KELLOGG W K FOUNDATION TRUST Adjusts Stake in Kellanova Co

On November 9, 2023, KELLOGG W K FOUNDATION TRUST (Trades, Portfolio) reported a reduction in its holdings of Kellanova Co (NYSE:K), a significant player in the global packaged foods industry. The firm sold 77,800 shares at a price of $51.87 each, adjusting its total share count to 53,631,638. This trade has led to a slight portfolio impact of -0.13%, with Kellanova Co now representing 86.64% of the firm's holdings and 15.66% of the traded stock's available shares.

Insight into KELLOGG W K FOUNDATION TRUST (Trades, Portfolio)

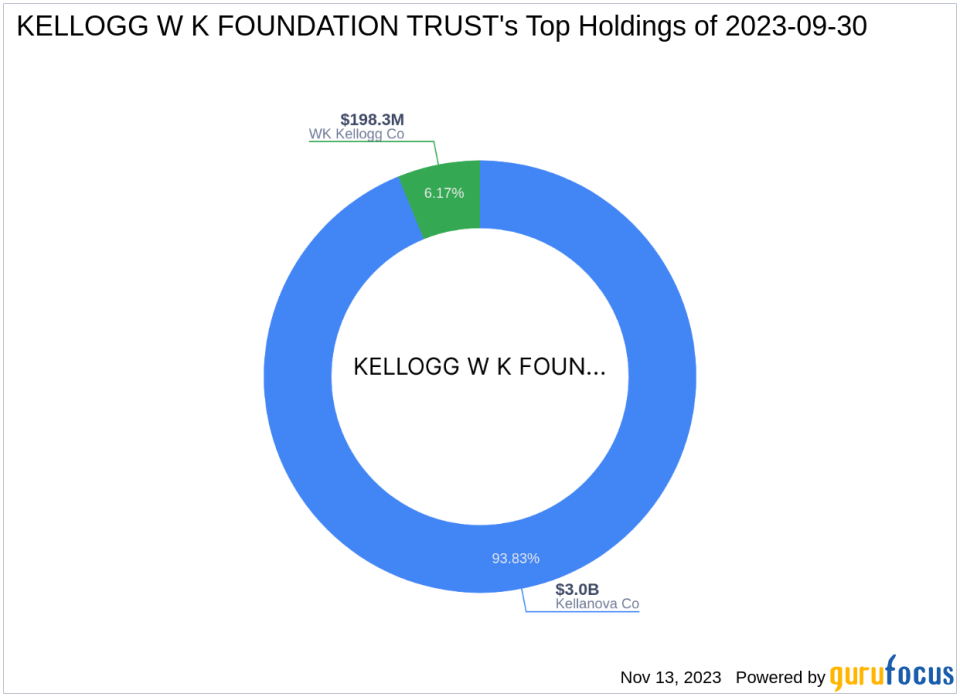

The W. K. Kellogg Foundation Trust, a prominent nonprofit charity organization, has a rich history dating back to its establishment by Will Keith Kellogg. With a focus on supporting vulnerable children and communities, the trust has grown into one of the largest philanthropic foundations in the United States. The firm's investment strategy is heavily weighted towards the consumer staples sector, with a significant portion of its assets in the Kellogg Company and a minor allocation in the iShares S&P 100 Index Fund. Currently, the trust's equity stands at $3.22 billion, with Kellanova Co and WK Kellogg Co (NYSE:KLG) as its top holdings.

