed results for second-quarter 2023, wherein earnings surpassed the Zacks Consensus Estimate, but net sales missed the same. Both metrics increased on a year-over-year basis.

AWI’s results were backed by robust growth in operating income and adjusted EBITDA, as well as expanded margins, fueled by positive performances from both the Mineral Fiber and Architectural Specialties segments. The company remain focused on advancing digital and healthy spaces initiatives and pursuing attractive, bolt-on acquisitions.

Want the latest recommendations from Zacks Investment Research? Today, you can download 7 Best Stocks for the Next 30 Days. Click to get this free report

Masco Corporation (MAS) : Free Stock Analysis Report

KBR, Inc. (KBR) : Free Stock Analysis Report

Armstrong World Industries, Inc. (AWI) : Free Stock Analysis Report

Otis Worldwide Corporation (OTIS) : Free Stock Analysis Report