Keeley-Teton Advisors, LLC: Q2 2023 13F Filing Analysis

Keeley-Teton Advisors, LLC (Trades, Portfolio), a firm renowned for its pioneering approach in small, mid, and micro-cap active value investing, recently submitted their 13F report for Q2 2023. The firm's investment strategy is rooted in disciplined bottom-up, fundamental analysis, seeking out inefficiently priced equities. This approach has been a cornerstone of both Teton Advisors, Inc. and Keeley Teton Advisors, LLC, especially since their transformative merger in March 2017. The combined entity has since evolved into a scalable investment firm with a robust portfolio.

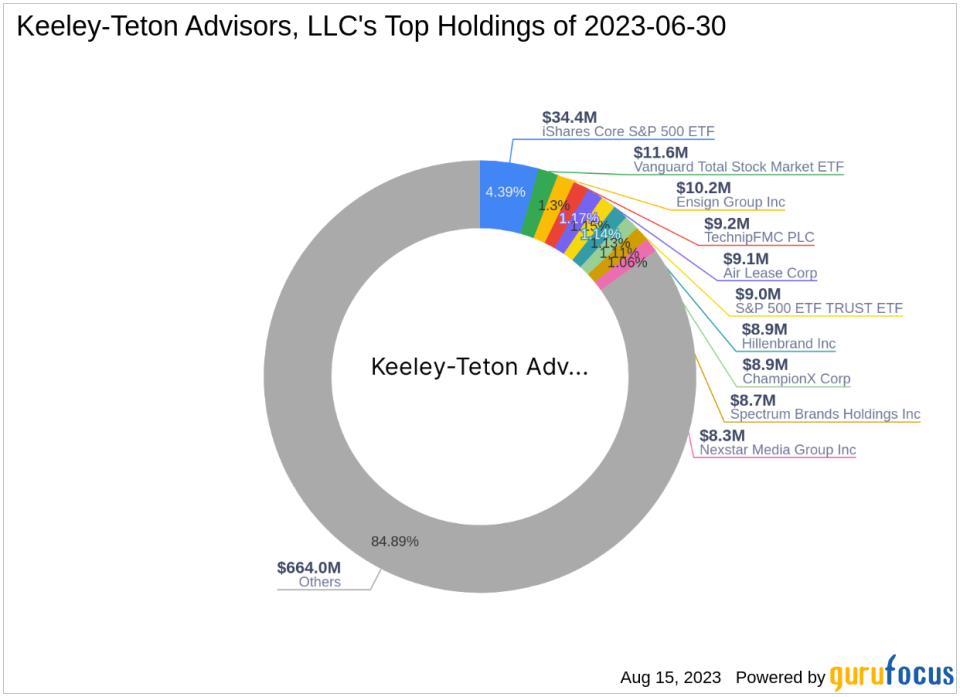

Overview of Keeley-Teton Advisors' Q2 2023 Portfolio

As of June 30, 2023, the firm's portfolio comprised 351 stocks with a total value of $782 million. The top holdings included IVV (4.39%), VTI (1.48%), and ENSG (1.30%).

Top Three Trades of Q2 2023

The firm's top three trades for the quarter involved Crane NXT Co (NYSE:CXT), Southwest Gas Holdings Inc (NYSE:SWX), and Zurn Elkay Water Solutions Corp (NYSE:ZWS).

Crane NXT Co (NYSE:CXT)

Keeley-Teton Advisors, LLC (Trades, Portfolio) purchased 87,693 shares of Crane NXT Co (NYSE:CXT), bringing their total holding to 96,932 shares. This trade had a 0.63% impact on the equity portfolio. The stock traded at an average price of $51.76 during the quarter. As of August 15, 2023, Crane NXT Co (NYSE:CXT) had a market cap of $3.45 billion and a stock price of $60.68. The company has a financial strength rating of 6/10 and a profitability rating of 5/10. Its valuation ratios include a P/E ratio of 18.62, a P/B ratio of 4.03, an EV-to-Ebitda ratio of 9.24, and a P/S ratio of 1.20.

Southwest Gas Holdings Inc (NYSE:SWX)

The firm established a new position in Southwest Gas Holdings Inc (NYSE:SWX), purchasing 65,213 shares. This gave the stock a 0.53% weight in the equity portfolio. The shares traded at an average price of $59.19 during the quarter. As of August 15, 2023, Southwest Gas Holdings Inc (NYSE:SWX) had a market cap of $4.59 billion and a stock price of $64.22. The company has a financial strength rating of 4/10 and a profitability rating of 6/10. Its valuation ratios include a P/B ratio of 1.41, an EV-to-Ebitda ratio of 20.39, and a P/S ratio of 0.80.

Zurn Elkay Water Solutions Corp (NYSE:ZWS)

Keeley-Teton Advisors, LLC (Trades, Portfolio) also established a new position in Zurn Elkay Water Solutions Corp (NYSE:ZWS), purchasing 143,346 shares. This gave the stock a 0.49% weight in the equity portfolio. The shares traded at an average price of $22.75 during the quarter. As of August 15, 2023, Zurn Elkay Water Solutions Corp (NYSE:ZWS) had a market cap of $5.07 billion and a stock price of $29.3252. The company has a financial strength rating of 6/10 and a profitability rating of 7/10. Its valuation ratios include a P/E ratio of 97.75, a P/B ratio of 3.19, an EV-to-Ebitda ratio of 27.98, and a P/S ratio of 3.37.

In conclusion, Keeley-Teton Advisors, LLC (Trades, Portfolio)'s Q2 2023 13F filing reveals a strategic focus on value investing, with significant trades in Crane NXT Co, Southwest Gas Holdings Inc, and Zurn Elkay Water Solutions Corp. The firm's disciplined approach to identifying inefficiently priced equities continues to shape its investment decisions.

This article first appeared on GuruFocus.