Kearny Financial Corp (KRNY) Faces Net Loss in Q2 Fiscal 2024 Amid Strategic Repositioning

Net Loss: Reported a net loss of $9.0 million, or $0.14 per diluted share for the quarter ended December 31, 2023.

Dividend: Declared a quarterly cash dividend of $0.11 per share, payable on February 21, 2024.

Balance Sheet: Total assets decreased by 0.9% to $7.90 billion, while loans receivable saw a slight increase.

Strategic Actions: Executed sale of investment securities and BOLI restructuring, and resolved non-performing assets.

Asset Quality: Non-performing assets decreased slightly to 0.63% of total assets.

Capital Ratios: Tangible equity to tangible assets ratio stood at 8.32%, with the company maintaining "well-capitalized" status.

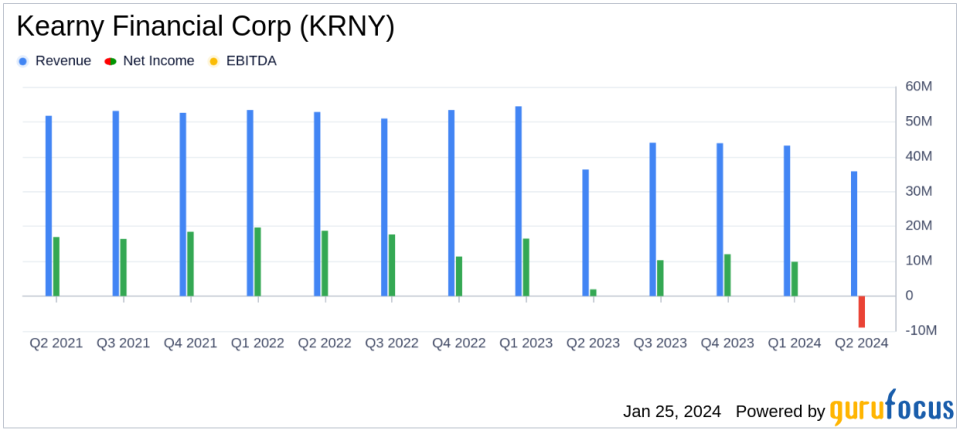

On January 25, 2024, Kearny Financial Corp (NASDAQ:KRNY) released its 8-K filing, detailing the financial results for the second quarter of fiscal year 2024. The federally-chartered stock savings bank, which operates primarily in New Jersey and New York, reported a net loss for the quarter ended December 31, 2023. This performance contrasts with the net income of $9.8 million, or $0.16 per diluted share, for the previous quarter. The company attributes the loss to several non-recurring items, indicating a period of strategic repositioning.

Kearny Financial Corp's primary business involves attracting deposits and using these funds to originate or purchase loans for its portfolios and invest in securities. The bank's loan portfolio is primarily composed of commercial and residential real estate loans, as well as secured and unsecured business and consumer loans. Net interest income is the bank's main revenue source.

Performance and Strategic Initiatives

The bank's net interest margin contracted by 16 basis points to 1.94%, driven by an increase in the cost of interest-bearing liabilities and a decrease in the average balance of interest-earning assets. Net interest income decreased by $3.3 million to $35.8 million from the previous quarter. Non-interest income turned into a loss of $11.2 million, primarily due to a pre-tax loss of $18.1 million related to the repositioning of the investment securities portfolio.

During the quarter, Kearny Financial Corp undertook several strategic actions to enhance its balance sheet, liquidity position, and risk profile. These included the sale of $122.2 million of available-for-sale debt securities, a restructuring of its bank-owned life insurance (BOLI) portfolio, and the resolution of non-performing assets, including the sale of a significant Other Real Estate Owned (OREO) asset.

President and CEO Craig L. Montanaro commented on the quarter's activities, stating:

"This quarter we executed strategies to enhance our balance sheet, liquidity position, risk profile and asset quality metrics. In addition, we have begun to see deposit pressures ease, while run-rate non-interest expense remains very well controlled. As we look ahead, we remain laser-focused on sustainable growth in core loan and deposit relationships, while continuing to further leverage our recently implemented, best-in-class, digital banking platform."

Financial Highlights and Challenges

The bank's balance sheet saw a slight decrease in total assets, with investment securities and BOLI experiencing reductions due to the strategic actions taken. Loans receivable showed a modest increase, and deposits decreased, excluding a drop in brokered certificates of deposits. The company's asset quality improved marginally, with a small decrease in non-performing assets to 0.63% of total assets.

Despite the net loss, Kearny Financial Corp maintained its quarterly cash dividend, reflecting confidence in its financial position and commitment to shareholder returns. The company's capital ratios remained strong, with tangible equity to tangible assets at 8.32%, and regulatory capital ratios exceeding the levels required to be classified as "well-capitalized."

The bank's performance this quarter reflects the challenges of repositioning its portfolio in a changing economic environment. However, the maintenance of the dividend and the strategic initiatives undertaken suggest a focus on long-term stability and growth. For value investors, the bank's efforts to enhance its risk profile and asset quality metrics could signal a prudent approach to navigating current market conditions.

For a more detailed analysis of Kearny Financial Corp's financial results, readers are encouraged to review the full earnings release and supplemental materials available on the company's website and the SEC's website.

Explore the complete 8-K earnings release (here) from Kearny Financial Corp for further details.

This article first appeared on GuruFocus.