KBR Reaches 52-Week High: What's Aiding the Stock's Growth?

KBR, Inc. KBR touched a new 52-week high of $65.76 on Jul 3. The stock pulled back to end the trading session at $65.68, up 1% from the previous day’s closing price of $65.06.

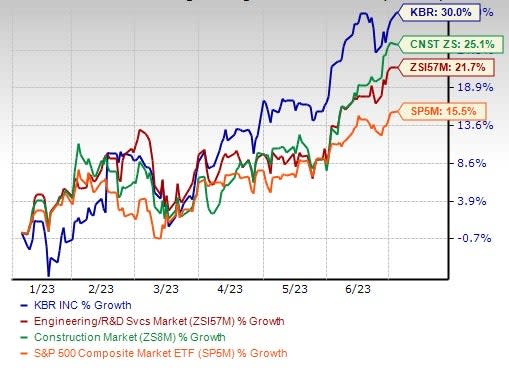

KBR has gained 30% in the past six months compared with the Zacks Engineering - R and D Services industry’s 21.7% growth, the Zacks Construction sector’s increase of 25.1% and the S&P 500 Index’s growth of 15.5%.

Despite the ongoing uncertainties in the global market, KBR is benefiting from consistent contract wins that are boosting its backlog and solid performance of the Government Solutions (GS) segment.

Image Source: Zacks Investment Research

On Jul 3, the company settled a decade-old legacy lawsuit concerning the cross-leveling of materials and equipment procurement as well as inventory management under the LOGCAP III contract in Iraq, between the years 2007 and 2011. This settlement has most likely contributed to inducing bullish sentiments among the investors, resulting in the company’s share price to touch a 52-week high.

Let’s delve deeper into the factors favoring this Zacks Rank #3 (Hold) company.

Factors Driving KBR’s Growth

Impressive Q1 Results: KBR reported strong results in first-quarter 2023, wherein earnings and revenues surpassed the Zacks Consensus Estimate by 15.5% and 4.9%, respectively. The top and the bottom lines grew year over year by 0.6% and 8.1%, respectively. Both metrics gained on strong underlying growth and margin expansion as well as excellent bookings in the reported quarter.

Solid Backlog Level: KBR’s ongoing contract wins enables it to gain growth momentum in the long run. The company’s determination to lower emissions, product diversification, energy efficiency and more sustainable technologies and solutions have been driving growth. As of Mar 31, 2023, the backlog and option level of KBR was $20.9 billion, compared with $19.8 billion at 2021-end. Also, it received $3.1 billion in bookings and options in highly strategic areas with a trailing 12-month book-to-bill of 1.4x.

Strong GS Segment Performance: The GS business of KBR has been banking on contract growth in logistics and engineering and take-away wins, alongside new work awarded under the company’s portfolio of well-positioned contracting vehicles. Strength in its overseas logistics and mission support programs on the back of higher military exercise activities, increased outsourcing of sustainment activities by the military and the ramp up of new wins enables growth.

As of Mar 31, 2023, nearly 71% of the backlog represents work in GS. The upside was attributable to favorable defense, space and military budgets, which resulted in increased demand for its GS services. Further, the company expects growth across all its key markets in the United States, the UK and Australia, driven by continued opportunities across the lifecycle of projects.

Key Picks

Some better-ranked stocks from the same sector are Eagle Materials Inc. EXP, Dycom Industries, Inc. DY and Vulcan Materials Company VMC.

Eagle Materials currently sports a Zacks Rank #1 (Strong Buy). You can see the complete list of today’s Zacks #1 Rank stocks here.

EXP delivered a trailing four-quarter earnings surprise of 6.5%, on average. Shares of the company have rallied 39.7% in the year-to-date period. The Zacks Consensus Estimate for EXP’s fiscal 2024 sales and earnings per share (EPS) indicates growth of 2% and 8.4%, respectively, from the previous year’s reported levels.

Dycom currently sports a Zacks Rank of 1. DY delivered a trailing four-quarter earnings surprise of 153.7%, on average. Shares of the company have risen 20.6% in the year-to-date period.

The Zacks Consensus Estimate for DY’s fiscal 2024 sales and EPS indicates growth of 8.3% and 41%, respectively, from the previous year’s reported levels.

Vulcan Materials currently carries a Zacks Rank #2 (Buy). VMC has a trailing four-quarter earnings surprise of 7.1%, on average. Shares of the company have gained 27.6% in the year-to-date period.

The Zacks Consensus Estimate for VMC’s 2023 sales and EPS indicates growth of 5.9% and 26.2%, respectively, from the previous year’s reported levels.

Want the latest recommendations from Zacks Investment Research? Today, you can download 7 Best Stocks for the Next 30 Days. Click to get this free report

Vulcan Materials Company (VMC) : Free Stock Analysis Report

KBR, Inc. (KBR) : Free Stock Analysis Report

Eagle Materials Inc (EXP) : Free Stock Analysis Report

Dycom Industries, Inc. (DY) : Free Stock Analysis Report