Overview of Kellanova Co

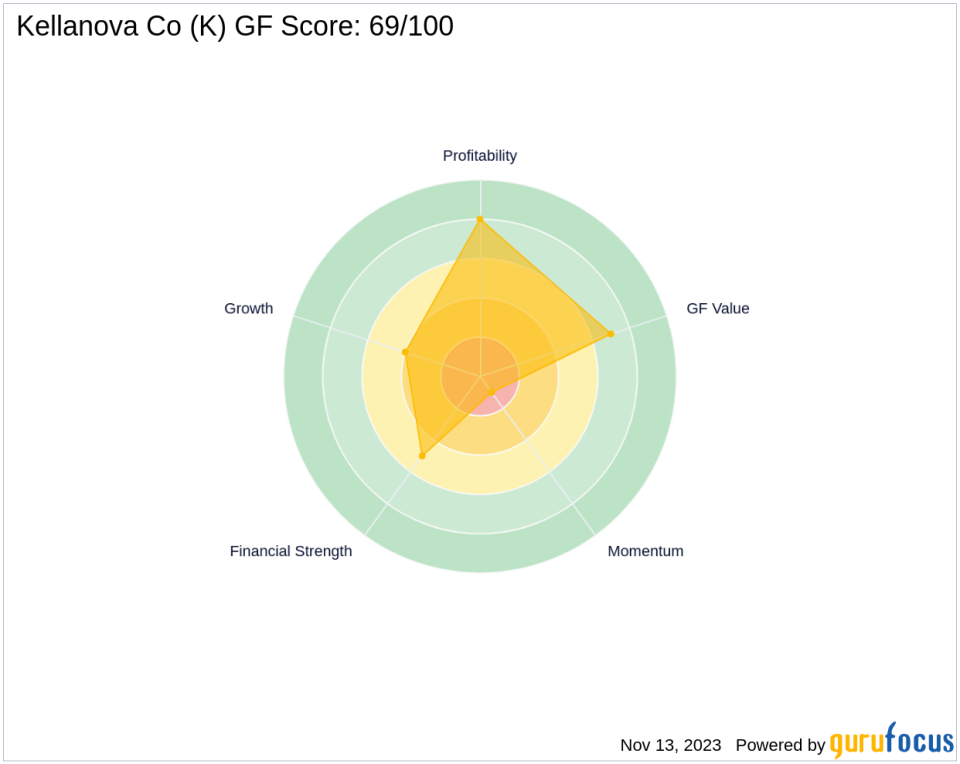

Kellanova Co, known for its diverse range of packaged foods, operates in over 180 countries and is recognized for brands like Pringles and Eggo. The company, which went public on May 12, 1959, has a market capitalization of $17.88 billion and is currently modestly undervalued according to GuruFocus metrics, with a GF Value of $65.11. The stock's price-to-GF Value ratio stands at 0.80, and it has experienced a year-to-date price change ratio of -21.93%. Kellanova's financial health is reflected in its GF Score of 69/100, indicating potential challenges in future performance.

Trade Impact and Strategic Significance

The recent trade by KELLOGG W K FOUNDATION TRUST (Trades, Portfolio) has slightly decreased its influence in Kellanova Co, yet the stock remains a dominant part of the firm's portfolio. This move aligns with the trust's investment philosophy, which emphasizes significant positions in a few select companies, particularly within the consumer staples sector.

Market Context and Valuation Perspectives

Kellanova Co's stock is currently trading at $52.21, slightly above the trade price, with a gain percentage of 0.66% since the transaction. The stock's PE Ratio is 21.94, and it has shown a remarkable increase of 3225.48% since its IPO. Despite recent market fluctuations, Kellanova's stock remains modestly undervalued, offering a potential margin of safety for investors.

Other Prominent Investors

While KELLOGG W K FOUNDATION TRUST (Trades, Portfolio) is a significant shareholder in Kellanova Co, other notable investors include Mario Gabelli (Trades, Portfolio), Joel Greenblatt (Trades, Portfolio), and Ken Fisher (Trades, Portfolio). Southeastern Asset Management holds the largest share percentage among the gurus, although specific figures are not provided.

Financial Health and Prospects

Kellanova Co's financial health is a mixed bag, with a Financial Strength rank of 5/10 and a Profitability Rank of 8/10. The company's Growth Rank is lower at 4/10, indicating some concerns about its future expansion. However, its Piotroski F-Score of 7 suggests healthy financial conditions, and an Altman Z score of 2.45 indicates moderate financial distress risk.

Conclusion

The recent transaction by KELLOGG W K FOUNDATION TRUST (Trades, Portfolio) reflects a minor adjustment in its investment strategy, maintaining a substantial stake in Kellanova Co. The stock's modest undervaluation and the trust's long-term commitment to the consumer staples sector suggest a continued belief in the company's fundamentals. Value investors may find Kellanova Co an interesting prospect, given its market position and the trust's significant involvement.

This article, generated by GuruFocus, is designed to provide general insights and is not tailored financial advice. Our commentary is rooted in historical data and analyst projections, utilizing an impartial methodology, and is not intended to serve as specific investment guidance. It does not formulate a recommendation to purchase or divest any stock and does not consider individual investment objectives or financial circumstances. Our objective is to deliver long-term, fundamental data-driven analysis. Be aware that our analysis might not incorporate the most recent, price-sensitive company announcements or qualitative information. GuruFocus holds no position in the stocks mentioned herein.

This article first appeared on GuruFocus.