KBR Q3 Earnings Beat Estimates, Revenues Miss, Stock Down

KBR, Inc. KBR reported mixed third-quarter 2023 results, wherein earnings surpassed the Zacks Consensus Estimate but revenues missed the same.

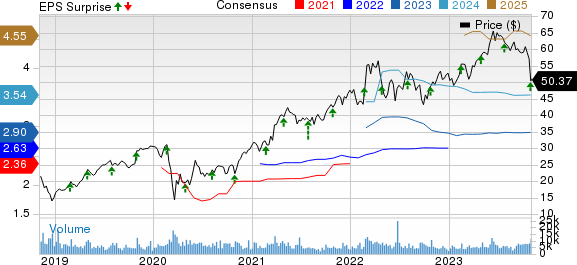

Earnings beat the consensus estimate for the eighth straight quarter. Revenues, on the other hand, surpassed the mark in three of the trailing eight quarters and missed on other five occasions.

Shares of the company declined 13.6% during the trading session on Nov 2.

KBR, Inc. Price, Consensus and EPS Surprise

KBR, Inc. price-consensus-eps-surprise-chart | KBR, Inc. Quote

Inside the Headline Numbers

Adjusted earnings per share (EPS) of 75 cents surpassed the consensus estimate of 73 cents by 2.7% and increased 15.4% from a year ago. The upside was due to increases in gross profit and equity in earnings from unconsolidated affiliates. These were partially offset by increases in selling, general and administrative expenses and interest expenses.

Total revenues inched up 8.9% year over year (all organic) to $1.77 billion but missed the consensus mark of $1.78 billion by 0.5%. The growth was attributable to the increase in new contracts and on-contract growth within all Government Solutions business units, as well as a rising demand for the Sustainable Technology Solutions portfolio.

Adjusted EBITDA increased 9% year over year to $186 million in the quarter. Adjusted EBITDA margin was 11%, the same as the year-ago level. Our model expected adjusted EBITDA to grow 7.3% year over year to $183.5 million in the quarter.

Segmental & Backlog Details

Revenues in the Government Solutions or GS segment increased 4% year over year to $1,345 million. The upside was backed by new and on-contract growth across its four business units. Our model predicted the segment revenues to grow 7.8% to $1,393.3 million in the quarter.

Adjusted EBITDA was $133 million (same as the prior-year quarter), and adjusted EBITDA margin of 10% (at par with the year-ago level). The segment benefited from the favorable international mix, excellent award fees and strong project execution.

Sustainable Technology Solutions' (STS) revenues rose 27.6% year over year to $425 million, driven by increased sustainable services and technology. Meanwhile, the segment generated more revenues than we expected. Our model predicted the segment revenues to grow 16.8% to $388.8 million in the quarter.

Adjusted EBITDA increased to $89 million from $66 million a year ago. Adjusted EBITDA margin for the segment was up 100 basis points to 21%. This was attributable to a favorable revenue mix, the achievement of certain licensing milestones, joint venture performance and increased demand.

As of Sep 29, 2023, the total backlog (including award options) was $21.8 billion compared with $19.76 billion at 2022-end. Of the total backlog, Government Solutions booked $12.28 billion. The Sustainable Technology Solutions segment accounted for $4.98 billion of the total backlog.

At the third-quarter end, the company delivered a trailing 12-month book-to-bill of 1.2x and recorded $3.5 billion in bookings and options.

Liquidity & Cash Flow

As of Sep 29, 2023, KBR’s cash and cash equivalents were $348 million, down from $389 million at 2022-end. Long-term debt was $1.52 million at September 2023-end, up from $1.38 million at 2022-end.

In the first nine months of 2023, cash provided by operating activities totaled $248 million, down from $336 million in the year-ago period. It had an adjusted free cash flow of $320 million during the same period, up from $297 million a year ago.

2023 Guidance

KBR still expects total revenues in the range of $6.9-$7.1 billion and an adjusted EBITDA between $730 and $750 million. Also, it expects an effective tax rate between 24% and 25% and adjusted EPS in the band of $2.76-$2.96. Adjusted operating cash flow is projected to be in the range of $425-$460 million.

Zacks Rank

KBR currently carries a Zacks Rank #2 (Buy). You can see the complete list of today’s Zacks #1 Rank (Strong Buy) stocks here.

Recent Construction Releases

Vulcan Materials Company VMC reported stellar results for the third quarter of 2023, surpassing the Zacks Consensus Estimate for both earnings and revenues.

VMC’s adjusted EPS of $2.29 increased 28.7% from the year-ago level of $1.78. Total revenues of $2,185.8 million increased 4.7% year over year.

Otis Worldwide Corporation OTIS reported impressive results in third-quarter 2023. Its earnings and net sales surpassed the Zacks Consensus Estimate and rose on a year-over-year basis. Its quarterly results reflected 12 consecutive quarters of organic sales growth and solid operating margin expansion, contributing to high-teens adjusted EPS growth.

OTIS reported quarterly EPS of 95 cents, increasing 18.8% from the year-ago quarter’s figure of 80 cents. Net sales of $3.52 billion rose 5.4% on a year-over-year basis.

United Rentals, Inc.’s URI third-quarter 2023 earnings and revenues surpassed the Zacks Consensus Estimate. On a year-over-year basis, earnings and revenues increased courtesy of sustained growth across the business, profitability and returns, underpinned by broad-based activity.

URI’s adjusted EPS of $11.73 increased 26.5% from the prior-year figure of $9.27. Total revenues of $3.77 billion grew 23.4% year over year.

Want the latest recommendations from Zacks Investment Research? Today, you can download 7 Best Stocks for the Next 30 Days. Click to get this free report

Vulcan Materials Company (VMC) : Free Stock Analysis Report

KBR, Inc. (KBR) : Free Stock Analysis Report

United Rentals, Inc. (URI) : Free Stock Analysis Report

Otis Worldwide Corporation (OTIS) : Free Stock Analysis Report